Nationalization involves the transfer of private assets or industries into public ownership, often by the government, to control critical sectors of the economy and promote social welfare. This process can impact economic efficiency, investment incentives, and the balance between public and private sector roles in your country. Explore the rest of this article to understand the causes, benefits, and challenges associated with nationalization.

Table of Comparison

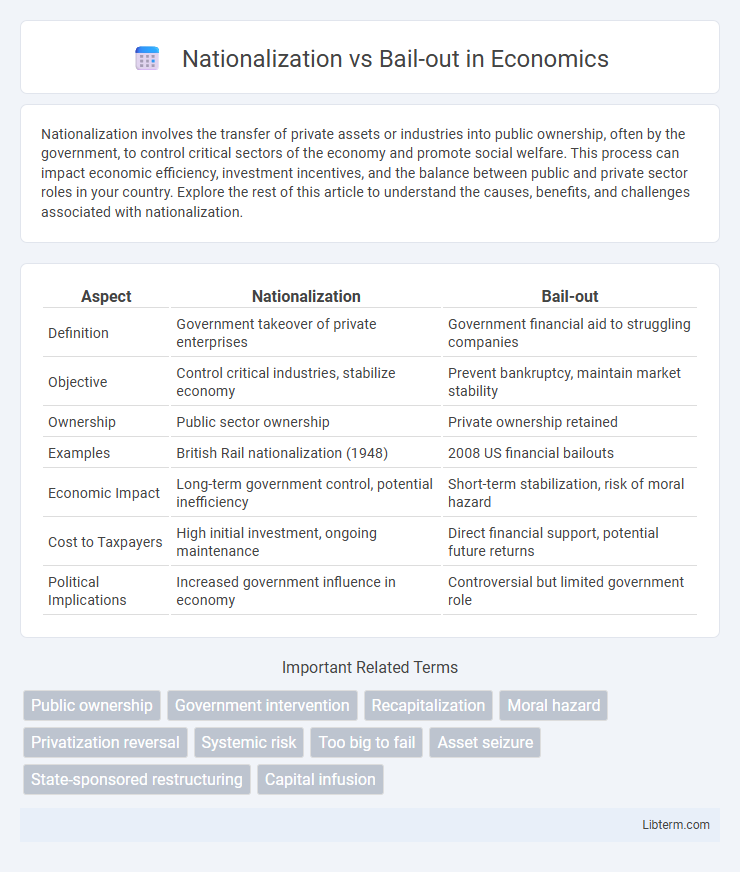

| Aspect | Nationalization | Bail-out |

|---|---|---|

| Definition | Government takeover of private enterprises | Government financial aid to struggling companies |

| Objective | Control critical industries, stabilize economy | Prevent bankruptcy, maintain market stability |

| Ownership | Public sector ownership | Private ownership retained |

| Examples | British Rail nationalization (1948) | 2008 US financial bailouts |

| Economic Impact | Long-term government control, potential inefficiency | Short-term stabilization, risk of moral hazard |

| Cost to Taxpayers | High initial investment, ongoing maintenance | Direct financial support, potential future returns |

| Political Implications | Increased government influence in economy | Controversial but limited government role |

Introduction to Nationalization and Bail-out

Nationalization refers to the process by which a government takes ownership and control of a privately-owned company or industry, often to stabilize critical sectors or protect public interests. Bail-outs involve government financial support provided to struggling companies to prevent collapse without transferring ownership, aiming to preserve economic stability and jobs. Both approaches serve as intervention tools during economic crises, but differ fundamentally in terms of ownership and long-term control implications.

Definitions: What is Nationalization?

Nationalization is the process by which a government takes control or ownership of private sector assets, industries, or companies, often to manage critical resources or stabilize the economy. It typically involves transferring private property into public ownership to serve broader social, economic, or political goals. This contrasts with bail-outs, where governments provide financial assistance to struggling companies without taking ownership.

Definitions: What is a Bail-out?

A bail-out refers to financial assistance provided by a government or external entity to a failing company or institution to prevent its collapse and stabilize the economy. It typically involves injecting capital, guaranteeing loans, or providing subsidies to ensure continued operations and protect jobs. Unlike nationalization, a bail-out does not entail government ownership but aims to restore solvency while preserving private management.

Historical Examples of Nationalization

Historical examples of nationalization highlight pivotal moments such as the UK's nationalization of key industries post-World War II, including coal, steel, and railways to rebuild the economy and ensure public control. In Latin America, Venezuela's nationalization of its oil industry in 1976 under President Hugo Chavez aimed to assert sovereignty over natural resources and increase state revenue. These cases contrast with bail-outs like the 2008 U.S. financial rescue, where governments temporarily supported failing private enterprises without permanent ownership changes.

Notable Bail-out Cases Worldwide

Notable bail-out cases worldwide include the 2008 U.S. government intervention in the financial sector, rescuing entities such as Lehman Brothers, AIG, and General Motors to prevent systemic collapse. The European Union's bail-out of Greece, Ireland, and Portugal during the Eurozone debt crisis demonstrated fiscal support to stabilize national economies without seizing ownership. Japan's 1990s banking crisis featured extensive public funds injected to recapitalize banks, highlighting a preference for bail-outs to maintain private sector control over nationalized assets.

Economic Impacts: Nationalization vs Bail-out

Nationalization transfers ownership of key industries to the government, enabling direct control over economic resources and potentially stabilizing essential sectors during crises. Bail-outs inject capital into struggling private firms, aiming to preserve market competition and prevent systemic failures without altering ownership structures. Economic impacts differ as nationalization often ensures long-term public benefits and strategic alignment, while bail-outs prioritize immediate liquidity and risk containment within the private sector.

Political Implications and Policy Debates

Nationalization often sparks intense political debate over government control versus free-market principles, with critics arguing it may lead to inefficiencies and reduced competition. Bail-outs trigger discussions on moral hazard and fairness, as public funds rescue private firms, potentially undermining market discipline and voter trust. Both approaches influence public policy by shaping regulatory frameworks and fiscal priorities, reflecting differing ideologies on state intervention in the economy.

Pros and Cons of Nationalization

Nationalization allows governments to gain full control over key industries, ensuring public interest and preventing market failures while providing stable employment and essential services. However, it often leads to inefficiencies, reduced competition, and increased fiscal burdens on taxpayers due to bureaucratic management and potential political interference. Balancing public accountability with operational efficiency remains a significant challenge in government-owned enterprises.

Pros and Cons of Bail-outs

Bail-outs provide immediate financial support to struggling companies, preventing sudden collapses that could destabilize the economy and protect jobs and investor confidence. However, they can create moral hazard, encouraging risky behavior by signaling that large firms might be rescued regardless of poor management or bad decisions. Critics argue bail-outs often use taxpayer money with limited transparency and accountability, potentially leading to long-term fiscal burdens without guaranteed market correction.

Conclusion: Choosing Between Nationalization and Bail-out

Choosing between nationalization and bail-out depends on the scale of the financial crisis and long-term economic goals. Nationalization offers government control, ensuring public interest and systemic stability, while bail-outs preserve private ownership and market confidence with fewer state resources. Policymakers must weigh the trade-offs between immediate financial support and structural reforms to decide the most effective intervention for economic recovery.

Nationalization Infographic

libterm.com

libterm.com