The barter system is an ancient method of exchange where goods and services are traded directly without using money. This system requires a double coincidence of wants, meaning both parties must have something the other desires, which can limit transactions. Explore the rest of the article to understand how the barter system influenced modern economics and its relevance today.

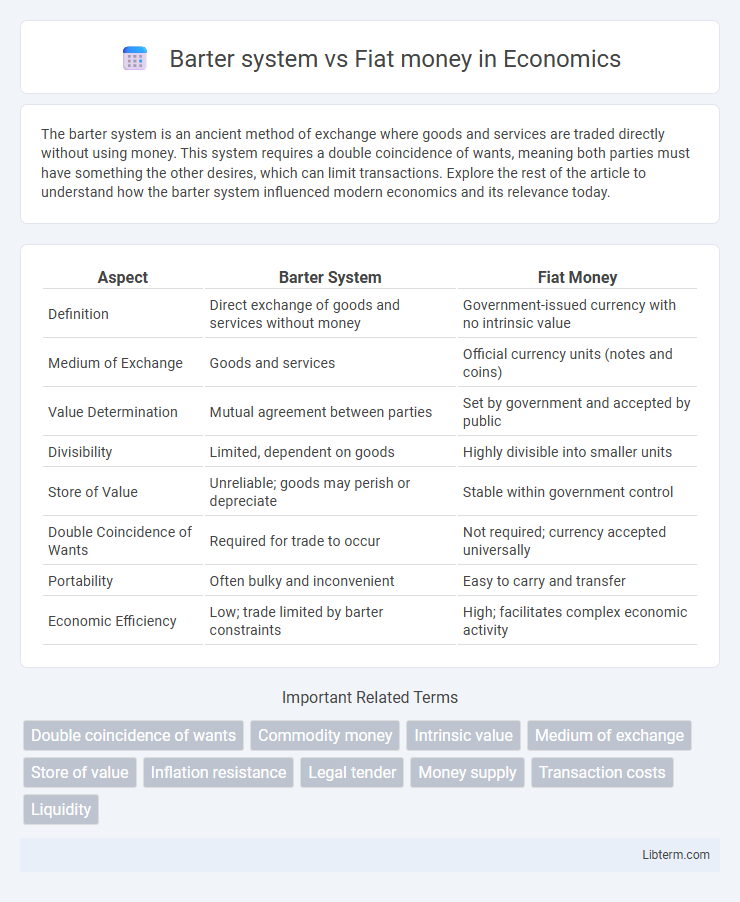

Table of Comparison

| Aspect | Barter System | Fiat Money |

|---|---|---|

| Definition | Direct exchange of goods and services without money | Government-issued currency with no intrinsic value |

| Medium of Exchange | Goods and services | Official currency units (notes and coins) |

| Value Determination | Mutual agreement between parties | Set by government and accepted by public |

| Divisibility | Limited, dependent on goods | Highly divisible into smaller units |

| Store of Value | Unreliable; goods may perish or depreciate | Stable within government control |

| Double Coincidence of Wants | Required for trade to occur | Not required; currency accepted universally |

| Portability | Often bulky and inconvenient | Easy to carry and transfer |

| Economic Efficiency | Low; trade limited by barter constraints | High; facilitates complex economic activity |

Introduction to Barter System and Fiat Money

The barter system involves the direct exchange of goods and services without using a medium of exchange, relying on a double coincidence of wants between parties. Fiat money, by contrast, is government-issued currency that has no intrinsic value but is accepted as a medium of exchange due to legal decree and trust in the issuing authority. While barter limits trade scope due to its inefficiencies, fiat money facilitates seamless transactions and economic growth by providing a standardized and widely accepted currency.

Historical Overview: Barter and the Rise of Money

The barter system, practiced in ancient civilizations like Mesopotamia and Egypt, involved the direct exchange of goods and services without a standardized medium. This method faced limitations such as the double coincidence of wants, prompting societies to develop money as a universal medium of exchange. The rise of fiat money, first seen in China during the Tang Dynasty and later adopted globally, transformed economic transactions by enabling standardized value storage and facilitating complex trade networks.

Core Principles of the Barter System

The core principles of the barter system revolve around the direct exchange of goods and services without using a medium of exchange like money. Transactions depend on a double coincidence of wants, where two parties must have mutually desired items to trade simultaneously. This system lacks a standard measure of value and store of wealth, which limits its efficiency compared to fiat money.

Fundamentals of Fiat Money

Fiat money is backed by government decree rather than a physical commodity, making it universally accepted for transactions and tax payments. Unlike the barter system, which relies on the direct exchange of goods and services, fiat currency facilitates complex economic activities by providing a stable medium of exchange, store of value, and unit of account. Central banks regulate fiat money supply to control inflation and maintain economic stability, ensuring confidence in its value.

Efficiency and Limitations of Barter

The barter system, characterized by direct exchange of goods and services without a common medium, suffers from inefficiencies such as the double coincidence of wants and difficulty in storing value. These limitations hinder scalability and complicate complex transactions compared to fiat money, which functions as a widely accepted medium of exchange, unit of account, and store of value. Fiat money enhances economic efficiency by facilitating standardized pricing, deferred payments, and liquidity, overcoming the intrinsic barriers present in barter economies.

Advantages and Disadvantages of Fiat Money

Fiat money offers advantages such as government regulation, ease of transport, and wide acceptance, facilitating efficient economic transactions compared to the barter system. However, it faces disadvantages including inflation risk, potential for government mismanagement, and lack of intrinsic value, which can undermine public trust. Unlike barter, fiat money's value depends entirely on legal decree and collective confidence rather than tangible assets or direct exchange of goods.

Challenges in Trade: Double Coincidence of Wants vs. Medium of Exchange

The barter system faces significant limitations in trade due to the double coincidence of wants, requiring both parties to have mutually desired goods simultaneously, which complicates and slows down transactions. Fiat money eliminates this challenge by serving as a widely accepted medium of exchange, facilitating smoother and more efficient trade without the need for direct goods exchange. This shift enhances market liquidity and supports the growth of complex economic systems by standardizing value measurement and exchange processes.

Value Determination: Intrinsic vs. Assigned Value

The barter system relies on intrinsic value, where goods and services hold worth based on their usefulness and scarcity to individuals involved in direct exchange. Fiat money derives its value from government decree and trust, lacking intrinsic value but accepted widely for transactions due to its legal tender status. The shift from intrinsic to assigned value marks a fundamental evolution in economic systems, enabling more efficient trade and monetary policy implementation.

Impact on Modern Economies

The barter system, reliant on direct exchange of goods and services, limited economic scalability and complicated trade due to the need for a double coincidence of wants. Fiat money, backed by government decree rather than intrinsic value, enabled efficient transaction processes, facilitated the development of complex financial markets, and supported monetary policy implementation crucial for stabilizing modern economies. The transition to fiat currency has significantly expanded economic growth potential by promoting liquidity, price discovery, and global trade integration.

Future Perspectives: Digital Currencies and the Evolution of Money

The barter system, reliant on direct exchange of goods and services, faces inherent limitations in scalability and efficiency compared to fiat money, which is government-issued and widely accepted. Future perspectives spotlight digital currencies, such as cryptocurrencies and central bank digital currencies (CBDCs), that promise enhanced transaction speed, security, and transparency while reducing dependency on physical cash. The evolution of money increasingly integrates blockchain technology and decentralized finance, signaling a transformative shift towards more inclusive, borderless, and programmable financial ecosystems.

Barter system Infographic

libterm.com

libterm.com