Fiscal transparency ensures that government financial activities are open, clear, and accessible to the public, fostering trust and accountability. It involves the timely disclosure of budgetary plans, expenditures, and debt levels, enabling citizens and stakeholders to assess public sector performance effectively. Explore the rest of the article to understand how fiscal transparency can empower your role in holding governments accountable.

Table of Comparison

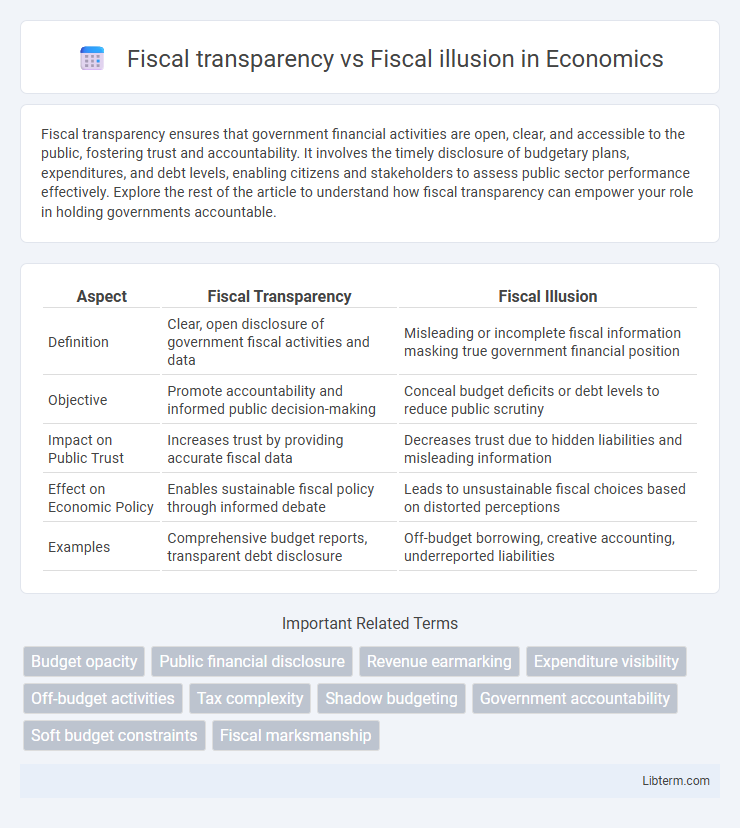

| Aspect | Fiscal Transparency | Fiscal Illusion |

|---|---|---|

| Definition | Clear, open disclosure of government fiscal activities and data | Misleading or incomplete fiscal information masking true government financial position |

| Objective | Promote accountability and informed public decision-making | Conceal budget deficits or debt levels to reduce public scrutiny |

| Impact on Public Trust | Increases trust by providing accurate fiscal data | Decreases trust due to hidden liabilities and misleading information |

| Effect on Economic Policy | Enables sustainable fiscal policy through informed debate | Leads to unsustainable fiscal choices based on distorted perceptions |

| Examples | Comprehensive budget reports, transparent debt disclosure | Off-budget borrowing, creative accounting, underreported liabilities |

Understanding Fiscal Transparency

Fiscal transparency involves the clear disclosure of government financial activities, enabling citizens and investors to assess public sector performance accurately. It promotes accountability by making budgetary decisions, revenue sources, and expenditure details accessible, reducing the risk of fiscal mismanagement. Understanding fiscal transparency is crucial for distinguishing genuine budgetary health from fiscal illusion, where obscured information may create misleading perceptions of government solvency.

Defining Fiscal Illusion

Fiscal illusion occurs when taxpayers misperceive the true cost of government expenditure due to complex fiscal structures, hidden taxes, or deficit financing, leading to underestimated public burdens. Unlike fiscal transparency, which ensures clear disclosure of government revenues and expenditures to promote accountability, fiscal illusion obscures the real fiscal position, impairing informed decision-making. Understanding fiscal illusion is crucial for evaluating how government policies influence public perception and fiscal behavior.

