Contingent valuation is an economic method used to estimate the value individuals place on non-market goods and services by asking their willingness to pay for specific benefits or willingness to accept compensation for losses. This technique plays a crucial role in environmental economics, public policy, and resource management by quantifying intangible assets such as clean air, wildlife preservation, and public parks. Explore the rest of the article to understand how contingent valuation can impact your decisions and policies.

Table of Comparison

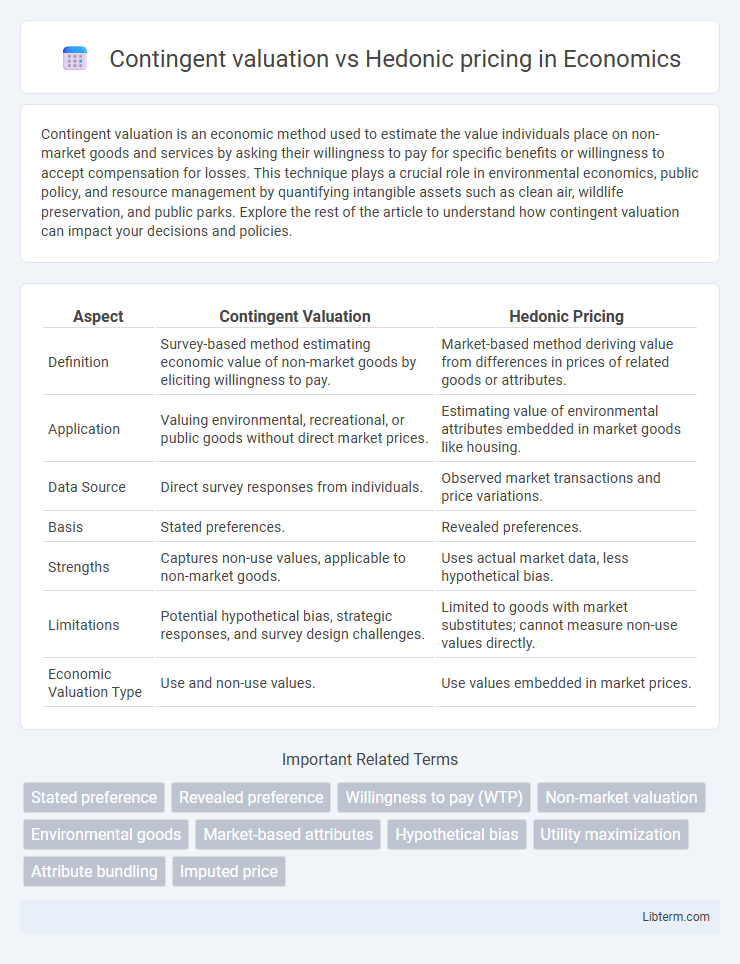

| Aspect | Contingent Valuation | Hedonic Pricing |

|---|---|---|

| Definition | Survey-based method estimating economic value of non-market goods by eliciting willingness to pay. | Market-based method deriving value from differences in prices of related goods or attributes. |

| Application | Valuing environmental, recreational, or public goods without direct market prices. | Estimating value of environmental attributes embedded in market goods like housing. |

| Data Source | Direct survey responses from individuals. | Observed market transactions and price variations. |

| Basis | Stated preferences. | Revealed preferences. |

| Strengths | Captures non-use values, applicable to non-market goods. | Uses actual market data, less hypothetical bias. |

| Limitations | Potential hypothetical bias, strategic responses, and survey design challenges. | Limited to goods with market substitutes; cannot measure non-use values directly. |

| Economic Valuation Type | Use and non-use values. | Use values embedded in market prices. |

Introduction to Non-Market Valuation Methods

Contingent valuation and hedonic pricing are two fundamental non-market valuation methods used to estimate economic values for goods and services not traded in conventional markets. Contingent valuation relies on surveys to elicit individuals' willingness to pay for specific environmental or public goods, providing direct value measures. Hedonic pricing analyzes how market prices of related goods, such as real estate, reflect underlying environmental attributes, capturing implicit valuations embedded in actual transactions.

