Stagflation occurs when an economy experiences stagnant growth, high unemployment, and rising inflation simultaneously, creating a challenging environment for policymakers. This economic condition reduces consumer purchasing power and increases production costs, often leading to decreased business confidence. Discover how stagflation impacts your finances and what strategies can help you navigate through it in the rest of this article.

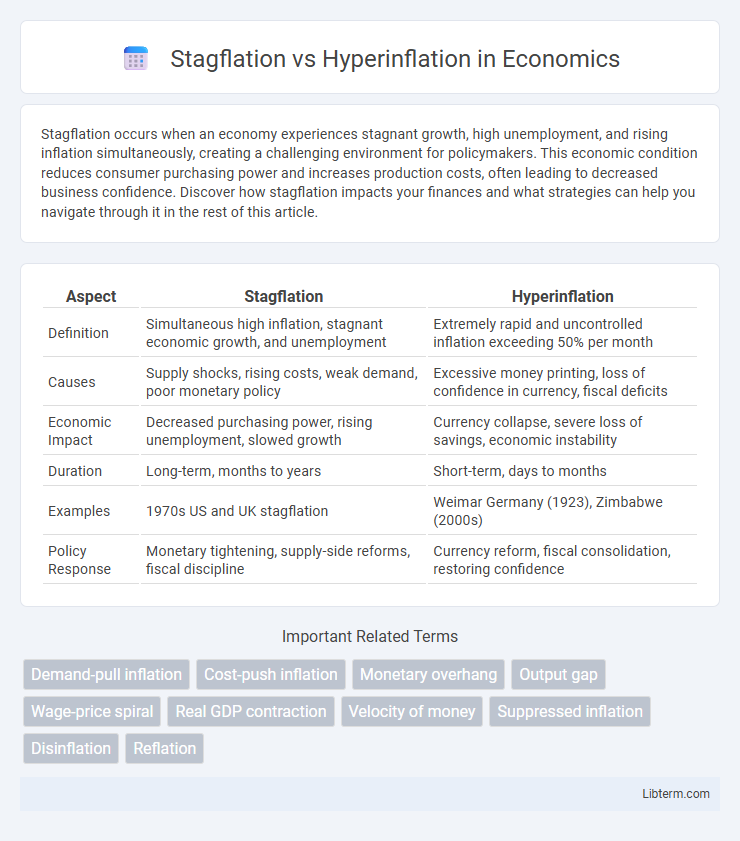

Table of Comparison

| Aspect | Stagflation | Hyperinflation |

|---|---|---|

| Definition | Simultaneous high inflation, stagnant economic growth, and unemployment | Extremely rapid and uncontrolled inflation exceeding 50% per month |

| Causes | Supply shocks, rising costs, weak demand, poor monetary policy | Excessive money printing, loss of confidence in currency, fiscal deficits |

| Economic Impact | Decreased purchasing power, rising unemployment, slowed growth | Currency collapse, severe loss of savings, economic instability |

| Duration | Long-term, months to years | Short-term, days to months |

| Examples | 1970s US and UK stagflation | Weimar Germany (1923), Zimbabwe (2000s) |

| Policy Response | Monetary tightening, supply-side reforms, fiscal discipline | Currency reform, fiscal consolidation, restoring confidence |

Understanding Stagflation: Definition and Key Features

Stagflation is an economic condition characterized by stagnant economic growth, high unemployment, and rising inflation occurring simultaneously, which defies the typical inverse relationship between inflation and unemployment. Key features include persistent inflation despite slow or negative GDP growth and labor market weaknesses, often triggered by supply shocks or poor monetary policies. Unlike hyperinflation, where inflation rises uncontrollably at rates exceeding 50% per month, stagflation presents a more complex challenge by combining inflation with economic stagnation rather than explosive price increases.

What is Hyperinflation? A Clear Overview

Hyperinflation is an economic condition characterized by an extremely rapid and uncontrollable increase in prices, often exceeding 50% per month, leading to a severe erosion of a currency's real value. Unlike stagflation, which combines high inflation with stagnant economic growth and unemployment, hyperinflation involves a complete loss of confidence in the currency, often triggered by excessive money printing or political instability. Key historical examples include Zimbabwe in the late 2000s and Germany's Weimar Republic in the 1920s, where hyperinflation devastated economies and resulted in widespread social and economic turmoil.

