Bargaining theory explores how individuals or groups negotiate agreements based on their preferences, power, and available options. It highlights strategic behavior and the balance of concessions to reach mutually beneficial outcomes. Discover how understanding these dynamics can improve Your negotiation skills by reading the full article.

Table of Comparison

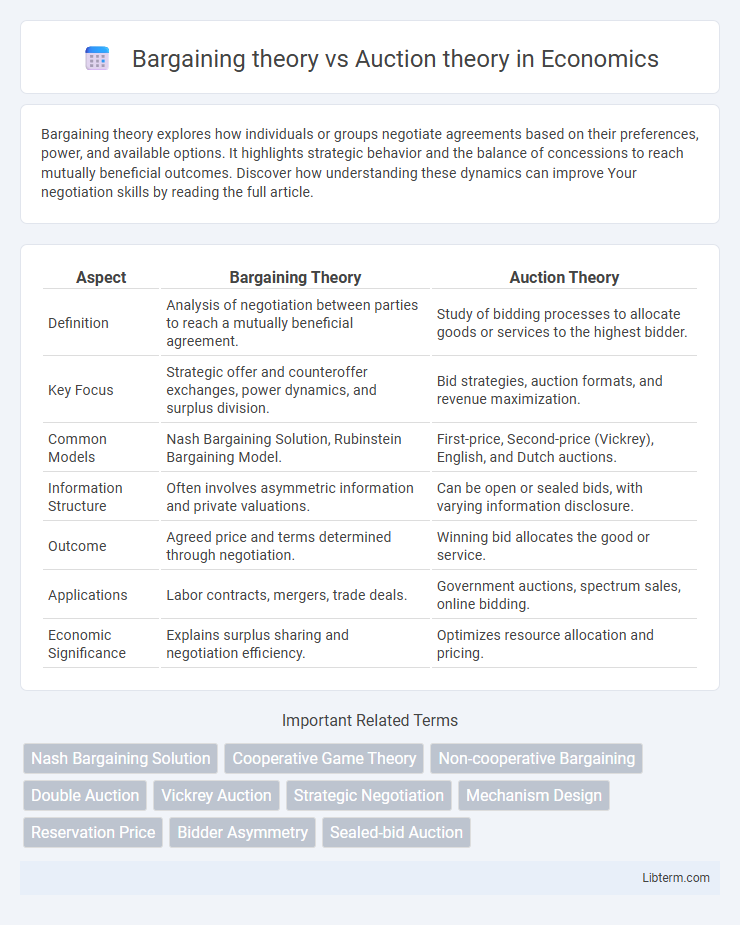

| Aspect | Bargaining Theory | Auction Theory |

|---|---|---|

| Definition | Analysis of negotiation between parties to reach a mutually beneficial agreement. | Study of bidding processes to allocate goods or services to the highest bidder. |

| Key Focus | Strategic offer and counteroffer exchanges, power dynamics, and surplus division. | Bid strategies, auction formats, and revenue maximization. |

| Common Models | Nash Bargaining Solution, Rubinstein Bargaining Model. | First-price, Second-price (Vickrey), English, and Dutch auctions. |

| Information Structure | Often involves asymmetric information and private valuations. | Can be open or sealed bids, with varying information disclosure. |

| Outcome | Agreed price and terms determined through negotiation. | Winning bid allocates the good or service. |

| Applications | Labor contracts, mergers, trade deals. | Government auctions, spectrum sales, online bidding. |

| Economic Significance | Explains surplus sharing and negotiation efficiency. | Optimizes resource allocation and pricing. |

Introduction to Bargaining Theory and Auction Theory

Bargaining theory examines strategic negotiation processes where two or more parties seek mutually beneficial agreements by considering preferences, payoffs, and negotiation power. Auction theory studies competitive bidding mechanisms used to allocate goods or resources efficiently, analyzing bidder behavior, auction formats, and revenue outcomes. Both theories provide foundational frameworks in game theory for understanding decision-making in economic interactions involving negotiation and competitive bidding.

