Neutrality fosters unbiased perspectives, encouraging balanced decision-making and fair judgments in complex situations. Maintaining neutrality helps minimize conflicts and supports harmonious relationships by avoiding favoritism. Discover how practicing neutrality can enhance your interactions and professional success throughout the rest of this article.

Table of Comparison

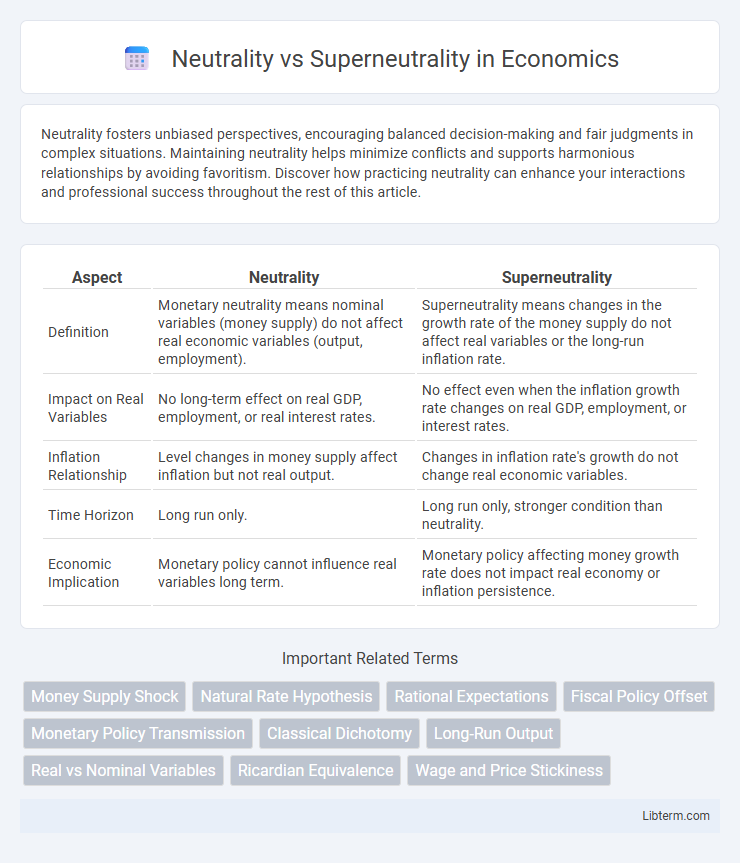

| Aspect | Neutrality | Superneutrality |

|---|---|---|

| Definition | Monetary neutrality means nominal variables (money supply) do not affect real economic variables (output, employment). | Superneutrality means changes in the growth rate of the money supply do not affect real variables or the long-run inflation rate. |

| Impact on Real Variables | No long-term effect on real GDP, employment, or real interest rates. | No effect even when the inflation growth rate changes on real GDP, employment, or interest rates. |

| Inflation Relationship | Level changes in money supply affect inflation but not real output. | Changes in inflation rate's growth do not change real economic variables. |

| Time Horizon | Long run only. | Long run only, stronger condition than neutrality. |

| Economic Implication | Monetary policy cannot influence real variables long term. | Monetary policy affecting money growth rate does not impact real economy or inflation persistence. |

Understanding Neutrality: Definition and Context

Neutrality in economics refers to the concept that changes in the nominal money supply do not affect real variables such as output or employment in the long run. It implies that while monetary policy can influence price levels and inflation rates, it cannot alter real economic fundamentals like productivity or real wages. Understanding neutrality is crucial in distinguishing it from superneutrality, which further asserts that changes in monetary growth rates have no effect on real variables even in the short run.

What is Superneutrality? A Deeper Perspective

Superneutrality refers to the property in monetary economics where neutral changes in the money supply have no effect on real variables, even in the short run, meaning inflation does not influence real output or employment. Unlike standard neutrality, which assumes money changes only impact nominal variables in the long run, superneutrality extends this by asserting that both the level and growth rate of the money supply do not affect real economic growth or productivity. This concept is critical in analyzing the long-term neutrality of money, emphasizing the implications of monetary policy on inflation without altering real economic fundamentals.

