Representative money is a type of currency that holds value because it can be exchanged for a fixed quantity of a commodity, usually precious metals like gold or silver. Unlike fiat money, its worth is backed by a tangible asset, providing a guarantee and stability in value. Discover how representative money influenced modern financial systems and your understanding of currency by reading the rest of the article.

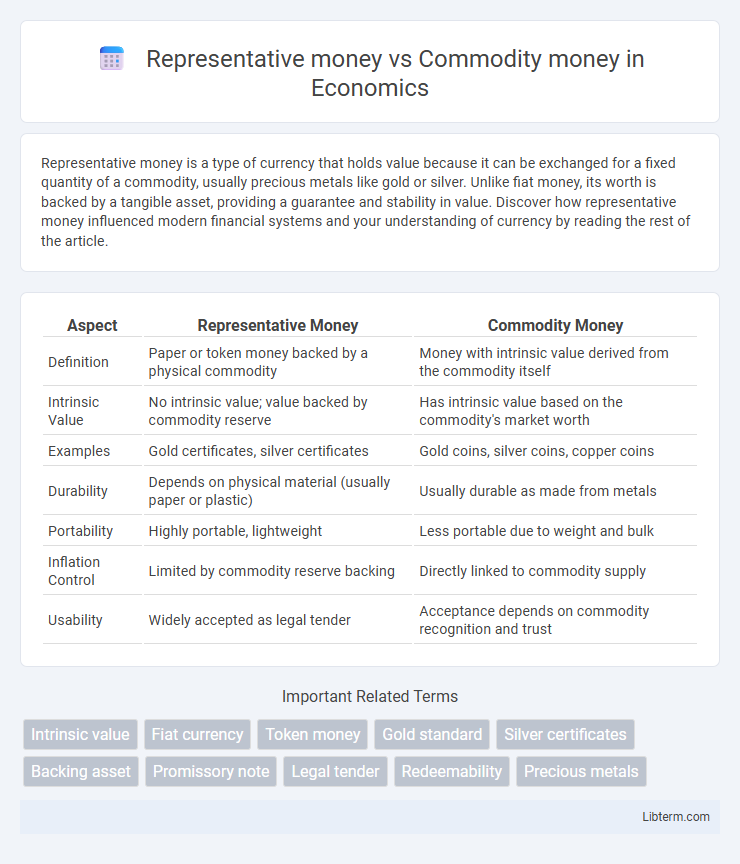

Table of Comparison

| Aspect | Representative Money | Commodity Money |

|---|---|---|

| Definition | Paper or token money backed by a physical commodity | Money with intrinsic value derived from the commodity itself |

| Intrinsic Value | No intrinsic value; value backed by commodity reserve | Has intrinsic value based on the commodity's market worth |

| Examples | Gold certificates, silver certificates | Gold coins, silver coins, copper coins |

| Durability | Depends on physical material (usually paper or plastic) | Usually durable as made from metals |

| Portability | Highly portable, lightweight | Less portable due to weight and bulk |

| Inflation Control | Limited by commodity reserve backing | Directly linked to commodity supply |

| Usability | Widely accepted as legal tender | Acceptance depends on commodity recognition and trust |

Introduction to Money: Definitions and Types

Representative money is a type of currency that derives its value from a promise to exchange it for a fixed amount of a commodity, such as gold or silver, serving as a claim on the tangible asset stored elsewhere. Commodity money, on the other hand, possesses intrinsic value, as the money itself is made from a valuable material like gold, silver, or copper coins, which can be used directly in trade. Both forms represent key stages in the evolution of money, highlighting the transition from goods with inherent worth to vehicle-based conceptions of value and trust in the monetary system.

What is Commodity Money?

Commodity money is a type of currency that holds intrinsic value due to the physical material it is made from, such as gold, silver, or copper. Unlike representative money, which derives value from a claim on a commodity, commodity money itself can be used in trade or as a store of value independent of any backing. Historically, commodity money facilitated trade economies by providing a universally accepted medium with tangible worth.

What is Representative Money?

Representative money is a type of currency backed by a physical commodity, such as gold or silver, which can be exchanged upon demand. Unlike commodity money, which holds intrinsic value, representative money derives its value from the guarantee that it can be converted into a fixed amount of the commodity. This system allows for easier transactions without the need to carry the actual precious metals while maintaining trust in its redeemability.

Historical Overview of Commodity Money

Commodity money has been used since ancient times, with items like gold, silver, shells, and salt serving as mediums of exchange due to their intrinsic value and widespread acceptance. This form of money was prevalent in Mesopotamia, Egypt, and early China, where commodities facilitated trade and store of value before the advent of coined money. Over time, the limitations of commodity money, such as bulkiness and divisibility issues, led to the development of representative money, which was backed by physical commodities but more convenient for transactions.

Historical Use of Representative Money

Representative money emerged prominently during the 17th century, facilitating trade by allowing claims on a fixed quantity of precious metals like gold or silver stored in banks. Unlike commodity money, which held intrinsic value, representative money relied on the trust that holders could exchange notes for the equivalent physical assets. This system streamlined large transactions and supported economic expansion before the widespread adoption of fiat currency.

Key Differences Between Commodity and Representative Money

Representative money derives its value from a claim on a commodity, such as gold or silver, whereas commodity money has intrinsic value as it is made from precious metals or other valuable materials. Unlike commodity money, representative money itself holds no intrinsic value but can be exchanged for a specified amount of the commodity it represents. The key difference lies in intrinsic worth; commodity money is valuable in itself, while representative money acts as a proxy for the commodity.

Advantages of Commodity Money

Commodity money offers inherent value as it is made from precious materials like gold or silver, providing stability and trust in economic transactions. Its intrinsic worth reduces the risk of inflation and devaluation compared to representative money, which relies on government backing or promises. The durability and universal acceptance of commodity money enhance its effectiveness as a medium of exchange and store of value across different markets.

Advantages of Representative Money

Representative money offers greater portability and convenience compared to commodity money, as it consists of paper currency or tokens that can be easily transported and stored without the bulk and weight of physical commodities like gold or silver. It enables more efficient trade and transactions by facilitating easier divisibility and standardization of value, unlike commodity money whose value may fluctuate due to scarcity or quality variations. Furthermore, representative money supports economic growth by allowing governments to regulate the money supply and implement monetary policy more effectively than with commodity money systems.

Modern Relevance and Examples

Representative money, such as gold certificates and silver certificates, functions as a claim on a commodity but itself holds no intrinsic value, making it more practical for modern transactions compared to cumbersome commodity money like gold or silver coins. Modern economies primarily use fiat money, a type of representative money backed by government trust rather than physical commodities, exemplified by the US dollar and the Euro. Digital currencies and central bank digital currencies (CBDCs) continue to evolve the concept of representative money by enabling secure, cashless transfers without relying on physical commodities.

Conclusion: Choosing Between Commodity and Representative Money

Choosing between commodity money and representative money depends on economic stability and liquidity needs; commodity money offers intrinsic value but limited divisibility, while representative money provides easier transactions backed by trust in redeemable assets. Inflation risk is generally lower with commodity money, whereas representative money allows for greater monetary flexibility in modern economies. Decision-makers must balance these factors to optimize financial system efficiency and public confidence.

Representative money Infographic

libterm.com

libterm.com