A long squeeze occurs when investors holding long positions are forced to sell their assets rapidly due to a sudden drop in prices, leading to accelerated losses and market volatility. This event intensifies downward price momentum as liquidity dries up, exacerbating the pressure on holders to exit their positions quickly. Discover how a long squeeze can impact your trading strategy and what to watch for in the market trends ahead.

Table of Comparison

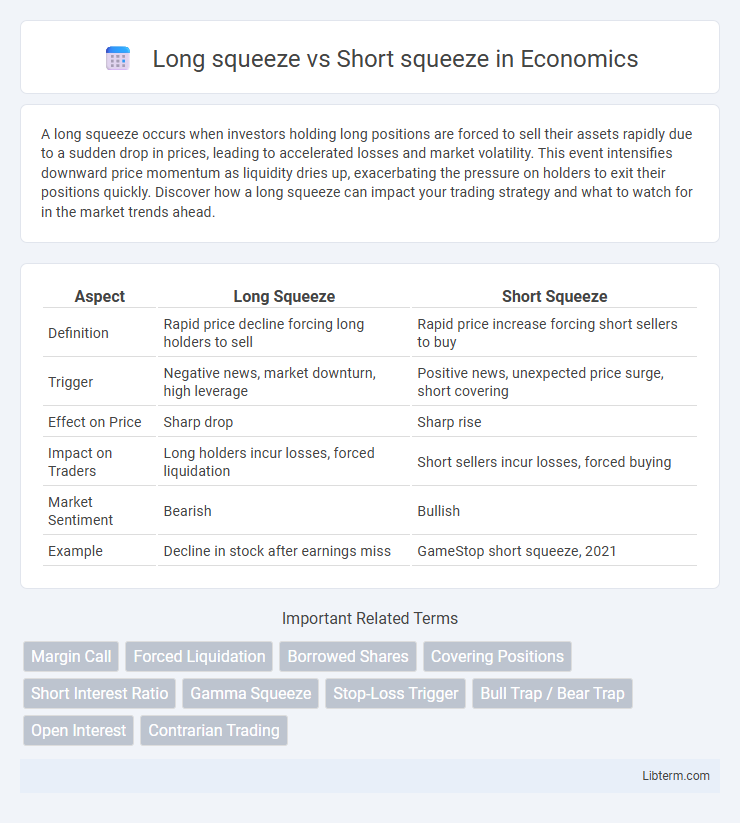

| Aspect | Long Squeeze | Short Squeeze |

|---|---|---|

| Definition | Rapid price decline forcing long holders to sell | Rapid price increase forcing short sellers to buy |

| Trigger | Negative news, market downturn, high leverage | Positive news, unexpected price surge, short covering |

| Effect on Price | Sharp drop | Sharp rise |

| Impact on Traders | Long holders incur losses, forced liquidation | Short sellers incur losses, forced buying |

| Market Sentiment | Bearish | Bullish |

| Example | Decline in stock after earnings miss | GameStop short squeeze, 2021 |

Understanding Short Squeeze: Definition and Mechanics

A short squeeze occurs when heavily shorted stock prices rise rapidly, forcing short sellers to buy shares to cover their positions, which further accelerates the price increase. This buying pressure results from short sellers' margin calls and stops triggered by the surge, creating a feedback loop. Understanding the mechanics of a short squeeze is crucial for investors to anticipate sudden price volatility driven by forced buying rather than fundamental changes.

What is a Long Squeeze? Overview and Process

A Long Squeeze occurs when investors holding long positions are forced to sell their assets rapidly due to a sudden price decline, intensifying downward pressure on the security. This process typically unfolds as falling prices trigger stop-loss orders and margin calls, prompting long holders to exit their positions to limit losses. The rapid liquidation creates a feedback loop that accelerates the price drop, contrasting with a Short Squeeze where short sellers are pressured to cover positions amid rising prices.

Key Differences Between Long Squeeze and Short Squeeze

A long squeeze occurs when investors holding long positions rush to sell their assets to avoid further losses, triggering a rapid price decline. In contrast, a short squeeze happens when short sellers are forced to buy back shares to cover their positions as prices rise unexpectedly, causing a sharp price increase. Key differences include the initiating position (long vs short), the direction of price movement (downward for long squeeze, upward for short squeeze), and the market sentiment driving the squeeze.

Market Conditions Favoring Short Squeezes

Market conditions favoring short squeezes include high short interest combined with limited stock float, creating scarcity when prices rise. Sudden positive news or strong buying pressure triggers rapid price increases, forcing short sellers to cover positions at escalating prices. This results in amplified volatility and accelerated upward price momentum, intensifying the short squeeze effect.

Scenarios Leading to Long Squeezes

Long squeezes occur when investors holding long positions face rapid price declines, forcing them to sell assets to limit losses, thereby accelerating the downward momentum. These scenarios often arise from negative news, unexpected earnings misses, or market-wide sell-offs triggering margin calls for long traders. In contrast to short squeezes, which result from heavy short covering during price spikes, long squeezes are driven by panic selling and liquidity crunches in falling markets.

Notable Historical Examples of Short Squeeze Events

The 2008 Volkswagen short squeeze remains one of the most notable in history, where Porsche's strategic stock accumulation led to a dramatic surge in Volkswagen's share price, forcing short sellers to cover at massive losses. Another key event occurred in 2021 with GameStop, where coordinated buying by retail investors on platforms like Reddit caused a rapid price spike, devastating institutional short positions. These examples highlight how concentrated buying pressure can rapidly inflate stock prices, compelling short sellers to close positions under extreme market stress.

Famous Long Squeeze Incidents in Financial Markets

Famous long squeeze incidents in financial markets include the 2008 short-lived spike in Volkswagen shares when a sudden surge forced short sellers to cover, escalating prices rapidly. Another notable case occurred in GameStop's 2021 rally, where heavy long positions amplified price volatility against traditional short squeeze narratives. These events highlight how long squeezes, driven by intense buying pressure and limited supply, can cause significant market dislocations akin to short squeeze dynamics.

Impact of Squeezes on Traders and Investors

Long squeezes force traders holding leveraged long positions to exit rapidly, often causing sharp price declines and increased market volatility. Short squeezes compel short sellers to cover positions at rising prices, driving prices even higher and creating amplified gains for some investors. Both types of squeezes increase liquidity stress, heighten margin calls, and can trigger significant losses or windfalls depending on market timing and position size.

How to Identify Potential Squeeze Setups

Identifying potential long or short squeeze setups involves analyzing unusually high short interest ratios and monitoring sudden spikes in trading volume combined with narrowing bid-ask spreads. Key indicators include a significant buildup of short positions relative to float and price patterns reflecting rapid upward or downward momentum signaling forced covering. Utilizing technical tools such as Relative Strength Index (RSI) and observing option open interest can further validate imminent squeeze conditions in volatile securities.

Risk Management Strategies During Squeeze Situations

Risk management during a long squeeze involves setting tight stop-loss orders and closely monitoring market momentum to prevent substantial losses as prices decline unexpectedly. In a short squeeze, traders must maintain sufficient margin and implement risk controls like trailing stops to avoid forced liquidations driven by rapid price surges. Employing diversified positions and stress-testing portfolios against squeeze scenarios enhances resilience and reduces exposure to extreme volatility inherent in squeeze situations.

Long squeeze Infographic

libterm.com

libterm.com