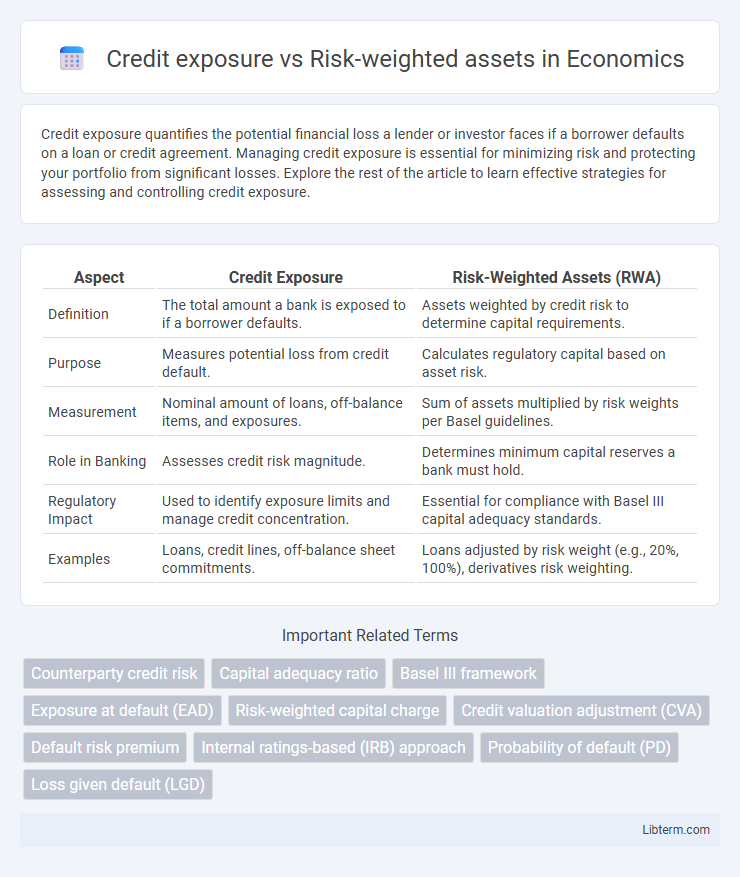

Credit exposure quantifies the potential financial loss a lender or investor faces if a borrower defaults on a loan or credit agreement. Managing credit exposure is essential for minimizing risk and protecting your portfolio from significant losses. Explore the rest of the article to learn effective strategies for assessing and controlling credit exposure.

Table of Comparison

| Aspect | Credit Exposure | Risk-Weighted Assets (RWA) |

|---|---|---|

| Definition | The total amount a bank is exposed to if a borrower defaults. | Assets weighted by credit risk to determine capital requirements. |

| Purpose | Measures potential loss from credit default. | Calculates regulatory capital based on asset risk. |

| Measurement | Nominal amount of loans, off-balance items, and exposures. | Sum of assets multiplied by risk weights per Basel guidelines. |

| Role in Banking | Assesses credit risk magnitude. | Determines minimum capital reserves a bank must hold. |

| Regulatory Impact | Used to identify exposure limits and manage credit concentration. | Essential for compliance with Basel III capital adequacy standards. |

| Examples | Loans, credit lines, off-balance sheet commitments. | Loans adjusted by risk weight (e.g., 20%, 100%), derivatives risk weighting. |

Understanding Credit Exposure: Definition and Importance

Credit exposure represents the total amount of credit a financial institution is exposed to at a given time, reflecting potential losses if a borrower defaults. It is crucial for banks to accurately measure credit exposure to ensure adequate capital reserves and maintain regulatory compliance. Understanding credit exposure helps in assessing the risk profile and optimizing risk-weighted assets, which directly impact capital adequacy and financial stability.

What Are Risk-Weighted Assets (RWA)?

Risk-weighted assets (RWA) represent the total of a bank's assets weighted by credit risk according to regulatory guidelines, used to determine capital adequacy requirements. Unlike credit exposure, which measures the amount at risk in loans or derivatives, RWA adjusts this exposure based on the riskiness of each asset class to better reflect potential losses. Regulators require financial institutions to maintain sufficient capital against RWA to ensure stability and reduce systemic risk.

