Opportunity costs represent the value of the next best alternative foregone when making a decision, highlighting the trade-offs involved in resource allocation. Understanding opportunity costs helps you optimize choices in both personal finance and business strategies by revealing what is sacrificed with each option. Dive into the rest of this article to explore how recognizing opportunity costs can improve your decision-making skills.

Table of Comparison

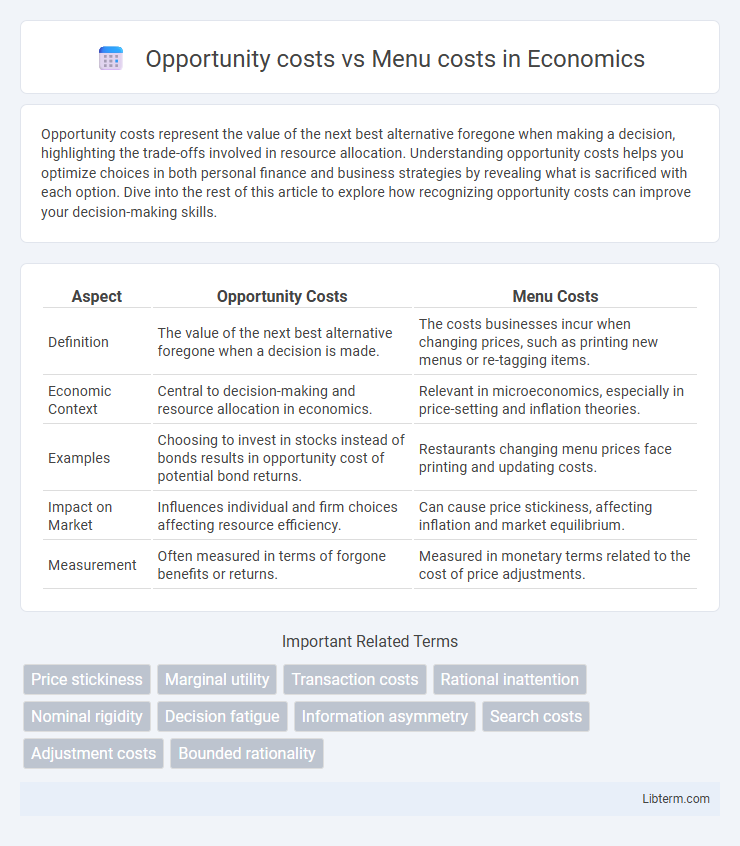

| Aspect | Opportunity Costs | Menu Costs |

|---|---|---|

| Definition | The value of the next best alternative foregone when a decision is made. | The costs businesses incur when changing prices, such as printing new menus or re-tagging items. |

| Economic Context | Central to decision-making and resource allocation in economics. | Relevant in microeconomics, especially in price-setting and inflation theories. |

| Examples | Choosing to invest in stocks instead of bonds results in opportunity cost of potential bond returns. | Restaurants changing menu prices face printing and updating costs. |

| Impact on Market | Influences individual and firm choices affecting resource efficiency. | Can cause price stickiness, affecting inflation and market equilibrium. |

| Measurement | Often measured in terms of forgone benefits or returns. | Measured in monetary terms related to the cost of price adjustments. |

Understanding Opportunity Costs: Definition and Importance

Opportunity costs represent the potential benefits an individual or business misses out on when choosing one alternative over another, making them a critical factor in decision-making and resource allocation. This concept highlights the trade-offs inherent in every economic choice, emphasizing the value of the next best option forgone. Understanding opportunity costs enables more efficient use of time, money, and resources, leading to optimized financial and operational outcomes.

The Concept of Menu Costs in Economics

Menu costs in economics refer to the expenses incurred by firms when changing prices, such as printing new menus, re-tagging items, or updating digital price lists. These costs create price rigidities, causing firms to delay adjustments in response to inflation or demand fluctuations, potentially leading to inefficiencies in the market. Differing from opportunity costs, menu costs specifically highlight the friction in price-setting processes rather than the value of foregone alternatives.

Key Differences Between Opportunity Costs and Menu Costs

Opportunity costs represent the value of the next best alternative foregone when making a decision, quantifying the trade-offs in resource allocation. Menu costs refer specifically to the expenses businesses incur when changing prices, including the physical costs of updating menus or price lists and the potential customer dissatisfaction. The key difference lies in opportunity costs measuring intangible economic trade-offs, while menu costs focus on tangible costs associated with price adjustments.

How Opportunity Costs Impact Decision-Making

Opportunity costs represent the value of the next best alternative foregone when making decisions, directly influencing resource allocation by highlighting trade-offs in investment, time, or consumption. This concept forces individuals and businesses to evaluate potential benefits against what must be sacrificed, thus optimizing choices for maximum gain. Understanding opportunity costs enables more informed decision-making by quantifying the implicit losses associated with different options, leading to more efficient economic behavior compared to focusing solely on explicit costs like menu costs.

The Real-World Consequences of Menu Costs

Menu costs, the expenses firms incur when changing prices, can lead to price stickiness that distorts market efficiency and slows economic adjustments. Real-world consequences include reduced responsiveness to demand shifts, leading to misallocation of resources and potential losses in consumer welfare. High menu costs in industries with frequent price fluctuations exacerbate inflation inertia and contribute to prolonged periods of disequilibrium in product markets.

Measuring Opportunity Costs: Methods and Examples

Measuring opportunity costs involves quantifying the potential benefits lost when choosing one alternative over another, often using methods such as comparative analysis and cost-benefit evaluation. For example, a business investing capital in new machinery must consider the forgone returns from alternative investments like marketing or research and development. Empirical case studies commonly illustrate opportunity costs by comparing net present values or projected profit margins of competing projects to guide resource allocation decisions.

Factors That Influence Menu Costs in Business

Menu costs in business are influenced by factors such as frequency of price changes, technological infrastructure, and market competitiveness. High menu costs often arise when businesses face frequent cost fluctuations, requiring constant updates in pricing strategies and physical menus or online interfaces. Efficient technology adoption, like dynamic pricing software, can reduce these costs by streamlining price adjustments and minimizing manual labor.

Opportunity Costs vs Menu Costs: Practical Case Studies

Opportunity costs quantify the benefits foregone when choosing one option over another, such as a business investing in new technology instead of expanding marketing efforts, resulting in potential lost revenue growth. Menu costs represent the tangible expenses firms incur when changing prices, like a restaurant printing new menus after a supplier price hike, impacting operational budgets. Practical case studies reveal companies balancing opportunity costs and menu costs to optimize pricing strategies and resource allocation, maximizing profitability while minimizing adjustment expenses.

Strategies to Minimize Both Opportunity and Menu Costs

Businesses can minimize opportunity costs by optimizing inventory management through just-in-time (JIT) systems, reducing excess stock and freeing capital for other investments. To lower menu costs, companies implement dynamic pricing software and digital menus that allow quick, low-cost updates to prices and product offerings. Combining efficient supply chain practices with technology-driven pricing adjustments enhances overall cost management and competitiveness.

Implications for Policy Makers and Business Leaders

Opportunity costs represent the potential benefits forgone when resources are allocated to one option over another, informing policymakers and business leaders to prioritize investments with the highest returns and avoid inefficient expenditure. Menu costs, the expenses incurred from changing prices, influence decisions on pricing strategies and frequency of adjustments, affecting inflation management and operational planning. Understanding both concepts enables strategic resource allocation and pricing policies that balance cost efficiency and market responsiveness.

Opportunity costs Infographic

libterm.com

libterm.com