Historical Examples: Stagflation vs Hyperinflation

The 1970s U.S. stagflation featured high inflation, stagnant economic growth, and rising unemployment, driven by oil price shocks and monetary policy challenges. In contrast, hyperinflation episodes like Zimbabwe in the late 2000s saw annual inflation rates exceeding billions percent, causing currency collapse and severe economic disruption. Germany's Weimar Republic in the 1920s demonstrated how hyperinflation erodes savings rapidly, whereas stagflation maintains moderate inflation alongside economic stagnation.

Economic Causes: Stagflation vs Hyperinflation

Stagflation arises from supply-side shocks that simultaneously increase inflation and unemployment, often triggered by rising production costs and stagnant economic growth. Hyperinflation occurs due to an excessive money supply growth caused by persistent fiscal deficits and loss of confidence in a currency, leading to rapidly accelerating price levels. While stagflation reflects a stagnant economy with rising prices, hyperinflation results from monetary collapse and uncontrolled inflation spirals.

Impact on Consumers and Businesses

Stagflation causes persistent high inflation coupled with stagnant economic growth and rising unemployment, leading consumers to face reduced purchasing power and businesses to struggle with increased production costs and decreased demand. Hyperinflation results in rapidly accelerating price increases that erode consumer savings and cripple business operations due to unpredictable costs and collapse of currency value. Both conditions severely disrupt market stability, but stagflation imposes prolonged economic stagnation while hyperinflation triggers acute financial crises.

Policy Responses to Stagflation

Effective policy responses to stagflation require a delicate balance between controlling inflation and stimulating economic growth, often involving tight monetary policies combined with targeted fiscal measures. Central banks may raise interest rates to curb inflation while governments implement supply-side reforms to enhance productivity and reduce structural unemployment. Coordinated efforts, including deregulation and investment in innovation, are essential to mitigate the dual challenges of stagnant economic growth and rising prices characteristic of stagflation.

Policy Responses to Hyperinflation

Policy responses to hyperinflation involve aggressive monetary tightening, including raising interest rates and reducing the money supply to restore price stability. Governments often implement fiscal discipline by cutting public spending and increasing tax revenues to curb excessive deficit financing. Currency reforms, such as introducing a new currency or pegging to a stable foreign currency, are critical measures to rebuild public confidence and stabilize the economy during hyperinflation crises.

Stagflation and Hyperinflation: Main Differences

Stagflation is characterized by stagnant economic growth, high unemployment, and rising inflation, whereas hyperinflation involves extremely rapid and uncontrollable price increases, often exceeding 50% per month. The primary difference lies in the economic conditions: stagflation combines inflation with economic stagnation, while hyperinflation indicates a collapse in currency value and economic stability. Central banks typically struggle to combat stagflation without worsening unemployment, whereas hyperinflation requires urgent monetary reforms to restore confidence and stabilize prices.

Warning Signs and Early Indicators

Stagflation is characterized by stagnant economic growth, high unemployment, and rising inflation, with early warning signs including a persistent increase in commodity prices alongside declining industrial production and wage stagnation. Hyperinflation manifests through rapid and uncontrollable price increases, often exceeding 50% per month, signaled by excessive money supply growth, collapsing currency value, and a loss of public confidence in the financial system. Monitoring central bank policies, fiscal deficits, and changes in consumer price indexes can provide critical early indicators to distinguish between these two inflationary scenarios.

Lessons Learned and Future Implications

Stagflation teaches the critical lesson that high inflation can coexist with stagnant economic growth and high unemployment, challenging traditional monetary policies that target either inflation or unemployment alone. Hyperinflation reveals the devastating impact of unchecked money supply growth, leading to a collapse in currency value and economic instability. Future implications emphasize the importance of balanced fiscal policies, credible central bank independence, and proactive inflation targeting to prevent these extreme economic conditions.

Stagflation Infographic

libterm.com

libterm.com