Key Differences Between Fiscal Transparency and Fiscal Illusion

Fiscal transparency involves clear and accessible disclosure of government financial activities, enabling citizens and investors to understand public sector finances accurately. Fiscal illusion occurs when governments obscure or manipulate fiscal data, leading taxpayers to underestimate the true cost of public spending. The key differences lie in transparency's promotion of accountability and informed decision-making, whereas fiscal illusion fosters misinformation and potential overspending due to hidden fiscal burdens.

Historical Perspectives on Fiscal Policy Openness

Historical perspectives on fiscal policy openness reveal a persistent tension between fiscal transparency and fiscal illusion, where governments often balance clear budget reporting against the temptation to obscure real fiscal conditions to gain political advantage. Fiscal transparency involves the public availability of detailed government financial data, fostering trust and improved policy decisions, whereas fiscal illusion exploits complex accounting to hide deficits or debt. Studies trace this dynamic back to early modern states, showing shifts in transparency practices influenced by political context, citizen demand for accountability, and evolving institutional frameworks.

Drivers of Fiscal Transparency in Modern Governance

Fiscal transparency ensures clear, accurate disclosure of government revenues, expenditures, and debt to promote accountability and reduce corruption. Key drivers include robust legal frameworks, advanced digital reporting systems, and independent audit institutions that enable real-time access to fiscal data for policymakers and the public. Enhanced transparency counters fiscal illusion by preventing misinformation around budgetary health and fostering informed decision-making in modern governance.

Mechanisms and Causes of Fiscal Illusion

Fiscal illusion occurs when taxpayers misperceive the true cost of government services due to complex tax structures or opaque budget practices, leading to increased public spending beyond efficient levels. Mechanisms include inflation tax, deficit financing, and non-transparent borrowing, which distort taxpayers' understanding of fiscal burdens and weaken accountability. Causes of fiscal illusion often involve political incentives to obscure fiscal realities, reliance on indirect taxation, and off-budget expenditures that mask the actual fiscal stance.

Impact of Fiscal Transparency on Public Trust

Enhanced fiscal transparency significantly boosts public trust by providing clear, accurate information about government revenues, expenditures, and debt levels. Transparent fiscal policies prevent fiscal illusion, where citizens underestimate government borrowing or deficits, leading to more informed decision-making and accountability. This improved trust encourages greater public support for necessary fiscal measures and promotes economic stability.

Consequences of Fiscal Illusion for Economic Decision-making

Fiscal illusion distorts the true cost of government spending by obscuring budget deficits and public debt, leading to suboptimal economic decisions by households and firms. This misperception encourages overspending, excessive borrowing, and under-saving, ultimately undermining fiscal sustainability and economic growth. Consequences also include inefficient allocation of resources and reduced accountability in public finance management.

Policy Tools to Promote Fiscal Transparency

Policy tools to promote fiscal transparency include comprehensive budget reports, real-time public access to government financial data, and standardized accounting practices that enhance clarity and comparability. Implementing independent fiscal institutions and conducting regular audits ensure accountability and reduce the risk of fiscal illusion, where government finances may appear better or worse than reality. Digital platforms and open data initiatives also empower citizens and stakeholders to monitor government expenditures, fostering informed decision-making and trust.

Overcoming Fiscal Illusion: Best Practices and Recommendations

Overcoming fiscal illusion requires enhancing fiscal transparency through clear reporting of government revenues, expenditures, and debts, enabling citizens and policymakers to accurately assess fiscal health. Best practices include implementing comprehensive budget disclosures, adopting open data standards, and ensuring timely access to fiscal information to prevent misperceptions about public finances. Encouraging independent fiscal oversight institutions and public engagement initiatives strengthens accountability and reduces the risk of fiscal mismanagement driven by illusion.

Fiscal transparency Infographic

libterm.com

libterm.com