Defining Contingent Valuation

Contingent valuation is an economic survey-based method that estimates the value individuals place on non-market environmental goods by directly asking their willingness to pay for specific changes. This approach captures subjective preferences through hypothetical market scenarios, enabling valuation of intangible benefits like clean air or endangered species preservation. Unlike hedonic pricing, which infers values from market behaviors and property price differentials, contingent valuation provides direct measures of use and non-use values for public goods.

Understanding Hedonic Pricing

Hedonic pricing is a method used to estimate the economic value of environmental attributes by analyzing variations in market prices, such as real estate values influenced by proximity to parks or pollution levels. It decomposes the price of a good into the implicit prices of its characteristics, providing insight into how specific factors contribute to overall value. This approach contrasts with contingent valuation, which relies on survey-based willingness-to-pay responses instead of actual market data.

Core Principles of Contingent Valuation

Contingent valuation estimates economic values for non-market environmental goods by directly asking individuals their willingness to pay in hypothetical scenarios, emphasizing stated preference methods. It captures total economic value, including use and non-use values, by presenting detailed descriptions and hypothetical markets to respondents. This approach relies on carefully designed surveys to minimize biases and elicit truthful valuations, contrasting with hedonic pricing that infers values from observed market prices of related goods.

Key Features of Hedonic Pricing

Hedonic pricing analyzes property prices by decomposing them into value components based on characteristics such as location, size, and environmental factors, enabling precise valuation of non-market goods like clean air or school quality. It relies on actual market data, providing revealed preference insights that reflect real-world buyer behavior, unlike contingent valuation, which gathers stated preferences through surveys. The method excels in capturing implicit prices of disaggregated attributes, facilitating detailed economic assessment of amenities and disamenities embedded in market transactions.

Strengths and Limitations of Contingent Valuation

Contingent valuation excels in capturing non-market values such as environmental benefits or public goods by directly eliciting individuals' willingness to pay through surveys, providing flexibility to value intangible assets. However, it faces limitations including hypothetical bias, where respondents may overstate or understate their true valuation, and strategic bias, as participants might manipulate responses to influence policy outcomes. The method also requires carefully designed scenarios to minimize information bias and ensure validity, making implementation complex and resource-intensive.

Advantages and Drawbacks of Hedonic Pricing

Hedonic pricing advantages include its reliance on actual market data, which captures consumer preferences indirectly through observed prices, making it useful for estimating values of environmental amenities and property attributes. Drawbacks involve its sensitivity to model specification errors, potential omitted variable bias, and difficulty in isolating the value of non-market goods when markets are imperfect or data are limited. Unlike contingent valuation, hedonic pricing cannot capture values for goods without existing markets or unpriced attributes, limiting its applicability for certain environmental or public goods.

Comparing Data Collection Techniques

Contingent valuation relies on survey-based data collection where respondents state their willingness to pay for non-market environmental goods, providing direct preference information. Hedonic pricing utilizes market transaction data to infer values by analyzing how environmental attributes affect property prices, offering revealed preference insights. Contingent valuation captures subjective valuations but may suffer from hypothetical bias, while hedonic pricing depends on the availability and quality of real estate market data.

Applications in Environmental Economics

Contingent valuation is widely applied in environmental economics to estimate non-market values of public goods such as clean air, water quality, and biodiversity by surveying individuals' willingness to pay for specific environmental improvements. Hedonic pricing analyzes market data, primarily housing prices, to infer the economic value of environmental attributes like noise reduction, air pollution levels, and proximity to parks. Both methods complement each other by capturing use and non-use values, enabling comprehensive cost-benefit analyses for environmental policy decisions.

Selecting the Appropriate Method for Policy Analysis

Selecting the appropriate method for policy analysis depends on the study's objective and the nature of the environmental good or service being valued. Contingent valuation excels in capturing non-market values for public goods like clean air or biodiversity by using surveys to elicit individuals' willingness to pay, while hedonic pricing analyzes market data to estimate how environmental factors influence property prices, making it ideal for valuing localized amenities or disamenities. Policymakers should consider data availability, valuation scope, and the target population when choosing between contingent valuation and hedonic pricing to ensure accurate and relevant economic assessments.

Contingent valuation Infographic

libterm.com

libterm.com