Key Differences Between Credit Exposure and RWA

Credit exposure represents the total amount of credit a financial institution is exposed to from borrowers before considering any risk mitigants, whereas Risk-Weighted Assets (RWA) adjust credit exposure by applying regulatory risk weights to account for the credit risk associated with different asset types. Credit exposure is a gross measure reflecting potential losses without risk adjustments, while RWA provides a risk-sensitive measure used to determine capital requirements under Basel regulatory frameworks. The key difference lies in credit exposure being an absolute exposure metric, while RWA translates this exposure into a weighted value that reflects the underlying risk profile and regulatory capital adequacy standards.

Measuring Credit Exposure: Methods and Tools

Measuring credit exposure involves quantifying the total amount at risk if a counterparty defaults, using tools like Exposure at Default (EAD) and Current Exposure Method (CEM) to estimate potential losses. Advanced techniques such as Internal Ratings-Based (IRB) approaches and Credit Value Adjustment (CVA) models enhance precision by incorporating collateral, netting agreements, and market fluctuations into the exposure calculation. Accurate measurement of credit exposure is essential for calculating Risk-Weighted Assets (RWA), which determine the capital banks must hold against credit risk.

Calculating Risk-Weighted Assets: Basel Framework

Credit exposure represents the total amount a bank is exposed to in loans and other credit instruments, while risk-weighted assets (RWAs) quantify these exposures adjusted for risk under the Basel Framework. Calculating RWAs involves assigning risk weights to different asset classes based on credit risk, operational risk, and market risk as prescribed by Basel III standards, ensuring banks hold capital proportional to their risk profiles. This standardized approach enhances capital adequacy by reflecting the potential loss severity, guiding regulators and institutions in maintaining financial stability.

Impact of Credit Exposure on Capital Requirements

Credit exposure directly influences capital requirements by determining the potential loss amount that banks must be prepared to absorb, which affects the calculation of risk-weighted assets (RWAs). Higher credit exposure to borrowers with lower credit quality increases RWAs, leading to elevated capital charges under regulatory frameworks like Basel III. Efficient management of credit exposure reduces RWAs, thereby optimizing a bank's capital adequacy ratio and maintaining financial stability.

Regulatory Standards for Risk-Weighted Assets

Regulatory standards for risk-weighted assets (RWA) require financial institutions to assign risk weights to credit exposures, reflecting the potential loss severity associated with different asset classes. These risk weights determine the capital banks must hold to safeguard against credit risk, as mandated by frameworks like Basel III, which emphasize the importance of accurate RWA calculation for maintaining systemic stability. Effective measurement and management of credit exposure through regulatory RWA standards ensure that banks maintain adequate capital buffers, reducing insolvency risks and promoting resilient financial markets.

Strategies to Manage Credit Exposure

Credit exposure management involves identifying and limiting potential losses by setting exposure limits, conducting regular portfolio reviews, and employing credit derivatives such as credit default swaps to transfer risk. Risk-weighted assets (RWA) calculation incorporates the credit quality of exposures, influencing regulatory capital requirements which drive institutions to optimize asset allocation towards lower-risk-weighted instruments. Implementing robust credit risk assessment models, enhancing collateral management, and diversifying credit portfolios effectively reduce credit exposure and improve overall capital efficiency within the framework of Basel III regulations.

Risk-Weighted Assets in Banking Supervision

Risk-weighted assets (RWA) are a critical metric in banking supervision, representing the total of a bank's assets weighted by credit risk according to regulatory guidelines, such as those under Basel III. Unlike credit exposure, which quantifies the total amount of risk a bank faces from its borrowers, RWA adjusts this exposure by assigning risk weights to different asset classes based on their probability of default and potential loss severity. Regulators use RWAs to determine the minimum capital banks must hold, ensuring they maintain sufficient buffers to absorb losses and remain solvent under adverse economic conditions.

Future Trends: Credit Exposure and RWA Management

Future trends in credit exposure and risk-weighted assets (RWA) management emphasize enhanced data analytics and machine learning to improve risk assessment accuracy. Financial institutions increasingly adopt real-time monitoring systems to dynamically adjust capital requirements based on evolving credit profiles and macroeconomic factors. Regulatory frameworks are expected to evolve, promoting more granular RWA calibration and stress testing to better capture emerging market risks.

Credit exposure Infographic

libterm.com

libterm.com