A currency board is a monetary authority that maintains a fixed exchange rate with a foreign currency by holding reserves equal to the domestic currency it issues. This system ensures stability and credibility in the national currency by limiting the central bank's ability to print money arbitrarily. Discover how a currency board can impact your economy and financial decisions by reading the full article.

Table of Comparison

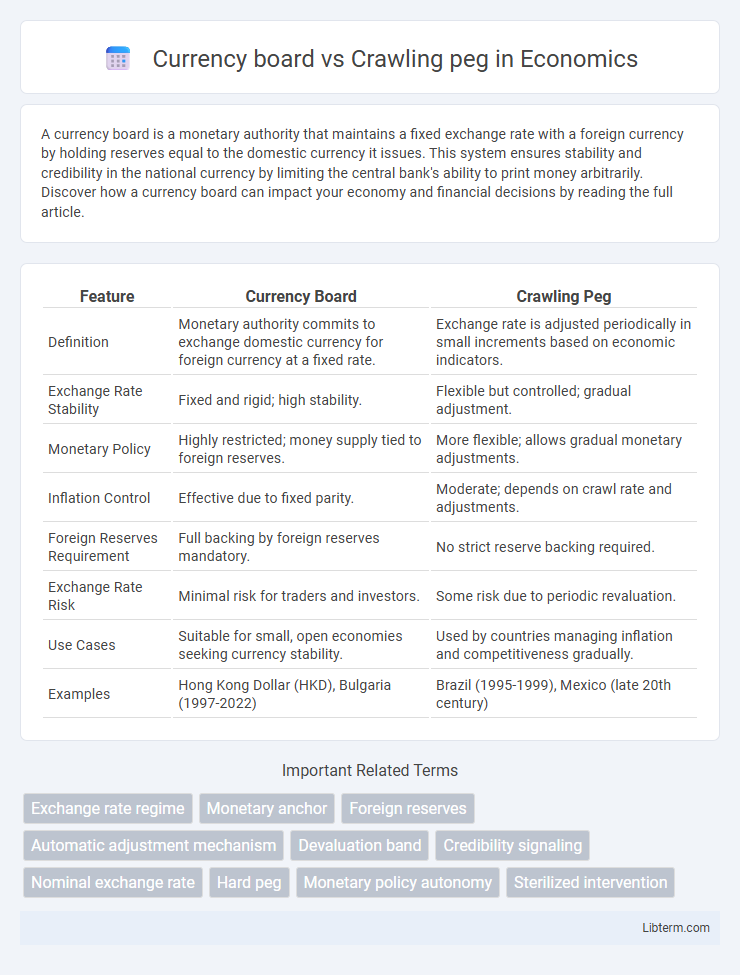

| Feature | Currency Board | Crawling Peg |

|---|---|---|

| Definition | Monetary authority commits to exchange domestic currency for foreign currency at a fixed rate. | Exchange rate is adjusted periodically in small increments based on economic indicators. |

| Exchange Rate Stability | Fixed and rigid; high stability. | Flexible but controlled; gradual adjustment. |

| Monetary Policy | Highly restricted; money supply tied to foreign reserves. | More flexible; allows gradual monetary adjustments. |

| Inflation Control | Effective due to fixed parity. | Moderate; depends on crawl rate and adjustments. |

| Foreign Reserves Requirement | Full backing by foreign reserves mandatory. | No strict reserve backing required. |

| Exchange Rate Risk | Minimal risk for traders and investors. | Some risk due to periodic revaluation. |

| Use Cases | Suitable for small, open economies seeking currency stability. | Used by countries managing inflation and competitiveness gradually. |

| Examples | Hong Kong Dollar (HKD), Bulgaria (1997-2022) | Brazil (1995-1999), Mexico (late 20th century) |

Introduction to Exchange Rate Regimes

Currency board systems maintain a fixed exchange rate by backing the domestic currency with a foreign anchor currency, ensuring strong monetary discipline and stability. Crawling peg regimes allow gradual, pre-announced adjustments of the exchange rate to accommodate inflation differentials and external shocks while limiting volatility. Both serve as intermediate exchange rate mechanisms balancing between fixed and flexible currency arrangements.

What is a Currency Board?

