Nominal interest rate represents the percentage increase in money you earn from an investment or pay on a loan before adjusting for inflation. It is a crucial factor in financial planning and understanding the true cost or return of borrowing and lending activities. Explore the rest of the article to learn how nominal interest rates impact your financial decisions and compare with real interest rates.

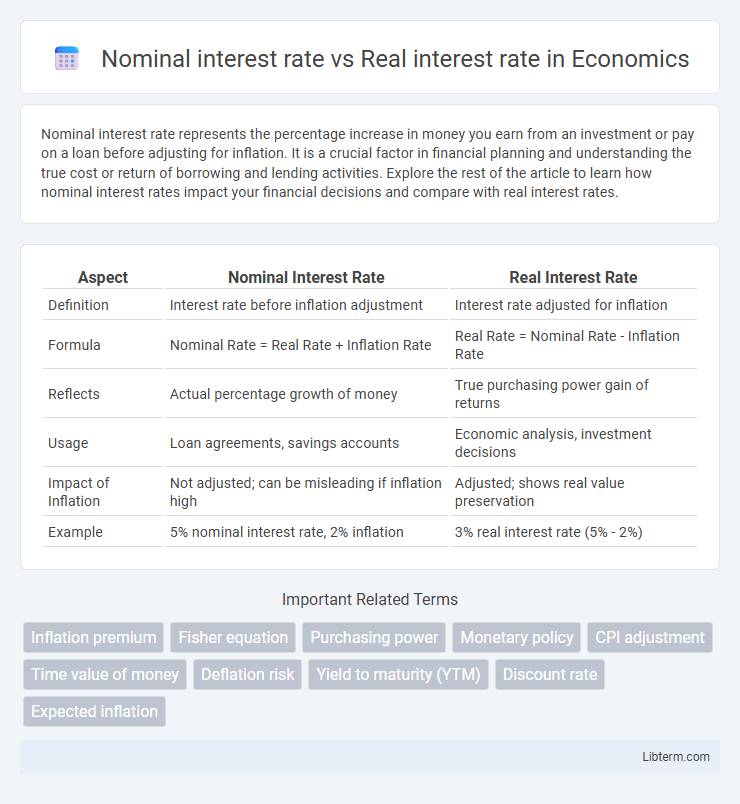

Table of Comparison

| Aspect | Nominal Interest Rate | Real Interest Rate |

|---|---|---|

| Definition | Interest rate before inflation adjustment | Interest rate adjusted for inflation |

| Formula | Nominal Rate = Real Rate + Inflation Rate | Real Rate = Nominal Rate - Inflation Rate |

| Reflects | Actual percentage growth of money | True purchasing power gain of returns |

| Usage | Loan agreements, savings accounts | Economic analysis, investment decisions |

| Impact of Inflation | Not adjusted; can be misleading if inflation high | Adjusted; shows real value preservation |

| Example | 5% nominal interest rate, 2% inflation | 3% real interest rate (5% - 2%) |

Understanding Nominal Interest Rate

Nominal interest rate represents the percentage increase in money that a borrower pays to a lender, not adjusted for inflation, reflecting the stated interest rate on loans or investments. It is crucial for understanding actual cash flow but can be misleading when comparing purchasing power over time due to inflation effects. Investors and borrowers often analyze nominal rates alongside inflation to gauge true earning potential or borrowing costs.

What is Real Interest Rate?

Real interest rate represents the nominal interest rate adjusted for inflation, reflecting the true cost of borrowing and the real yield on investments. It is calculated by subtracting the inflation rate from the nominal interest rate, providing a more accurate measure of purchasing power changes over time. Understanding the real interest rate is crucial for investors and borrowers to gauge the actual profitability and expenses beyond inflation effects.

Key Differences Between Nominal and Real Interest Rates

Nominal interest rates represent the percentage increase in money paid by a borrower without adjusting for inflation, while real interest rates reflect the inflation-adjusted return on an investment or loan. The key difference lies in the real interest rate's ability to measure the true purchasing power gained or lost, calculated by subtracting the inflation rate from the nominal interest rate. Investors and policymakers use real interest rates to assess the actual cost of borrowing and the real yield on investments, making it a crucial factor for economic decision-making.

How Inflation Impacts Interest Rates

The nominal interest rate reflects the stated rate without adjusting for inflation, while the real interest rate accounts for inflation's effect by subtracting the inflation rate from the nominal rate. Inflation erodes purchasing power, leading lenders to demand higher nominal rates to maintain returns, which causes nominal interest rates to rise during inflationary periods. The real interest rate provides a more accurate measure of the true cost of borrowing and the real yield on investments by isolating inflation's impact.

Calculating Nominal vs. Real Interest Rate

Calculating nominal interest rate involves determining the stated rate without adjusting for inflation, typically expressed as a percentage per period. The real interest rate adjusts the nominal rate by subtracting the inflation rate, reflecting the true purchasing power of the returns. The Fisher equation, Real Interest Rate Nominal Interest Rate - Inflation Rate, is commonly used to estimate real rates for more accurate economic decision-making.

Importance for Borrowers and Investors

Nominal interest rates represent the stated percentage charged on loans or earned on investments without adjusting for inflation, directly influencing borrowing costs and investment returns. Real interest rates, calculated by subtracting the inflation rate from the nominal rate, provide a more accurate measure of purchasing power changes, crucial for borrowers to assess the true cost of debt and for investors to gauge real profitability. Understanding the distinction helps borrowers avoid underestimating repayment burdens and enables investors to protect their capital's value against inflation erosion.

Effects on Loan and Investment Decisions

Nominal interest rate represents the stated percentage without adjusting for inflation, directly impacting loan repayment amounts and perceived investment returns. Real interest rate accounts for inflation, providing a clearer measure of purchasing power and influencing decisions by reflecting true loan costs and investment profitability. Understanding the difference helps borrowers evaluate actual debt burden, while investors assess genuine yield, optimizing financial strategies under varying economic conditions.

Historical Trends in Nominal and Real Rates

Historical trends in nominal and real interest rates reveal significant fluctuations influenced by inflation and monetary policy shifts. Nominal interest rates often rose sharply during periods of high inflation, such as the 1970s, while real interest rates, adjusted for inflation, displayed more stability or even turned negative. Understanding these trends helps investors and economists assess the true cost of borrowing and the real yield on investments over time.

Common Misconceptions About Interest Rates

Many people confuse nominal interest rates, which are the stated rates without inflation adjustment, with real interest rates that account for inflation's impact on purchasing power. A common misconception is that a higher nominal interest rate always means higher returns, while inflation can significantly erode actual earnings. Understanding the difference between these rates is crucial for accurate financial planning and investment assessment.

Choosing the Right Rate for Financial Planning

Choosing the right interest rate for financial planning requires understanding the difference between nominal and real interest rates. Nominal interest rates reflect the stated percentage without adjusting for inflation, while real interest rates account for inflation, revealing the true purchasing power of returns. Prioritizing the real interest rate helps investors and savers make informed decisions by accurately assessing growth potential and preserving wealth over time.

Nominal interest rate Infographic

libterm.com

libterm.com