Rising inflation impacts your purchasing power by increasing the cost of goods and services, which can strain household budgets and reduce savings. Understanding the causes and effects of inflation helps you make informed financial decisions to protect your assets. Explore the rest of this article to learn effective strategies for managing inflation's challenges.

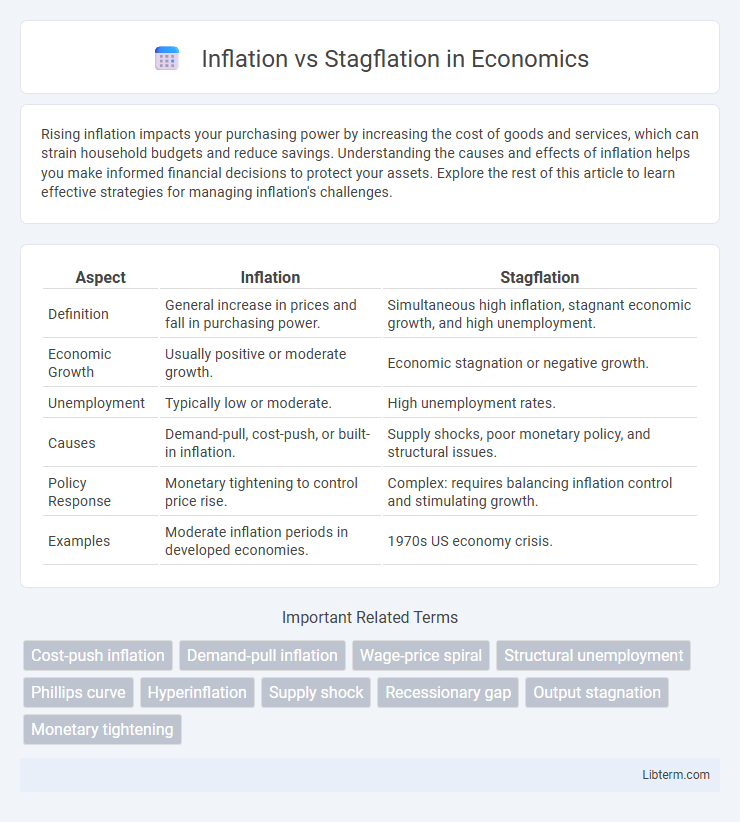

Table of Comparison

| Aspect | Inflation | Stagflation |

|---|---|---|

| Definition | General increase in prices and fall in purchasing power. | Simultaneous high inflation, stagnant economic growth, and high unemployment. |

| Economic Growth | Usually positive or moderate growth. | Economic stagnation or negative growth. |

| Unemployment | Typically low or moderate. | High unemployment rates. |

| Causes | Demand-pull, cost-push, or built-in inflation. | Supply shocks, poor monetary policy, and structural issues. |

| Policy Response | Monetary tightening to control price rise. | Complex: requires balancing inflation control and stimulating growth. |

| Examples | Moderate inflation periods in developed economies. | 1970s US economy crisis. |

Understanding Inflation: Definition and Causes

Inflation is the rate at which the general level of prices for goods and services rises, leading to a decrease in purchasing power. It is primarily caused by demand-pull factors, where demand exceeds supply, cost-push factors driven by rising production costs, and built-in inflation resulting from adaptive expectations. Understanding these causes helps differentiate inflation from stagflation, where inflation coexists with stagnant economic growth and high unemployment.

What is Stagflation? Key Characteristics

Stagflation is an economic condition characterized by stagnant economic growth, high unemployment, and rising inflation occurring simultaneously, which challenges traditional economic theories. Key characteristics include persistent inflation despite weak demand, declining industrial production, and job market stagnation, making policy responses difficult. Unlike typical inflationary periods, stagflation combines slowing GDP growth with price increases, leading to eroded purchasing power and economic uncertainty.

