The classical model emphasizes rational decision-making and clear organizational structure to enhance efficiency and productivity in businesses. It focuses on well-defined hierarchy, standardized procedures, and a division of labor to achieve consistent results. Discover how this foundational approach can optimize your organization's performance by exploring the rest of the article.

Table of Comparison

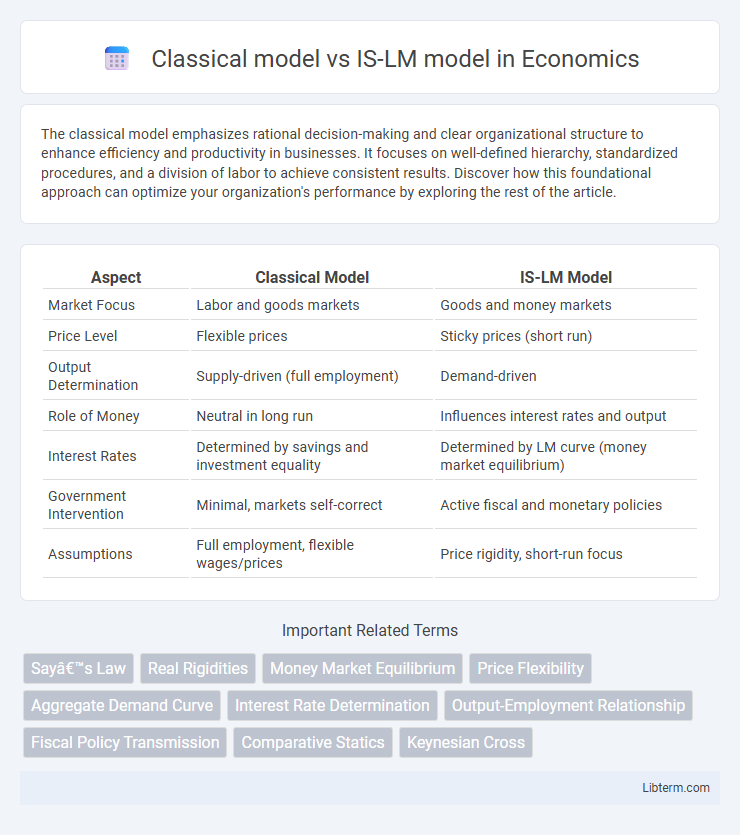

| Aspect | Classical Model | IS-LM Model |

|---|---|---|

| Market Focus | Labor and goods markets | Goods and money markets |

| Price Level | Flexible prices | Sticky prices (short run) |

| Output Determination | Supply-driven (full employment) | Demand-driven |

| Role of Money | Neutral in long run | Influences interest rates and output |

| Interest Rates | Determined by savings and investment equality | Determined by LM curve (money market equilibrium) |

| Government Intervention | Minimal, markets self-correct | Active fiscal and monetary policies |

| Assumptions | Full employment, flexible wages/prices | Price rigidity, short-run focus |

Introduction to the Classical and IS-LM Models

The Classical model emphasizes flexible prices and wages, ensuring that markets clear and the economy always operates at full employment. The IS-LM model integrates goods and money markets, depicting equilibrium where investment equals savings (IS curve) and money demand equals money supply (LM curve). Together, these frameworks contrast classical assumptions of self-adjusting markets with Keynesian insights on output and interest rate determination.

Core Assumptions of the Classical Model

The Classical model assumes full employment and price flexibility, where markets clear through wage and price adjustments without government intervention. It posits that money is neutral in the long run, affecting only nominal variables and leaving real output and employment unchanged. The model also relies on Say's Law, which states that aggregate supply creates its own aggregate demand, ensuring equilibrium in goods and factor markets.

Core Assumptions of the IS-LM Model

The IS-LM model assumes equilibrium in both goods and money markets, where the IS curve represents combinations of interest rates and output with goods market equilibrium, and the LM curve depicts money market equilibrium at given interest rates and income levels. It incorporates price rigidity in the short run, allowing output to deviate from full employment, and assumes fixed nominal money supply controlled by the central bank. The model also presumes that investment depends negatively on interest rates, consumption depends positively on disposable income, and money demand depends positively on income and negatively on interest rates.