Historical Background: Neutrality in Policy and Practice

Neutrality in economic policy historically refers to the idea that changes in the nominal money supply do not affect real economic variables in the long run, a concept rooted in classical economics and further developed during the 20th century by monetarists like Milton Friedman. Superneutrality extends this notion by asserting that not only the level but also the growth rate of money supply has no long-term impact on real variables, a theory explored in the context of modern macroeconomic models and monetary policy frameworks. The distinction between neutrality and superneutrality has shaped central banking practices and inflation targeting strategies, influencing how policymakers respond to monetary interventions over different time horizons.

Superneutrality: Emerging Trends and Theories

Superneutrality in monetary economics posits that nominal money supply changes have no effect on real economic variables, even in the short run, contrasting with the traditional neutrality concept which applies only in the long run. Emerging trends in superneutrality explore the influence of inflation expectations and adaptive learning in dynamic stochastic general equilibrium (DSGE) models, showing more nuanced interactions between money growth and output. Recent theories integrate financial frictions and heterogeneous agent frameworks, refining superneutrality's role in macroeconomic stabilization policy and challenging older assumptions under rigid price settings.

Key Differences Between Neutrality and Superneutrality

Neutrality in monetary policy implies that changes in the money supply only affect nominal variables like prices and wages, without impacting real economic factors such as output or employment. Superneutrality extends this concept by suggesting that even the growth rate of money supply does not influence real variables over the long term. The key difference lies in neutrality addressing the immediate non-effect on real variables, while superneutrality emphasizes that varying inflation rates or money growth rates also fail to alter real economic outcomes.

Practical Implications: Neutrality vs Superneutrality

Neutrality in monetary economics suggests that changes in the money supply only affect nominal variables, leaving real variables unchanged in the long run, while superneutrality extends this to imply that even the growth rate of money supply does not influence real economic factors like output or employment. In practical terms, neutrality allows policymakers to adjust inflation without altering real economic performance, whereas superneutrality implies that monetary policy has no long-term impact on economic growth or real interest rates regardless of the inflation rate. Understanding these distinctions informs the design of monetary policy, highlighting when central banks can pursue inflation targets without compromising real economic objectives.

Advantages and Disadvantages of Neutrality

Neutrality in monetary policy stabilizes inflation expectations by keeping real interest rates unaffected by nominal changes, promoting economic predictability and reducing uncertainty for investors and consumers. However, its disadvantage lies in limited flexibility to respond to economic shocks, potentially delaying recovery during recessions or overheating during booms. This rigidity contrasts with superneutrality, which implies even long-run real variables remain unaffected by nominal changes, but neutrality better balances stability and policy responsiveness.

Pros and Cons of Superneutrality

Superneutrality in monetary policy ensures that anticipated changes in the money supply do not affect real economic variables like output or employment, promoting long-term price stability and anchoring inflation expectations. However, this rigidity can limit central banks' flexibility to respond effectively to short-term economic shocks or recessions, potentially exacerbating volatility in real economic activity. While superneutrality fosters credibility and predictability, it may also reduce monetary policy's ability to stabilize the business cycle, hindering countercyclical interventions.

Case Studies: Neutrality versus Superneutrality in Action

Case studies on neutrality versus superneutrality reveal contrasting effects of monetary policy on real economic variables, with neutrality suggesting no long-term impact and superneutrality indicating even changes in money growth rates do not affect real output. Empirical evidence from economies experiencing hyperinflation or long-term stable inflation, such as Zimbabwe and Japan, underscores how superneutrality fails in high inflation settings but may hold in low, stable inflation environments. These real-world examples highlight the nuanced role of monetary policy frameworks in influencing inflation expectations and growth dynamics under varying economic conditions.

Choosing the Right Approach: Which Suits Your Goals?

Neutrality focuses on maintaining stable inflation by adjusting monetary policy to counteract economic shocks, ensuring predictable price levels. Superneutrality assumes long-term neutrality of money growth, where changes in inflation rates do not affect real economic variables like output or employment. Choosing the right approach depends on your goals: neutrality suits short-term economic stabilization, while superneutrality aligns with policies aiming at sustained, long-term economic predictability without sacrificing growth.

Neutrality Infographic

libterm.com

libterm.com