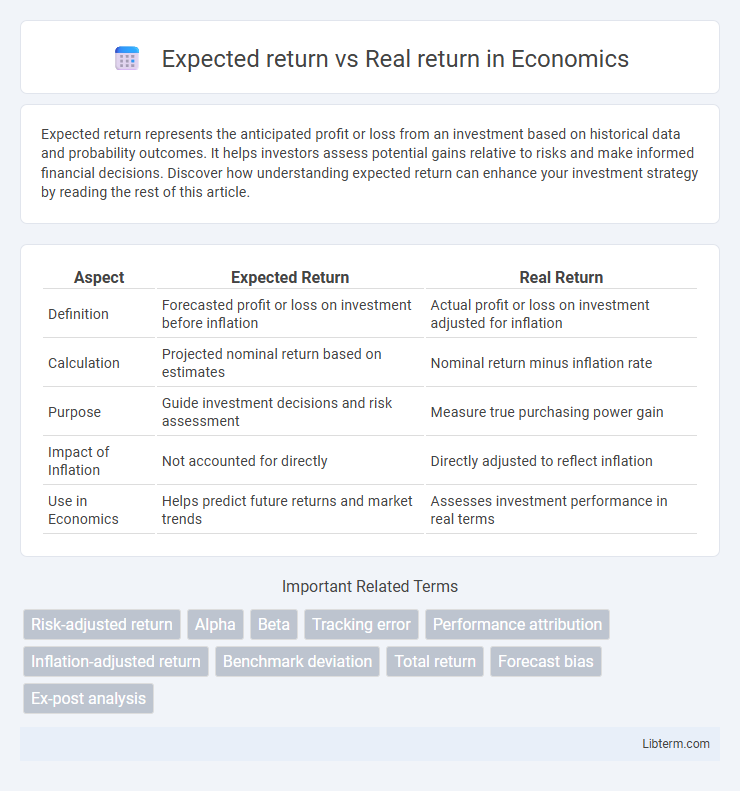

Expected return represents the anticipated profit or loss from an investment based on historical data and probability outcomes. It helps investors assess potential gains relative to risks and make informed financial decisions. Discover how understanding expected return can enhance your investment strategy by reading the rest of this article.

Table of Comparison

| Aspect | Expected Return | Real Return |

|---|---|---|

| Definition | Forecasted profit or loss on investment before inflation | Actual profit or loss on investment adjusted for inflation |

| Calculation | Projected nominal return based on estimates | Nominal return minus inflation rate |

| Purpose | Guide investment decisions and risk assessment | Measure true purchasing power gain |

| Impact of Inflation | Not accounted for directly | Directly adjusted to reflect inflation |

| Use in Economics | Helps predict future returns and market trends | Assesses investment performance in real terms |

Understanding Expected Return

Expected return represents the anticipated profit or loss from an investment based on historical data, probabilities, or financial models, reflecting an investor's forecast before actual outcomes. It serves as a crucial metric for comparing potential investments and making informed portfolio decisions by estimating average returns over time. Understanding expected return helps investors manage risks and align investment choices with their financial goals and risk tolerance.

Defining Real Return

Real return represents the investment gain adjusted for inflation, reflecting the actual increase in purchasing power. It differs from expected return, which is a forecasted estimate based on historical data or market predictions. Understanding real return is essential for accurately assessing investment performance over time and maintaining wealth value.

Key Differences Between Expected and Real Return

Expected return represents the predicted average percentage profit or loss on an investment based on historical data and probability, while real return adjusts this figure for inflation, reflecting the true increase in purchasing power. Key differences include expected return being a forecast used for investment decision-making, whereas real return measures actual performance after considering inflation's impact. Investors rely on expected return for planning but assess real return to understand the genuine growth of their investments.

The Role of Inflation in Returns

Expected return represents the anticipated profitability of an investment based on historical data and market forecasts, while real return adjusts this figure by accounting for the erosion of purchasing power due to inflation. Inflation plays a critical role in real returns by diminishing the nominal gains, meaning investors must achieve returns above the inflation rate to preserve or increase their wealth. Understanding the distinction between nominal expected return and inflation-adjusted real return is essential for accurate investment performance assessment and long-term financial planning.

Importance of Risk Adjustment

Expected return represents the anticipated average outcome on an investment, while real return accounts for the actual gain after adjusting for inflation, taxes, and other costs. Risk adjustment is crucial as it refines the expected return by incorporating the variability and uncertainty of returns, providing a more accurate measure of potential profitability. By considering risk, investors can make informed decisions to optimize portfolio performance and avoid misleading conclusions from nominal returns alone.

Factors Influencing Real Return

Expected return represents the anticipated percentage profit on an investment based on historical data and market forecasts, while real return adjusts this figure by accounting for inflation, reflecting the true purchasing power gain. Factors influencing real return include inflation rates, tax policies, market volatility, and changes in interest rates, all of which can erode or enhance the nominal gains of an investment. Understanding the impact of economic conditions, such as consumer price index fluctuations and monetary policy shifts, is essential for accurately estimating the real return.

Common Misconceptions About Returns

Expected return often causes confusion due to its projection based on historical averages, which may not represent actual future performance in fluctuating markets. Real return adjusts for inflation, revealing the genuine purchasing power gained or lost, a factor frequently overlooked by investors fixated on nominal returns. Misinterpreting expected return as guaranteed profitability leads to unrealistic financial planning and underestimated risks in investment portfolios.

Calculating Your Actual Investment Performance

Calculating your actual investment performance requires understanding the difference between expected return and real return, where expected return estimates future gains based on historical data, while real return adjusts for inflation's impact on purchasing power. To determine real return, subtract the inflation rate from the nominal return, revealing the true growth of your investment. Accurate assessment of these returns enables investors to make informed decisions and evaluate the effectiveness of their investment strategy.

Strategies to Bridge the Expectation-Reality Gap

Investors can bridge the expectation-reality gap by adopting diversified portfolios that account for inflation's erosion of expected returns, ensuring real returns remain positive over time. Implementing dynamic asset allocation strategies, regularly adjusting investments in response to market performance and economic indicators, helps align expected outcomes with actual returns. Utilizing instruments like Treasury Inflation-Protected Securities (TIPS) and inflation-linked bonds can protect purchasing power, effectively narrowing the disparity between nominal expected returns and real realized returns.

Practical Tips for Investors

Real return accounts for inflation's impact on investment gains, providing a clearer measure of purchasing power growth than expected return, which is a forecast based on historical data and market assumptions. Investors should prioritize calculating real returns by adjusting nominal returns with inflation rates to make informed decisions and avoid overestimating investment performance. Utilizing tools like inflation-indexed bonds or incorporating conservative inflation estimates into portfolio projections can help ensure realistic expectations and better long-term planning.

Expected return Infographic

libterm.com

libterm.com