A zero-coupon bond is a fixed income security that does not pay periodic interest but is issued at a discount to its face value, allowing investors to earn returns through price appreciation at maturity. Understanding how zero-coupon bonds work can help you assess their suitability for your investment portfolio, especially in terms of risk and tax implications. Explore the rest of this article to learn more about the benefits and considerations of investing in zero-coupon bonds.

Table of Comparison

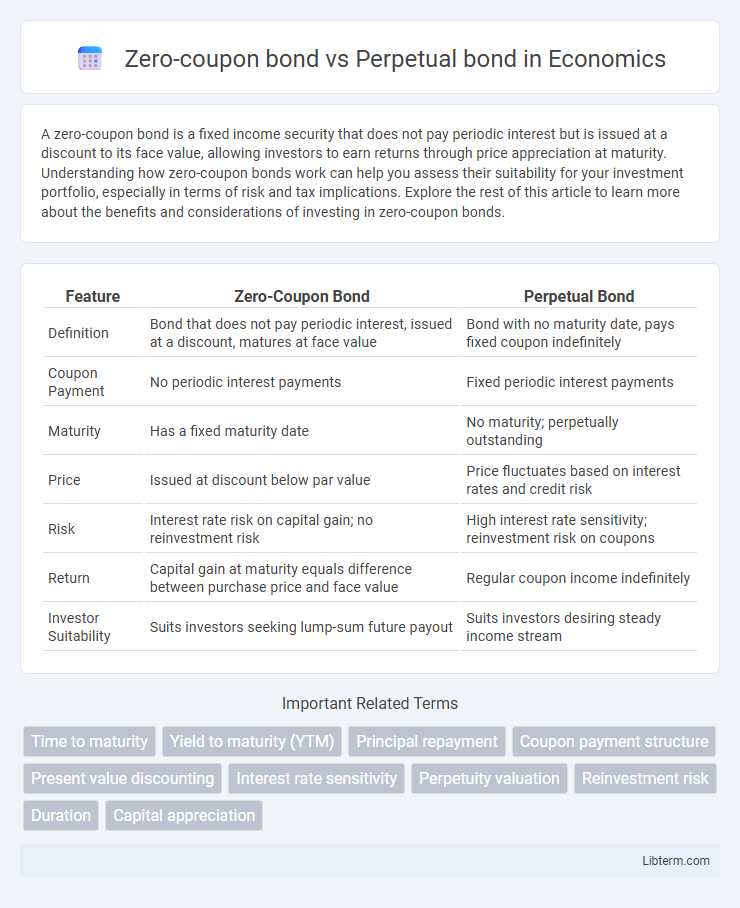

| Feature | Zero-Coupon Bond | Perpetual Bond |

|---|---|---|

| Definition | Bond that does not pay periodic interest, issued at a discount, matures at face value | Bond with no maturity date, pays fixed coupon indefinitely |

| Coupon Payment | No periodic interest payments | Fixed periodic interest payments |

| Maturity | Has a fixed maturity date | No maturity; perpetually outstanding |

| Price | Issued at discount below par value | Price fluctuates based on interest rates and credit risk |

| Risk | Interest rate risk on capital gain; no reinvestment risk | High interest rate sensitivity; reinvestment risk on coupons |

| Return | Capital gain at maturity equals difference between purchase price and face value | Regular coupon income indefinitely |

| Investor Suitability | Suits investors seeking lump-sum future payout | Suits investors desiring steady income stream |

Introduction to Zero-Coupon and Perpetual Bonds

Zero-coupon bonds are debt securities issued at a discount, providing no periodic interest payments but repaid at face value upon maturity, making them ideal for investors seeking lump-sum returns. Perpetual bonds, or consol bonds, have no maturity date and offer fixed coupon payments indefinitely, appealing to investors interested in consistent income streams without principal repayment. Understanding their distinct cash flow structures helps investors align bond choices with financial goals and risk tolerance.

