The endowment effect describes the psychological tendency for people to value an item more highly simply because they own it. Your perception of an object's worth increases once it becomes part of your possessions, often leading to irrational decision-making in buying or selling situations. Explore the rest of this article to understand how the endowment effect influences your everyday choices and strategies to overcome it.

Table of Comparison

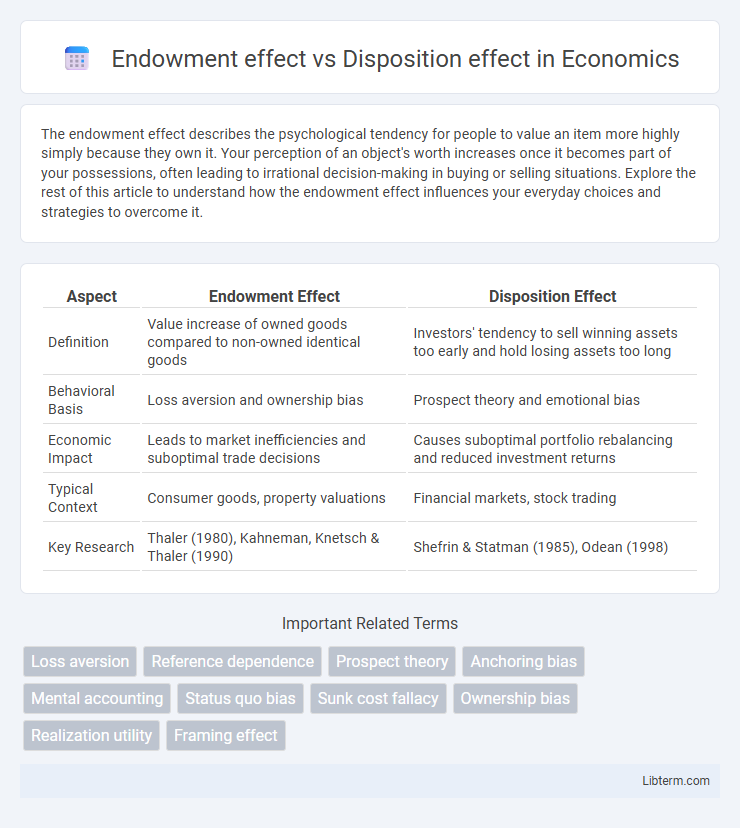

| Aspect | Endowment Effect | Disposition Effect |

|---|---|---|

| Definition | Value increase of owned goods compared to non-owned identical goods | Investors' tendency to sell winning assets too early and hold losing assets too long |

| Behavioral Basis | Loss aversion and ownership bias | Prospect theory and emotional bias |

| Economic Impact | Leads to market inefficiencies and suboptimal trade decisions | Causes suboptimal portfolio rebalancing and reduced investment returns |

| Typical Context | Consumer goods, property valuations | Financial markets, stock trading |

| Key Research | Thaler (1980), Kahneman, Knetsch & Thaler (1990) | Shefrin & Statman (1985), Odean (1998) |

Understanding the Endowment Effect: Definition and Origins

The endowment effect describes the cognitive bias where individuals assign higher value to objects simply because they own them, originating from the principle of loss aversion in behavioral economics. Rooted in the seminal work of Kahneman, Knetsch, and Thaler (1990), this phenomenon explains why people demand more to give up an item than they would be willing to pay to acquire it. Understanding this effect is crucial for analyzing consumer behavior and decision-making processes in economics and psychology.

Disposition Effect Explained: Behavioral Finance Perspective

The disposition effect refers to investors' tendency to sell assets that have increased in value while holding onto assets that have declined, driven by loss aversion and the desire to avoid regret. Behavioral finance research links this effect to cognitive biases such as prospect theory, where individuals overweight losses relative to gains, resulting in suboptimal portfolio performance. Understanding the disposition effect helps explain market anomalies like momentum and reversal patterns as investors' decisions deviate from rational price expectations.

Key Psychological Drivers of the Endowment Effect

The endowment effect arises primarily from loss aversion, where individuals perceive the pain of giving up an owned item as greater than the pleasure of acquiring it. Ownership increases the item's subjective value due to attachment and psychological ownership, intensifying emotional bias. This effect is driven by cognitive biases such as status quo bias and framing, which distort decision-making and valuation in economic contexts.

Mechanisms Behind the Disposition Effect in Investing

The disposition effect in investing stems from cognitive biases such as loss aversion and mental accounting, where investors disproportionately fear realizing losses while eagerly realizing gains. This behavior is driven by the psychological discomfort associated with admitting errors and the tendency to segregate gains and losses, leading to premature selling of winning assets and holding onto losing ones. Understanding these mechanisms reveals how emotional and cognitive factors distort rational decision-making in financial markets.

Core Differences: Endowment Effect vs Disposition Effect

The Endowment Effect describes the tendency of individuals to overvalue items they own simply because of ownership, leading to higher selling prices compared to buying prices. The Disposition Effect refers to investors' behavior of selling assets that have gained value while holding onto losing assets to avoid realizing losses. Core differences lie in psychological ownership driving the Endowment Effect, whereas the Disposition Effect is motivated by emotional biases and loss aversion in investment decision-making.

Real-World Examples Illustrating Both Effects

Investors often hold losing stocks too long due to the disposition effect, exemplified by a trader refusing to sell a declining asset to avoid realizing a loss. Conversely, the endowment effect is seen when homeowners overprice their property simply because they own it, leading to inflated market expectations. Both effects highlight how ownership biases distort rational decision-making in financial markets.

Impact on Decision-Making: Everyday Life and Financial Choices

The endowment effect causes individuals to overvalue owned items, leading to reluctance in selling or trading possessions, which significantly impacts everyday decisions such as reluctance to part with gifts or used goods. The disposition effect influences investors to prematurely sell winning stocks while holding onto losing assets, distorting rational financial decision-making and potentially reducing overall portfolio performance. Both biases highlight cognitive distortions that affect risk assessment and value perception, complicating practical choices from everyday consumption to investment strategies.

Strategies to Mitigate the Endowment and Disposition Effects

Mitigating the endowment effect involves strategies such as adopting a market perspective, where individuals view owned items as part of a broader trading environment rather than personal possessions, and employing decision aids like price comparison tools to enhance objective valuation. To counteract the disposition effect, investors can use systematic selling rules based on predetermined performance targets instead of emotional responses, and utilize portfolio rebalancing techniques that reinforce disciplined trading behavior. Both effects can be further reduced through financial education programs that improve awareness of cognitive biases and promote evidence-based decision-making frameworks.

Implications for Investors and Asset Managers

The Endowment effect leads investors and asset managers to overvalue owned assets, causing reluctance to sell despite better alternatives, which can hinder portfolio rebalancing. The Disposition effect results in premature selling of winning investments and holding onto losing ones, negatively impacting returns through suboptimal trade timing. Understanding these biases allows for improved decision-making frameworks, risk assessment, and strategic asset allocation to enhance investment performance.

Future Research Directions in Behavioral Economics

Future research directions in behavioral economics should explore the neurobiological underpinnings distinguishing the Endowment Effect and the Disposition Effect, enhancing understanding of how ownership and loss aversion influence decision-making. Investigating cross-cultural variations and contextual factors can clarify the boundary conditions and generalizability of these biases. Advanced experimental designs involving real-world trading environments and longitudinal studies can provide deeper insights into their long-term impacts on financial behavior and market outcomes.

Endowment effect Infographic

libterm.com

libterm.com