Historical Context: Notable Periods of Inflation and Stagflation

The 1970s oil crisis marked a notable period of stagflation, combining high inflation rates exceeding 10% with stagnant economic growth and rising unemployment in the United States and Western Europe. Post-World War II economies experienced significant inflation during rapid reconstruction phases, particularly in Germany's hyperinflation era of the 1920s where prices doubled within days. The Great Inflation of the 1960s and 1970s in the U.S. showcased persistent inflation driven by expansive fiscal policies and loose monetary conditions before strong anti-inflation measures stabilized the economy in the 1980s.

Core Differences Between Inflation and Stagflation

Inflation refers to a general increase in prices across the economy, leading to a decline in purchasing power, while stagflation combines high inflation with stagnant economic growth and rising unemployment. Inflation typically occurs during periods of economic expansion, whereas stagflation results from supply shocks or poor economic policies that cause both inflation and economic stagnation simultaneously. The core difference lies in the economic conditions: inflation reflects rising prices in a growing economy, whereas stagflation is characterized by sluggish growth alongside persistent inflation and labor market challenges.

Economic Indicators: Measuring Inflation vs Stagflation

Inflation is primarily measured by rising Consumer Price Index (CPI) and Producer Price Index (PPI), indicating a general increase in price levels across the economy. Stagflation uniquely combines high inflation rates with stagnant GDP growth and rising unemployment rates, presenting a challenging scenario for standard economic policy. While inflation reflects purchasing power erosion, stagflation signals a deeper economic malaise where supply shocks and demand stagnation coexist.

Impact on Consumers and Businesses

Inflation erodes purchasing power, leading consumers to pay higher prices for goods and services while businesses face increased production costs that can reduce profit margins. Stagflation combines high inflation with stagnant economic growth and rising unemployment, causing consumers to cut back on spending due to economic uncertainty and businesses to struggle with declining demand and rising expenses. This dual challenge intensifies financial strain, complicating budgeting and investment decisions across the economy.

Government Policy Responses: Fighting Inflation vs Stagflation

Government policy responses to inflation typically involve tightening monetary policy by raising interest rates and reducing money supply to curb demand-driven price increases. In contrast, fighting stagflation requires a balanced approach that addresses both inflation and stagnant economic growth, often combining moderate monetary restraint with targeted fiscal stimulus to support employment. Supply-side policies, such as deregulation and incentives for production, are also crucial in mitigating stagflation's persistent supply shocks and price pressures.

Investment Strategies in Inflationary and Stagflationary Environments

Investment strategies in inflationary environments emphasize assets that preserve purchasing power, such as Treasury Inflation-Protected Securities (TIPS), commodities, and real estate. During stagflation, characterized by stagnant growth and high inflation, investors often shift toward defensive sectors like utilities and consumer staples, while maintaining exposure to gold and inflation-hedged bonds to mitigate risk. Diversification and a focus on cash flow-generating assets help protect portfolios against both reduced economic output and rising prices.

Global Perspectives: Inflation vs Stagflation Across Economies

Inflation represents a general rise in prices and a decrease in purchasing power, affecting global economies with varying intensity depending on monetary policies and external shocks. Stagflation combines stagnant economic growth, high unemployment, and persistent inflation, posing a unique challenge observed in diverse regions, notably during the 1970s oil crisis and more recently in some emerging markets. Countries with rigid labor markets and supply chain dependencies often face prolonged stagflation periods, complicating fiscal and monetary responses worldwide.

Future Outlook: Preparing for Inflation or Stagflation

Future economic strategies must emphasize adaptive monetary policies to manage inflationary pressures while mitigating risks of stagflation characterized by stagnant growth and rising prices. Businesses and investors should prioritize diversification and inflation-resistant assets, including commodities and inflation-indexed bonds, to safeguard purchasing power in uncertain markets. Policymakers will likely focus on balancing supply chain enhancements and fiscal discipline to prevent prolonged economic stagnation amid persistent inflation.

Inflation Infographic

libterm.com

libterm.com