Key Features of Zero-Coupon Bonds

Zero-coupon bonds are debt securities that do not pay periodic interest and are issued at a significant discount to their face value, maturing at par. These bonds provide returns through capital appreciation rather than coupon payments, making them sensitive to interest rate changes and often preferred for long-term financial goals. Unlike perpetual bonds, which pay indefinite coupons without maturity, zero-coupon bonds have a fixed maturity date, offering predictable redemption value.

Key Features of Perpetual Bonds

Perpetual bonds have no maturity date, meaning they pay interest indefinitely without returning the principal. They typically offer higher coupon rates to compensate for the lack of principal repayment and interest rate risk. These bonds provide steady income streams but carry greater risk due to price sensitivity to interest rate changes and issuer creditworthiness.

Differences in Interest Payments

Zero-coupon bonds do not provide periodic interest payments; instead, they are sold at a discount and pay the face value at maturity, generating interest through the price appreciation. Perpetual bonds, also known as consol bonds, pay fixed interest indefinitely without returning the principal, providing continuous income but no maturity date. The key difference lies in the zero-coupon bond's lump-sum payment at maturity versus the perpetual bond's ongoing interest receipts.

Maturity and Redemption Comparison

Zero-coupon bonds have a fixed maturity date, at which point the bondholder receives the face value without interim interest payments, making them finite-term instruments with a clear redemption timeline. Perpetual bonds, also known as consol bonds, lack a maturity date and pay interest indefinitely, meaning they do not have a redemption date unless called by the issuer. The key difference in maturity and redemption lies in the zero-coupon bond's predetermined end date, versus the perpetual bond's continuous existence without principal repayment.

Risk Profiles: Zero-Coupon vs Perpetual Bonds

Zero-coupon bonds carry interest rate risk and reinvestment risk due to their lack of periodic coupon payments, exposing investors to potential price volatility until maturity. Perpetual bonds present higher credit risk and interest rate sensitivity as they never mature, causing price fluctuations that reflect changes in the issuer's creditworthiness and overall market rates. Investors seeking principal return at maturity may prefer zero-coupon bonds, while those accepting indefinite exposure with steady coupon income might choose perpetual bonds despite elevated market risks.

Yield and Return Potential

Zero-coupon bonds offer fixed returns by discounting the face value to present price, delivering yield primarily through capital appreciation at maturity without interim interest payments. Perpetual bonds provide ongoing interest income with no maturity date, yielding steady cash flow but less capital gain potential compared to the zero-coupon alternative. Investors seeking lump-sum future value favor zero-coupon bonds, while those prioritizing continuous income and yield stability often prefer perpetual bonds.

Suitability for Different Investor Types

Zero-coupon bonds suit conservative investors seeking predictable, long-term capital appreciation without periodic interest income, often favored by individuals planning for future expenses like education or retirement. Perpetual bonds attract income-focused investors and institutions desiring steady, indefinite interest payments without maturity, benefiting portfolios that prioritize ongoing cash flow over principal repayment. Understanding these differences helps investors align bond investments with their risk tolerance, income needs, and time horizons.

Tax Implications for Investors

Zero-coupon bonds generate imputed interest income that is taxable annually despite no cash payments until maturity, potentially raising tax liabilities during the bond's life. Perpetual bonds pay regular coupon interest, which is considered taxable income each year, providing consistent taxable events for investors. Investors in higher tax brackets should evaluate the timing and frequency of these tax obligations to optimize after-tax returns from either bond type.

Choosing Between Zero-Coupon and Perpetual Bonds

Choosing between zero-coupon and perpetual bonds depends on investment goals and risk tolerance. Zero-coupon bonds offer a fixed return by paying no periodic interest and maturing at face value, making them ideal for predictable, long-term capital growth. Perpetual bonds provide indefinite interest payments without principal repayment, appealing to investors seeking steady income but accepting higher interest rate risk and no maturity date.

Zero-coupon bond Infographic

libterm.com

libterm.com