The Keynesian cross model demonstrates how aggregate demand determines overall economic output and employment during short-run fluctuations. This model highlights the equilibrium where planned expenditure equals actual output, emphasizing the role of government spending and consumer behavior in stabilizing the economy. Explore the rest of the article to understand how this model shapes fiscal policy decisions and impacts your economic environment.

Table of Comparison

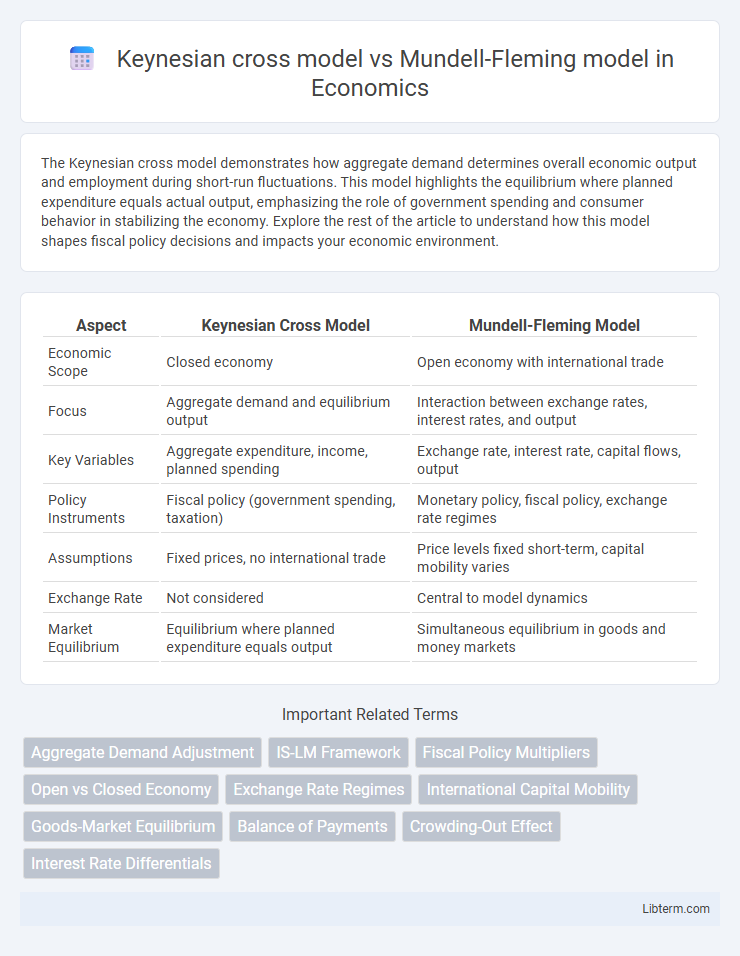

| Aspect | Keynesian Cross Model | Mundell-Fleming Model |

|---|---|---|

| Economic Scope | Closed economy | Open economy with international trade |

| Focus | Aggregate demand and equilibrium output | Interaction between exchange rates, interest rates, and output |

| Key Variables | Aggregate expenditure, income, planned spending | Exchange rate, interest rate, capital flows, output |

| Policy Instruments | Fiscal policy (government spending, taxation) | Monetary policy, fiscal policy, exchange rate regimes |

| Assumptions | Fixed prices, no international trade | Price levels fixed short-term, capital mobility varies |

| Exchange Rate | Not considered | Central to model dynamics |

| Market Equilibrium | Equilibrium where planned expenditure equals output | Simultaneous equilibrium in goods and money markets |

Introduction to Keynesian Cross and Mundell-Fleming Models

The Keynesian Cross model illustrates how aggregate demand determines equilibrium output in a closed economy, emphasizing the role of planned expenditure and income. The Mundell-Fleming model extends this analysis to an open economy setting, integrating the effects of exchange rates and capital mobility on fiscal and monetary policy effectiveness. Both models serve as foundational frameworks in macroeconomic theory, highlighting different mechanisms of achieving equilibrium under varying economic conditions.

Theoretical Foundations: Key Assumptions

The Keynesian cross model assumes a closed economy with fixed prices and focuses on aggregate demand determining output through planned expenditure equals actual output. The Mundell-Fleming model extends Keynesian principles to an open economy by incorporating capital mobility, exchange rates, and price flexibility, with assumptions varying under fixed versus flexible exchange rate regimes. Both models emphasize equilibrium income but differ in their treatment of international trade, capital flows, and monetary-fiscal policy effectiveness.