Fundamental Concepts in Bargaining Theory

Bargaining theory centers on negotiation processes where two or more parties seek to reach a mutually beneficial agreement through offers and counteroffers, emphasizing concepts like bargaining power, threat points, and negotiation strategies. Key elements include the Nash bargaining solution, representing an equitable division based on each party's utility, and the significance of outside options that influence the negotiation outcomes. Unlike auction theory, which focuses on competitive bidding and price determination mechanisms, bargaining theory analyzes cooperative negotiation dynamics and strategic behavior within incomplete information settings.

Key Elements of Auction Theory

Auction theory centers on key elements such as bidding strategies, auction formats (e.g., English, Dutch, sealed-bid), and information asymmetry among bidders which directly impact the final price and allocative efficiency. It examines how auction rules influence bidder behavior, revenue outcomes, and resource allocation under various assumptions about valuation distributions and bidder risk preferences. Understanding these components allows for designing auctions that maximize seller revenue or social welfare while minimizing inefficiencies caused by strategic bidding or collusion.

Similarities Between Bargaining and Auction Theories

Bargaining theory and auction theory both analyze strategic interactions where participants compete to maximize their payoffs under conditions of incomplete information. Both frameworks model how players make offers or bids while anticipating opponents' responses to optimize outcomes. Central concepts like equilibrium strategies and incentive compatibility play crucial roles in predicting the behavior of agents in these economic decision-making processes.

Differences in Strategic Approaches

Bargaining theory emphasizes direct negotiation where parties strategically balance offers and counteroffers to reach a mutually beneficial agreement, often relying on information asymmetry and timing to influence outcomes. Auction theory involves a competitive bidding process where participants submit bids based on private valuations, using strategic behavior to maximize individual payoffs under rules like English or Dutch auctions. The key strategic difference lies in bargaining's iterative interpersonal negotiation versus auction's structured competition with predefined bidding mechanisms.

Information Asymmetry in Bargaining vs Auctions

Bargaining theory deals with negotiated agreements where parties often possess private information, creating significant information asymmetry that influences strategic behavior and outcomes. Auction theory models scenarios where bidders have varying degrees of private valuation knowledge, and the auction design aims to minimize information asymmetry to maximize seller revenue. Information asymmetry in bargaining typically leads to prolonged negotiations and inefficiencies, whereas auction mechanisms seek to reveal or aggregate private information to achieve efficient allocation.

Efficiency and Outcome Comparison

Bargaining theory analyzes negotiated agreements where parties have private information and strategic incentives, often resulting in efficient but sometimes delayed outcomes due to hold-up problems. Auction theory examines competitive bidding processes designed to allocate resources efficiently by revealing bidders' valuations, typically yielding outcomes that maximize expected revenue or social welfare. Compared to bargaining, auctions generally achieve higher efficiency and predictability in allocating goods or contracts, especially in environments with many participants and asymmetric information.

Real-World Applications: Bargaining vs Auction Settings

Bargaining theory applies to negotiations in labor disputes, international trade deals, and mergers where parties seek mutually beneficial terms through direct interaction and information exchange. Auction theory governs markets for art, spectrum licenses, and online advertising, optimizing resource allocation by leveraging competitive bidding mechanisms and pricing strategies. Real-world settings illustrate bargaining's focus on cooperative value division, while auctions prioritize efficiency and price discovery under competitive pressure.

Limitations and Critiques of Each Theory

Bargaining theory faces limitations such as oversimplifying negotiation dynamics by assuming rationality and symmetric information, often neglecting behavioral factors and power imbalances. Auction theory is critiqued for its reliance on specific auction formats and assumptions like bidder rationality and independent private values, which may not hold in real-world markets with complex bidder interactions. Both theories struggle to fully capture strategic behaviors and external influences, reducing explanatory power in practical economic and market environments.

Future Trends in Market Design and Negotiation Theory

Future trends in market design and negotiation theory emphasize integrating bargaining theory and auction theory to enhance efficiency and strategic decision-making. Advances in algorithmic game theory and artificial intelligence facilitate dynamic negotiation mechanisms that adapt to real-time information and participant behaviors. Emerging research explores hybrid models combining the decentralized flexibility of bargaining with the structured incentives of auctions, aiming to optimize market outcomes in digital platforms and decentralized finance.

Bargaining theory Infographic

libterm.com

libterm.com