An illiquid market is characterized by low trading volume and limited buyer or seller activity, making it difficult to quickly buy or sell assets without impacting prices. This lack of liquidity can lead to wider bid-ask spreads and increased price volatility, posing challenges for investors seeking to enter or exit positions efficiently. Discover essential insights on how illiquid markets affect your investments and strategies by reading the rest of the article.

Table of Comparison

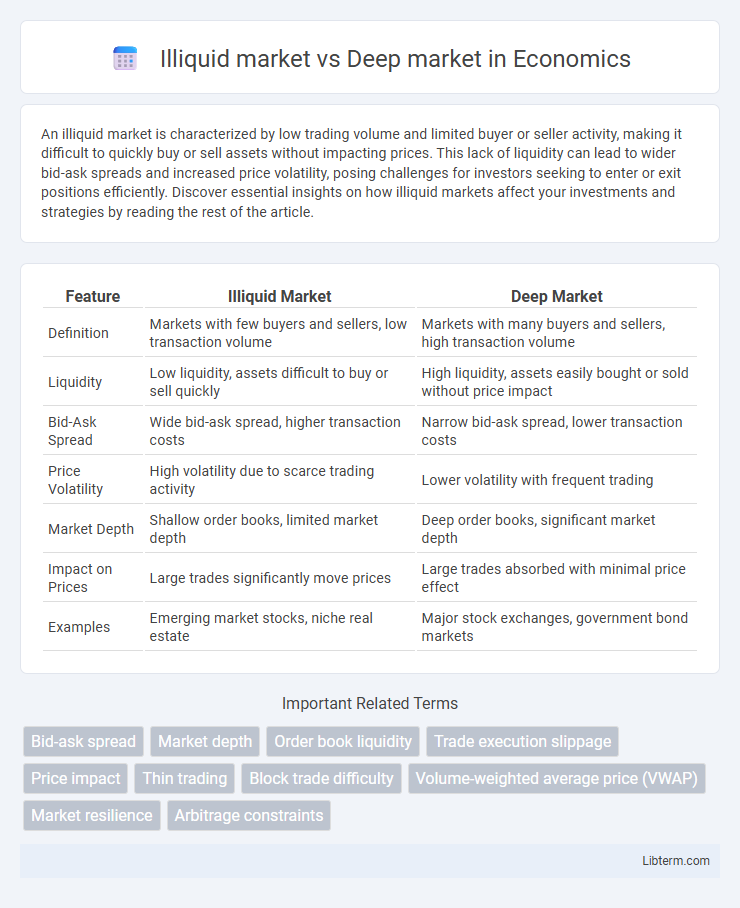

| Feature | Illiquid Market | Deep Market |

|---|---|---|

| Definition | Markets with few buyers and sellers, low transaction volume | Markets with many buyers and sellers, high transaction volume |

| Liquidity | Low liquidity, assets difficult to buy or sell quickly | High liquidity, assets easily bought or sold without price impact |

| Bid-Ask Spread | Wide bid-ask spread, higher transaction costs | Narrow bid-ask spread, lower transaction costs |

| Price Volatility | High volatility due to scarce trading activity | Lower volatility with frequent trading |

| Market Depth | Shallow order books, limited market depth | Deep order books, significant market depth |

| Impact on Prices | Large trades significantly move prices | Large trades absorbed with minimal price effect |

| Examples | Emerging market stocks, niche real estate | Major stock exchanges, government bond markets |

Understanding Market Liquidity

An illiquid market is characterized by low trading volume, wide bid-ask spreads, and difficulty executing large orders without significant price impact, which hinders quick transaction completion. A deep market exhibits high trading volume, narrow bid-ask spreads, and robust order books allowing large trades to be executed smoothly without affecting asset prices. Understanding market liquidity involves assessing trading activity, order book depth, and price stability to evaluate how easily assets can be bought or sold in financial markets.

What is an Illiquid Market?

An illiquid market is characterized by low trading volume and limited availability of buyers and sellers, resulting in difficulty executing large transactions without significant price changes. Price discovery is often inefficient in illiquid markets, leading to wider bid-ask spreads and higher transaction costs. Examples of illiquid markets include certain real estate sectors, rare collectibles, and some small-cap stocks with minimal daily trading activity.

Characteristics of Illiquid Markets

Illiquid markets exhibit low trading volumes, wide bid-ask spreads, and high price volatility due to limited buyer and seller activity. These markets often lack transparency and have fewer market participants, resulting in slower transaction execution and difficulty in quickly converting assets to cash without significant price impact. Such characteristics increase the risk and cost of trading in illiquid markets compared to deep markets, where liquidity and market depth facilitate smoother transactions.

Risks Associated with Illiquid Markets

Illiquid markets pose significant risks due to limited trading volume and wide bid-ask spreads, often leading to price volatility and difficulties in executing large transactions without substantial market impact. These markets may experience extended holding periods and higher transaction costs as assets cannot be quickly converted to cash. In contrast, deep markets offer high liquidity with numerous buyers and sellers, facilitating efficient price discovery and smoother trade executions.

What is a Deep Market?

A deep market refers to a financial market characterized by high liquidity, where large volumes of assets can be bought or sold with minimal impact on price. In a deep market, there are numerous buyers and sellers at various price levels, ensuring tight bid-ask spreads and efficient price discovery. This contrasts with illiquid markets, where limited participants and lower trading volumes lead to greater price volatility and wider spreads.

Features of Deep Markets

Deep markets exhibit high liquidity characterized by a large volume of buy and sell orders at various price levels, ensuring minimal price volatility even with substantial trades. They offer tight bid-ask spreads, enabling efficient price discovery and lower transaction costs for investors. The presence of diverse market participants and continuous trading activity further enhances market depth and stability.

Advantages of Trading in Deep Markets

Deep markets offer high liquidity, enabling traders to execute large orders with minimal price impact and tighter bid-ask spreads. This increased market depth reduces volatility and enhances price stability, benefiting both institutional and retail investors. Access to a deep market also improves price discovery, allowing for more accurate reflection of asset value in real-time trading.

Key Differences: Illiquid vs Deep Markets

Illiquid markets have low trading volumes, wide bid-ask spreads, and limited buyer-seller activity, causing higher price volatility and difficulty in executing large orders without significant price impact. Deep markets feature high liquidity with narrow bid-ask spreads, abundant buyers and sellers, enabling smooth transactions even for large trade volumes. The key difference lies in market depth and liquidity, where deep markets ensure easier asset conversion to cash, unlike illiquid markets that pose risks of delayed trades and price distortions.

How Liquidity Affects Trading Strategies

In illiquid markets, limited trading volume and wide bid-ask spreads lead to higher price volatility and greater slippage, compelling traders to use cautious or longer-term strategies to avoid unfavorable executions. Deep markets, characterized by high liquidity and narrow spreads, enable large transactions without significant price impact, allowing traders to implement aggressive, high-frequency, or short-term strategies effectively. Understanding liquidity dynamics is critical for optimizing trade timing, order size, and risk management in diverse market conditions.

Choosing the Right Market for Your Investments

Choosing the right market for your investments depends on your liquidity needs and risk tolerance. Illiquid markets have fewer buyers and sellers, leading to higher price volatility and longer transaction times, which may increase risk but also offer potential for higher returns. Deep markets provide high trading volumes and tighter bid-ask spreads, ensuring easier entry and exit for investors seeking stability and quick execution.

Illiquid market Infographic

libterm.com

libterm.com