The Earned Income Tax Credit (EITC) is a valuable tax benefit designed to assist low to moderate-income working individuals and families by reducing the amount of tax owed and potentially increasing your tax refund. Eligibility and credit amounts vary based on income, filing status, and number of qualifying children, making it essential to understand the specific criteria. Discover how the EITC can maximize your tax savings by reading the full article.

Table of Comparison

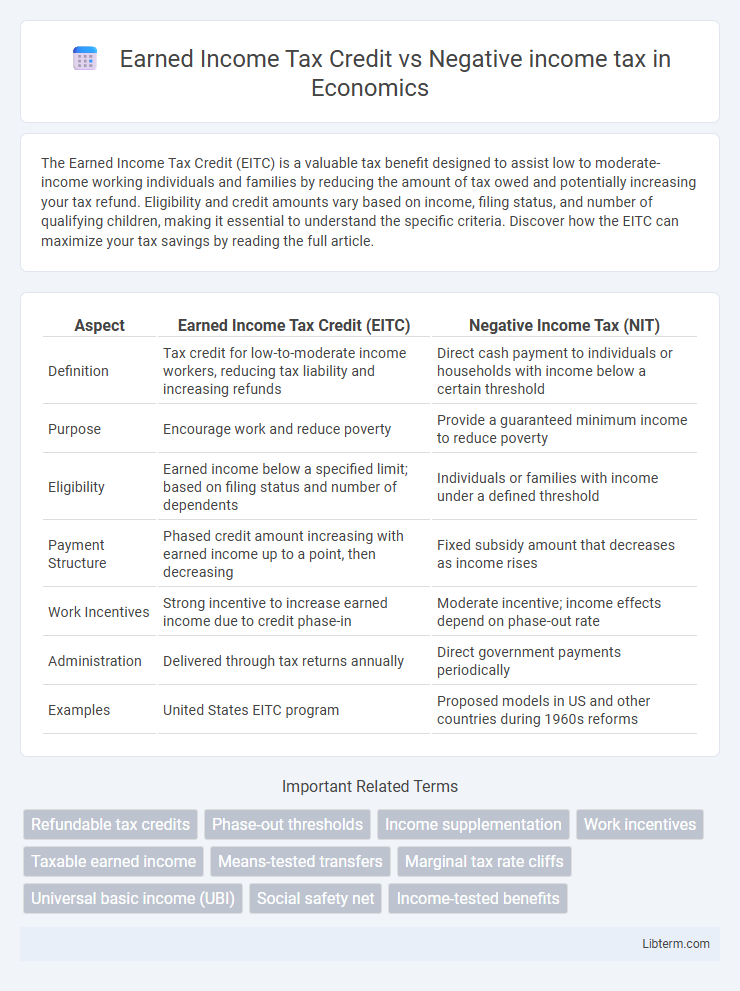

| Aspect | Earned Income Tax Credit (EITC) | Negative Income Tax (NIT) |

|---|---|---|

| Definition | Tax credit for low-to-moderate income workers, reducing tax liability and increasing refunds | Direct cash payment to individuals or households with income below a certain threshold |

| Purpose | Encourage work and reduce poverty | Provide a guaranteed minimum income to reduce poverty |

| Eligibility | Earned income below a specified limit; based on filing status and number of dependents | Individuals or families with income under a defined threshold |

| Payment Structure | Phased credit amount increasing with earned income up to a point, then decreasing | Fixed subsidy amount that decreases as income rises |

| Work Incentives | Strong incentive to increase earned income due to credit phase-in | Moderate incentive; income effects depend on phase-out rate |

| Administration | Delivered through tax returns annually | Direct government payments periodically |

| Examples | United States EITC program | Proposed models in US and other countries during 1960s reforms |

Introduction to Earned Income Tax Credit and Negative Income Tax

The Earned Income Tax Credit (EITC) provides refundable tax benefits to low- to moderate-income working individuals and families, aiming to reduce poverty and incentivize employment. In contrast, the Negative Income Tax (NIT) is a policy mechanism where individuals earning below a certain threshold receive supplemental income through tax refunds, effectively guaranteeing a minimum income. Both systems serve as social safety nets, but while EITC targets wage earners specifically, NIT applies more broadly as a direct income support.

Historical Background and Policy Origins

The Earned Income Tax Credit (EITC) originated in the United States during the 1970s as a response to rising poverty and unemployment, designed to incentivize work among low-income families by providing refundable tax credits based on earned income. The Negative Income Tax (NIT) concept, developed in the 1960s by economist Milton Friedman, proposed a direct government cash subsidy to individuals earning below a certain threshold, aiming to simplify welfare and reduce poverty. Both policies emerged from efforts to reform social safety nets and shift support from traditional welfare to work-based assistance programs.