A Currency Board is a monetary authority that pegs the domestic currency at a fixed exchange rate to a foreign anchor currency, ensuring full convertibility and maintaining foreign currency reserves equal to or greater than the domestic currency in circulation. It eliminates discretionary monetary policy by strictly backing the domestic currency with foreign reserves, thus promoting exchange rate stability and controlling inflation. In contrast, a crawling peg allows gradual adjustments of the exchange rate within a predetermined band, providing more flexibility but less rigidity than a Currency Board.

Key Features of a Crawling Peg

A crawling peg is a type of exchange rate regime where a currency's value is adjusted periodically at a predetermined rate or in response to specific indicators such as inflation differentials or trade balances. Key features include gradual, incremental adjustments that reduce volatility, maintain competitiveness, and accommodate moderate inflation without sudden shocks to the economy. Unlike a fixed currency board, the crawling peg allows more flexibility in managing external shocks while maintaining a degree of exchange rate stability.

Historical Context and Examples

Currency boards have been historically used in countries like Hong Kong and Argentina to maintain fixed exchange rates by issuing domestic currency fully backed by foreign reserves, ensuring monetary stability during economic crises. Crawling peg systems, as implemented by Mexico and Brazil in the 1990s, allowed gradual devaluation of the currency to prevent sudden shocks and adapt to inflation or trade balances. These mechanisms reflect distinct approaches: currency boards emphasize strict commitment to currency convertibility, while crawling pegs offer flexibility through periodic adjustments in the exchange rate.

Monetary Policy Flexibility Comparison

Currency boards impose strict monetary policy rigidity by fixing the local currency fully backed by foreign reserves, eliminating independent monetary policy adjustments. Crawling peg regimes allow for gradual, pre-announced exchange rate adjustments, providing moderate monetary policy flexibility to respond to inflation and external shocks. The crawling peg balances exchange rate stability with some policy autonomy, while currency boards prioritize credibility and rigidity over flexibility.

Exchange Rate Stability and Management

Currency boards ensure exchange rate stability by pegging a country's currency directly to a foreign anchor currency with full backing of reserves, eliminating discretionary monetary policy. Crawling pegs maintain exchange rate stability through gradual, predefined adjustments to the peg, allowing for more flexibility in response to inflation differentials and external shocks. Currency boards emphasize strict automatic adjustments, while crawling pegs enable controlled management to balance stability and competitiveness.

Impact on Inflation Control

A currency board maintains a fixed exchange rate by backing domestic currency with foreign reserves, leading to strong inflation control through monetary discipline and limited money supply growth. In contrast, a crawling peg allows gradual exchange rate adjustments, which can moderate inflation by providing some flexibility but may also introduce inflationary pressures if adjustments are too frequent or misaligned. Empirical studies show currency boards tend to deliver more stable and lower inflation rates compared to crawling peg regimes due to their strict commitment to currency stability.

Economic Growth Implications

Currency boards stabilize exchange rates by fixing the domestic currency to a foreign anchor, which can enhance investor confidence and reduce inflation, fostering a stable environment for economic growth. Crawling pegs allow gradual, adjustable devaluation aligned with inflation differentials, promoting export competitiveness and reducing balance of payments crises, thus supporting sustained growth. However, currency boards limit monetary policy flexibility, potentially constraining growth during external shocks, while crawling pegs balance stability with adaptability to changing economic conditions.

Risks and Vulnerabilities

Currency boards face risks such as rigid monetary policy and loss of lender of last resort function, making economies vulnerable to external shocks and speculative attacks due to the fixed exchange rate. Crawling peg systems carry vulnerabilities including frequent realignment leading to uncertainty, potential misalignment with fundamentals, and increased risk of capital flight during periods of market stress. Both mechanisms expose economies to exchange rate inflexibility, but crawling pegs allow gradual adjustments which may mitigate sudden shocks compared to strict currency boards.

Choosing the Right Regime: Currency Board vs Crawling Peg

Selecting between a currency board and a crawling peg regime hinges on economic stability and exchange rate flexibility requirements. Currency boards offer strict monetary discipline and credibility by pegging the currency to a stable foreign anchor with full backing in reserves, ideal for countries needing strong inflation control. Crawling pegs provide gradual, adjustable exchange rates to accommodate inflation differentials and external shocks, benefiting economies requiring moderate flexibility to maintain competitiveness.

Currency board Infographic

libterm.com

libterm.com