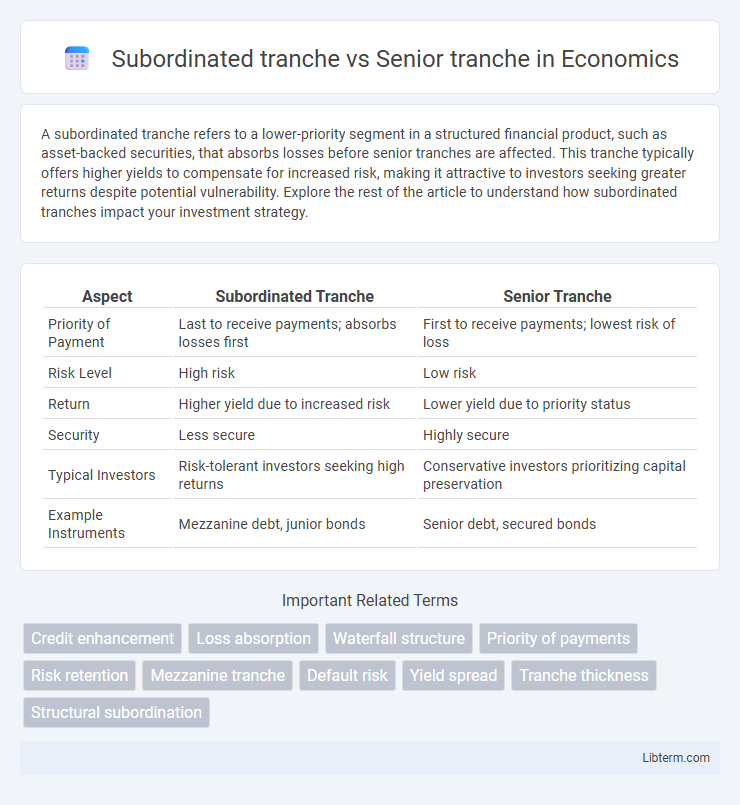

A subordinated tranche refers to a lower-priority segment in a structured financial product, such as asset-backed securities, that absorbs losses before senior tranches are affected. This tranche typically offers higher yields to compensate for increased risk, making it attractive to investors seeking greater returns despite potential vulnerability. Explore the rest of the article to understand how subordinated tranches impact your investment strategy.

Table of Comparison

| Aspect | Subordinated Tranche | Senior Tranche |

|---|---|---|

| Priority of Payment | Last to receive payments; absorbs losses first | First to receive payments; lowest risk of loss |

| Risk Level | High risk | Low risk |

| Return | Higher yield due to increased risk | Lower yield due to priority status |

| Security | Less secure | Highly secure |

| Typical Investors | Risk-tolerant investors seeking high returns | Conservative investors prioritizing capital preservation |

| Example Instruments | Mezzanine debt, junior bonds | Senior debt, secured bonds |

Introduction to Tranches in Structured Finance

Subordinated tranche and senior tranche represent different layers of risk and priority in structured finance securities, where the senior tranche holds the highest repayment priority and lower risk. The subordinated tranche, also called the mezzanine or junior tranche, absorbs initial losses and offers higher yields to compensate for its increased risk exposure. Tranche structuring enables diversified investor preferences by segmenting cash flows and credit risk from underlying assets such as mortgage-backed securities or collateralized debt obligations.

Defining Senior and Subordinated Tranches

Senior tranches have priority in receiving interest and principal payments, making them lower-risk and typically rated higher by credit agencies. Subordinated tranches absorb losses first in the event of default, acting as a buffer to protect senior tranches and carrying higher risk and potential return. The structural hierarchy in collateralized debt obligations (CDOs) or mortgage-backed securities (MBS) clearly distinguishes senior tranches as the safest investment, while subordinated tranches offer increased risk exposure for higher yield.

Key Differences: Senior vs Subordinated Tranches

Senior tranches hold priority claim on assets and receive payments before subordinated tranches, which bear higher risk but offer higher yields. Subordinated tranches absorb initial losses first, providing protection to senior tranches and enhancing their credit quality. The difference in payment priority and risk exposure directly influences investment strategies and return expectations for both senior and subordinated tranche holders.

Risk Profiles of Senior and Subordinated Tranches

Senior tranches in structured finance carry lower risk due to their priority in receiving payments and protection from initial losses, making them more attractive to conservative investors seeking stable returns. Subordinated tranches absorb losses first, resulting in higher risk but offering potentially greater yields to compensate for increased exposure to credit events. The risk profile difference is critical for portfolio diversification, as senior tranches mitigate default risk while subordinated tranches serve investors willing to assume elevated credit and liquidity risks.

Return Potential: Comparing Yield Expectations

The subordinated tranche typically offers higher yield expectations due to increased credit risk and loss absorption priority compared to the senior tranche. Senior tranches provide lower returns but benefit from greater credit protection and priority claim on cash flows, reducing default risk. Investors seeking higher return potential with tolerable risk exposure often prefer subordinated tranches, while conservative investors usually opt for senior tranches for stable income.

Payment Waterfall Structure Explained

In the payment waterfall structure, senior tranches receive principal and interest payments first, offering lower risk and priority over subordinated tranches. Subordinated tranches absorb losses first and only receive payments after all senior tranche obligations are fully met, reflecting higher risk and potential for greater returns. This hierarchy ensures that senior tranche investors have higher payment assurance, while subordinated tranche holders provide a credit cushion for the entire structured finance deal.

Investor Suitability: Who Should Invest in Each Tranche?

Investors with higher risk tolerance and a preference for higher potential returns are suitable for subordinated tranches, as these carry greater credit risk and absorb initial losses in structured finance deals. Senior tranches appeal to risk-averse investors seeking more stable income streams and lower default risk, often featuring priority in payment and higher credit ratings. Understanding the risk-return profile and the structural position within the capital stack is crucial for aligning investment choices with financial goals and risk appetite.

Impact of Default on Senior and Subordinated Investors

In a structured finance deal, subordinated tranche investors face higher risk as they absorb losses first in the event of default, providing a credit buffer that protects senior tranche investors. Senior tranche holders benefit from priority claim on cash flows and principal repayments, significantly reducing their exposure to defaults. This risk hierarchy results in subordinated tranches typically offering higher yields to compensate for increased default risk, while senior tranches enjoy lower yields due to their enhanced security.

Real-World Examples: Senior vs Subordinated Tranches

Senior tranches, such as those in the 2008 Lehman Brothers mortgage-backed securities, receive priority in interest and principal payments, attracting conservative investors like pension funds. Subordinated tranches, exemplified by the residual equity in the 2020 COVID-19 relief bond issuances, absorb initial losses but offer higher yields, appealing to hedge funds and high-risk investors. This hierarchical payment structure in real-world asset-backed securities highlights risk distribution and investment return differentiation.

Conclusion: Choosing Between Senior and Subordinated Tranches

Choosing between senior and subordinated tranches depends on the investor's risk tolerance and return expectations. Senior tranches offer lower risk and priority in cash flow distributions but come with lower yields, while subordinated tranches carry higher risk with potential for greater returns due to their lower repayment priority. An optimal portfolio balances exposure to both tranches, leveraging the stability of senior debt and the higher income potential of subordinated tranches to achieve diversified risk-adjusted returns.

Subordinated tranche Infographic

libterm.com

libterm.com