Closed Economy vs. Open Economy Context

The Keynesian cross model analyzes aggregate demand and output equilibrium within a closed economy, emphasizing the relationship between planned expenditure and national income without international trade effects. In contrast, the Mundell-Fleming model extends these concepts to an open economy, integrating exchange rates, capital mobility, and international trade to explain macroeconomic equilibrium under different exchange rate regimes. The key distinction lies in the Mundell-Fleming model's ability to incorporate external sector influences, making it essential for policy analysis in open economies.

Aggregate Demand Mechanism in Both Models

The Keynesian cross model emphasizes aggregate demand as the total spending in a closed economy, where equilibrium output is determined by the intersection of aggregate expenditure and actual output, highlighting fiscal policy's role in influencing demand. The Mundell-Fleming model extends this framework to an open economy with fixed or flexible exchange rates, incorporating the effects of international capital flows and exchange rate adjustments on aggregate demand. In both models, shifts in aggregate demand drive changes in income and output, but the Mundell-Fleming model explicitly accounts for external sector influences through trade and capital mobility.

Role of Fiscal Policy: Comparative Analysis

The Keynesian cross model emphasizes fiscal policy as a primary tool to manage aggregate demand through government spending and taxation, impacting equilibrium output in a closed economy. The Mundell-Fleming model integrates fiscal policy effects in an open economy context, where fiscal expansion raises output but may influence exchange rates and capital flows depending on the exchange rate regime. In contrast to the Keynesian cross, Mundell-Fleming highlights the varying effectiveness of fiscal policy under fixed versus flexible exchange rates, showing diminished fiscal multipliers in flexible exchange rate systems due to offsetting currency appreciation.

Monetary Policy Effects: Keynesian Cross vs. Mundell-Fleming

The Keynesian Cross model emphasizes fiscal policy with monetary policy having limited direct impact on output due to fixed prices and interest rates, primarily affecting aggregate demand through government spending or taxes. The Mundell-Fleming model, incorporating open economy dynamics, reveals that monetary policy effectiveness varies with exchange rate regimes, showing high potency under flexible exchange rates through capital flows and interest rate changes. Under fixed exchange rates, monetary policy is constrained by the need to maintain currency parity, transferring control to foreign interest rates and limiting domestic monetary autonomy.

Exchange Rate Regimes and Model Predictions

The Keynesian cross model primarily addresses goods market equilibrium without explicitly incorporating exchange rate regimes, making it less suitable for open economy analysis. The Mundell-Fleming model extends Keynesian analysis by integrating exchange rate regimes--fixed, floating, and managed--and predicting distinct macroeconomic outcomes such as monetary policy effectiveness under floating rates and fiscal policy effectiveness under fixed rates. Consequently, the Mundell-Fleming model offers nuanced predictions on capital mobility and exchange rate adjustments that are crucial for understanding open economy macroeconomic policy impacts.

Applicability in Modern Macroeconomics

The Keynesian cross model serves as a foundational framework for understanding equilibrium output in a closed economy with fixed prices, emphasizing aggregate demand management through fiscal policy. The Mundell-Fleming model extends this analysis to open economies, integrating exchange rate regimes and capital mobility, thus providing crucial insights for international macroeconomic policy under varying conditions of exchange rate flexibility. Modern macroeconomics relies on the Keynesian cross for short-run domestic output analysis, while the Mundell-Fleming model is indispensable for evaluating policy effectiveness in a globalized economic environment with cross-border financial flows.

Limitations and Criticisms of Each Model

The Keynesian cross model is limited by its assumption of a closed economy and fixed price levels, which ignores international trade and exchange rate dynamics, leading to oversimplified fiscal policy effectiveness. The Mundell-Fleming model, while addressing open economies and capital mobility, assumes perfect capital mobility and short-run price rigidity, which can misrepresent real-world financial frictions and exchange rate adjustments. Both models face criticisms for their static nature and inability to fully capture complex, dynamic macroeconomic interactions in modern global economies.

Conclusion: Implications for Economic Policy

The Keynesian cross model emphasizes the impact of fiscal policy on aggregate demand within a closed economy, highlighting government spending as a key tool for stabilizing output and employment. The Mundell-Fleming model extends this analysis to an open economy, demonstrating how exchange rate regimes and capital mobility alter the effectiveness of fiscal and monetary policies. Policymakers must consider international capital flows and exchange rate flexibility when applying fiscal or monetary interventions to achieve desired economic outcomes.

Keynesian cross model Infographic

libterm.com

libterm.com