Market Structures: Labor, Goods, and Money

The Classical model assumes flexible wages and prices ensuring labor and goods markets clear, leading to full employment and equilibrium output. The IS-LM model incorporates rigidities in prices and wages, causing goods and money markets to interact dynamically with interest rates influencing investment and aggregate demand. Labor market in IS-LM reflects involuntary unemployment due to wage stickiness, contrasting with the Classical model's natural rate of unemployment derived from labor market equilibrium.

Price and Wage Flexibility: Contrasts and Implications

The Classical model assumes complete price and wage flexibility, allowing markets to clear instantly and ensuring full employment equilibrium without government intervention. In contrast, the IS-LM model incorporates sticky prices and wages, causing short-term disequilibrium in labor and goods markets and necessitating monetary and fiscal policy to stabilize the economy. These differences imply that while Classical economics predicts self-correcting markets, the IS-LM framework highlights the potential for persistent unemployment and output gaps.

Government Policy: Role in Each Framework

The Classical model assumes that government policy is largely ineffective in influencing output due to flexible prices and wages ensuring full employment. In contrast, the IS-LM model highlights government policy as a critical tool for stabilizing the economy through fiscal and monetary interventions, impacting interest rates and aggregate demand. This divergence reflects the IS-LM's emphasis on short-run deviations from full employment, where government spending and taxation affect equilibrium income and interest rates.

Interest Rate Determination in Both Models

The Classical model determines interest rates through the real equilibrium in the loanable funds market, where savings and investment intersect, emphasizing flexible prices and wages that ensure full employment. In contrast, the IS-LM model captures interest rate determination by the simultaneous equilibrium of the goods market (IS curve) and money market (LM curve), highlighting the role of monetary policy and liquidity preference in influencing rates. While the Classical model assumes that interest rates adjust purely by real factors, the IS-LM model incorporates both real and monetary factors, allowing short-run fluctuations in interest rates driven by shifts in money supply and aggregate demand.

Output and Employment: Full Employment vs. Underemployment

The Classical model assumes full employment where output is determined by productive capacity, reflecting flexible wages and prices that equilibrate labor markets. The IS-LM model allows for underemployment equilibrium by incorporating rigidities in wages and prices, where output fluctuates due to demand shocks and monetary-fiscal interactions. Consequently, the IS-LM framework explains persistent unemployment and output gaps in the short run, contrasting the Classical model's emphasis on natural output levels.

Strengths and Limitations of Each Model

The Classical model excels in explaining long-term economic equilibrium through flexible prices and wages, ensuring full employment, but it lacks effectiveness in addressing short-term fluctuations and rigidities in the economy. The IS-LM model captures short-run interactions between the real economy and monetary policy by incorporating interest rates and income levels, offering a clearer framework for fiscal and monetary analysis, yet it assumes fixed price levels and may oversimplify expectations and market adjustments. Both models provide valuable insights, with the Classical model emphasizing supply-side factors and the IS-LM model focusing on demand-side dynamics, but each shows limitations in accounting for modern economic complexities like inflation inertia and financial market imperfections.

Conclusion: Key Takeaways and Contemporary Relevance

The Classical model emphasizes long-term price flexibility and market-clearing mechanisms, assuming full employment and neutral money, while the IS-LM model incorporates short-term rigidities with interest rate and output determination through goods and money market equilibrium. Contemporary relevance lies in the IS-LM model's ability to analyze fiscal and monetary policy effects under Keynesian assumptions, providing frameworks for understanding demand management in modern mixed economies. Key takeaways highlight the Classical focus on supply-side factors and the IS-LM model's utility in capturing short-run economic fluctuations and policy impacts.

Classical model Infographic

libterm.com

libterm.com