Core Concepts: How EITC and Negative Income Tax Work

The Earned Income Tax Credit (EITC) provides refundable tax credits to low- to moderate-income working individuals and families, directly reducing tax liability and increasing refunds based on earned income and number of dependents. The Negative Income Tax (NIT) offers a guaranteed minimum income by providing payments that phase out as recipients earn more, effectively functioning as a federal subsidy that replaces traditional welfare. Both mechanisms aim to alleviate poverty by supplementing income, but EITC targets working individuals through the tax system, while NIT establishes a baseline income irrespective of employment status.

Eligibility Criteria and Target Populations

The Earned Income Tax Credit (EITC) primarily targets low to moderate-income working individuals and families, with eligibility based on earned income, filing status, and number of qualifying children. In contrast, the Negative Income Tax (NIT) proposal centers on providing a guaranteed minimum income to low-income individuals regardless of employment status, often evaluated through a means-tested income threshold. EITC emphasizes work incentives and child-related benefits, whereas NIT focuses on income floor support to reduce poverty across broader demographic groups.

Calculation Methods and Benefit Structures

The Earned Income Tax Credit (EITC) calculation method uses a phase-in, plateau, and phase-out structure based on earned income and number of qualifying children, offering a refundable credit that reduces tax liability and may result in a refund. Negative Income Tax (NIT) programs calculate benefits by setting a guaranteed minimum income level and reducing the benefit gradually as earned income rises, providing direct cash payments instead of tax credits. While EITC benefits increase with earned income up to a point before tapering off, NIT ensures a baseline income through a benefit formula, both aiming to incentivize work and reduce poverty through distinct fiscal mechanisms.

Impact on Low-Income Households

The Earned Income Tax Credit (EITC) directly boosts low-income households' earnings by providing refundable tax credits based on wages, reducing poverty and encouraging work participation. Negative income tax (NIT) offers guaranteed minimum income through direct payments that decrease as earnings rise, simplifying welfare but potentially creating varying work incentives. Studies show EITC significantly increases employment among low-income workers, while NIT models emphasize universal income support but require careful calibration to avoid disincentivizing labor.

Work Incentives and Economic Mobility

The Earned Income Tax Credit (EITC) directly increases work incentives by providing refundable tax credits that boost earnings for low- to moderate-income workers, encouraging labor force participation and reducing poverty. In contrast, the Negative Income Tax (NIT) offers a guaranteed minimum income that gradually phases out as earnings rise, aiming to support economic mobility while minimizing welfare cliffs. Both policies seek to enhance economic mobility but differ in structure, with EITC more targeted on incentivizing work and NIT emphasizing income security.

Administrative Complexity and Cost Efficiency

The Earned Income Tax Credit (EITC) involves a complex administrative framework requiring extensive income verification and periodic audits to prevent fraud, which can increase overhead costs. Negative Income Tax (NIT) systems typically simplify administration by providing direct payments based on reported income, reducing the need for intricate eligibility checks. Cost efficiency is higher in NIT implementations due to streamlined processing, whereas EITC's targeted benefit structure demands more resources for enforcement and compliance monitoring.

Policy Debates and Proposed Reforms

Policy debates around the Earned Income Tax Credit (EITC) emphasize its targeted support for low- to moderate-income workers, with discussions on expanding credit amounts and eligibility to reduce poverty effectively. In contrast, proposed reforms to the Negative Income Tax (NIT) revolve around simplifying welfare programs and reducing bureaucratic costs by providing a guaranteed minimum income. Key policy challenges include balancing financial incentives to work while preventing benefit cliffs and ensuring administrative feasibility for both EITC and NIT frameworks.

Conclusion: Comparing Effectiveness and Future Prospects

Earned Income Tax Credit (EITC) effectively targets low- to moderate-income working families, reducing poverty and encouraging workforce participation through refundable tax benefits, while Negative Income Tax (NIT) proposes a direct income guarantee that simplifies welfare but faces administrative and political challenges. Studies show EITC's proven scalability and positive labor market impacts contrast with NIT's theoretical appeal but limited practical deployment. Future prospects favor EITC expansions due to existing infrastructure and evidence, though NIT models continue to influence policy discussions on universal basic income and comprehensive income support reform.

Earned Income Tax Credit Infographic

libterm.com

libterm.com