Business cycles describe the fluctuations in economic activity over time, characterized by periods of expansion, peak, contraction, and trough. Understanding these cycles helps businesses and investors anticipate shifts in the market, manage risks, and make informed decisions. Explore the full article to learn how business cycles impact your financial strategies and economic outlook.

Table of Comparison

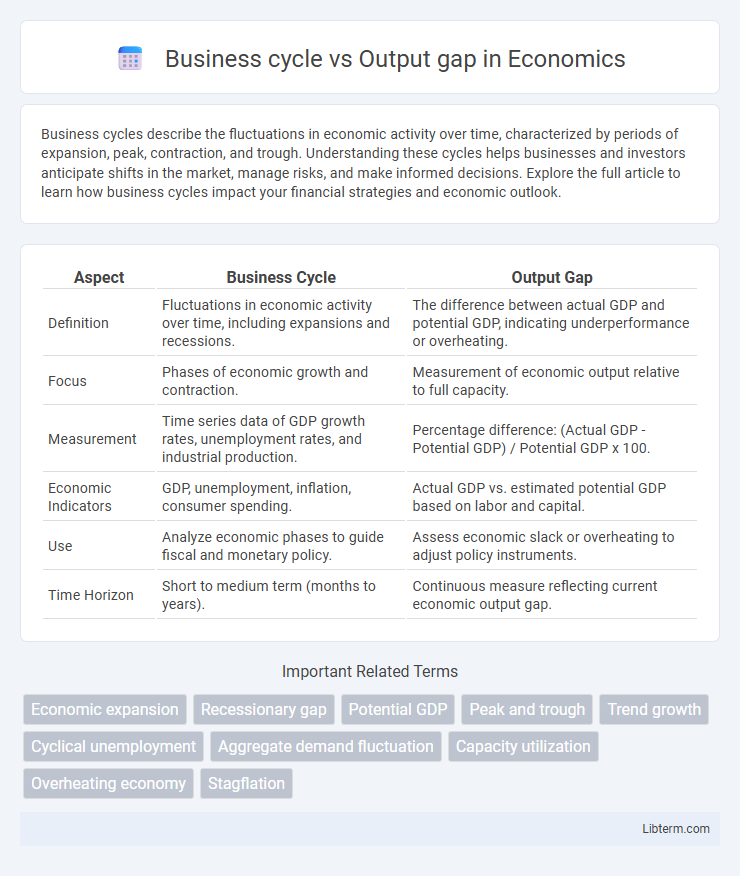

| Aspect | Business Cycle | Output Gap |

|---|---|---|

| Definition | Fluctuations in economic activity over time, including expansions and recessions. | The difference between actual GDP and potential GDP, indicating underperformance or overheating. |

| Focus | Phases of economic growth and contraction. | Measurement of economic output relative to full capacity. |

| Measurement | Time series data of GDP growth rates, unemployment rates, and industrial production. | Percentage difference: (Actual GDP - Potential GDP) / Potential GDP x 100. |

| Economic Indicators | GDP, unemployment, inflation, consumer spending. | Actual GDP vs. estimated potential GDP based on labor and capital. |

| Use | Analyze economic phases to guide fiscal and monetary policy. | Assess economic slack or overheating to adjust policy instruments. |

| Time Horizon | Short to medium term (months to years). | Continuous measure reflecting current economic output gap. |

Introduction to Business Cycle and Output Gap

The business cycle refers to the natural fluctuations in economic activity characterized by periods of expansion and contraction in GDP over time. The output gap measures the difference between actual economic output and potential output, indicating underperformance or overheating in the economy. Understanding the relationship between the business cycle and output gap helps policymakers assess economic health and implement appropriate fiscal or monetary interventions.

Defining the Business Cycle

The business cycle represents the fluctuations in economic activity characterized by periods of expansion and contraction in gross domestic product (GDP). It reflects changes in output, employment, and income over time, with phases including peak, recession, trough, and recovery. Understanding the business cycle helps identify deviations from potential output, which is crucial for analyzing the output gap and its impact on inflation and economic policy.

Understanding the Output Gap

The output gap measures the difference between actual economic output and potential output, indicating whether an economy is underperforming or overheating. Understanding the output gap helps policymakers assess inflationary pressures and guide monetary or fiscal interventions to stabilize growth. A positive output gap signals an economy operating above its capacity, while a negative gap highlights unused resources and economic slack.

Key Differences Between Business Cycle and Output Gap

The business cycle represents fluctuations in economic activity over time, including phases of expansion, peak, contraction, and trough, reflecting the overall economic health. The output gap measures the difference between actual GDP and potential GDP, indicating underutilization or overheating of resources in the economy. Key differences lie in their focus: business cycles describe temporal economic patterns, while the output gap quantifies economic performance relative to sustainable capacity.

Phases of the Business Cycle

The business cycle consists of four primary phases: expansion, peak, contraction, and trough, each representing fluctuations in economic activity. During expansion, output rises above potential, reducing the output gap, while contraction phases cause actual output to fall below potential, widening the output gap. The output gap measures the difference between actual GDP and potential GDP, serving as an indicator of economic slack or overheating during different business cycle stages.

Types of Output Gaps: Positive vs. Negative

Positive output gaps occur when actual economic output exceeds potential output, indicating an overheated economy often accompanied by inflationary pressures. Negative output gaps arise when actual output falls below potential output, reflecting underutilized resources and higher unemployment rates. Understanding these output gaps helps in analyzing different phases of the business cycle, such as expansions linked to positive gaps and recessions associated with negative gaps.

Measuring the Output Gap

Measuring the output gap involves comparing actual GDP to potential GDP, reflecting economic performance relative to full capacity. Economists use statistical methods such as the Hodrick-Prescott filter and production function approaches to estimate potential output and identify deviations. Accurate measurement of the output gap is crucial for formulating monetary and fiscal policies aimed at stabilizing the business cycle and controlling inflation.

Impact of Business Cycle on Output Gap

The business cycle significantly influences the output gap by causing fluctuations in actual GDP relative to potential GDP. During expansions, increased economic activity narrows the output gap as output approaches or exceeds potential levels, while recessions widen the gap due to reduced production and higher unemployment. Understanding this relationship is crucial for policymakers aiming to implement countercyclical measures that stabilize economic growth and minimize output deviations.

Policy Implications: Business Cycle and Output Gap

Understanding the business cycle and output gap is crucial for effective economic policy formulation, as they indicate periods of economic expansion or contraction and the deviation of actual output from potential output. Policymakers use this information to implement counter-cyclical fiscal and monetary measures, aiming to stabilize economic fluctuations, reduce unemployment, and control inflation. Targeted interventions depend on accurately assessing the output gap during different phases of the business cycle to optimize growth and maintain price stability.

Conclusion: Bridging Business Cycle and Output Gap

Understanding the business cycle and output gap is essential for effective economic policy and forecasting. The business cycle measures fluctuations in economic activity over time, while the output gap quantifies the difference between actual and potential GDP. Bridging these concepts enables policymakers to identify periods of economic overheating or underperformance, guiding targeted fiscal and monetary interventions to stabilize growth and achieve sustainable economic equilibrium.

Business cycle Infographic

libterm.com

libterm.com