Fiat money is government-issued currency that is not backed by a physical commodity but derives its value from trust and legal decree. Its value depends on the stability of the issuing government and economic policies. Explore the rest of this article to understand how fiat money impacts your financial decisions.

Table of Comparison

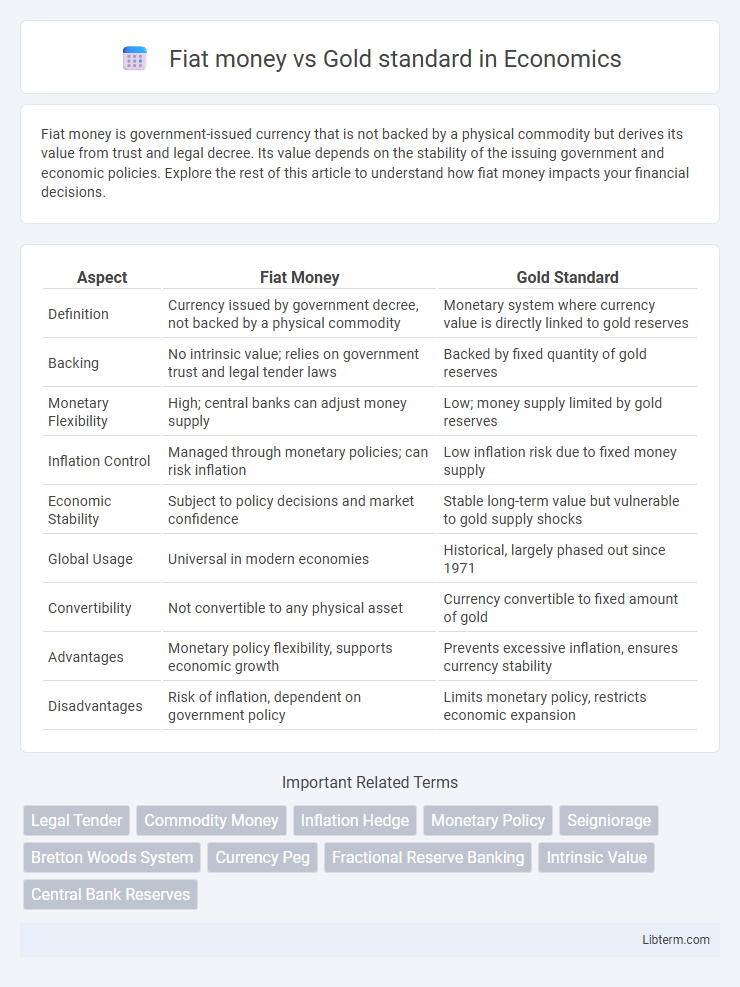

| Aspect | Fiat Money | Gold Standard |

|---|---|---|

| Definition | Currency issued by government decree, not backed by a physical commodity | Monetary system where currency value is directly linked to gold reserves |

| Backing | No intrinsic value; relies on government trust and legal tender laws | Backed by fixed quantity of gold reserves |

| Monetary Flexibility | High; central banks can adjust money supply | Low; money supply limited by gold reserves |

| Inflation Control | Managed through monetary policies; can risk inflation | Low inflation risk due to fixed money supply |

| Economic Stability | Subject to policy decisions and market confidence | Stable long-term value but vulnerable to gold supply shocks |

| Global Usage | Universal in modern economies | Historical, largely phased out since 1971 |

| Convertibility | Not convertible to any physical asset | Currency convertible to fixed amount of gold |

| Advantages | Monetary policy flexibility, supports economic growth | Prevents excessive inflation, ensures currency stability |

| Disadvantages | Risk of inflation, dependent on government policy | Limits monetary policy, restricts economic expansion |

Introduction to Fiat Money and Gold Standard

Fiat money is currency that a government declares as legal tender without intrinsic value or backing by a physical commodity, relying on public trust and government stability for its acceptance. The gold standard is a monetary system where currency value is directly linked to a specific amount of gold, ensuring currency stability through gold reserves. While fiat money allows flexible monetary policy and economic growth, the gold standard restricts money supply to gold reserves, limiting inflation but also economic adaptability.

Historical Background: Evolution of Monetary Systems

The evolution of monetary systems transitioned from commodity-based standards, such as the gold standard peaking in the 19th and early 20th centuries, to fiat money systems dominating the modern economy. The gold standard provided fixed exchange rates by tying currency value directly to gold reserves, fostering international trade stability until its gradual abandonment during the 20th century amid economic crises. Fiat money emerged as governments gained flexibility in managing monetary policy, enabling control over inflation and liquidity without the constraints of physical gold backing.

How Fiat Money Works

Fiat money operates as a medium of exchange based on government decree and public trust rather than intrinsic value, enabling flexible monetary policy and economic control. Unlike gold standard currency, fiat money allows central banks to adjust money supply to manage inflation, interest rates, and economic growth effectively. This system relies on the stability of the issuing government and the widespread acceptance of currency for transactions and store of value.

Understanding the Gold Standard

The gold standard is a monetary system where a country's currency value is directly linked to gold, allowing holders to exchange paper money for a fixed amount of gold. This system provides long-term price stability and limits inflation by restricting money supply expansion to the amount of gold reserves held by the government. Unlike fiat money, which is backed only by government decree and subject to inflation risks, the gold standard offers intrinsic value and confidence in currency convertibility.

Inflation and Price Stability: Fiat vs Gold

Fiat money often leads to higher inflation rates due to government control over money supply, allowing frequent currency expansion that can erode purchasing power. The gold standard limits money supply growth by tying currency issuance to gold reserves, promoting long-term price stability but restricting monetary policy flexibility. Historical data shows that economies under the gold standard experienced lower inflation rates compared to those using fiat money systems.

Economic Flexibility and Policy Tools

Fiat money provides governments and central banks with greater economic flexibility by allowing adjustments in the money supply to respond to changing economic conditions, such as inflation and unemployment. Under the gold standard, the money supply is tied to gold reserves, limiting the ability to implement monetary policies like quantitative easing or interest rate changes, which restricts economic stimulus options during downturns. This constraint can lead to deflationary pressures and prolonged recessions, whereas fiat currency systems enable more dynamic and responsive policy tools to stabilize and stimulate the economy.

Risks and Vulnerabilities of Both Systems

Fiat money faces risks such as inflation and loss of public trust due to its value relying solely on government regulation without intrinsic value backing. The gold standard, while providing long-term price stability, is vulnerable to supply constraints and economic shocks that limit monetary policy flexibility. Both systems can experience financial instability; fiat money is prone to hyperinflation, whereas the gold standard can cause deflation and economic stagnation during gold shortages.

Global Adoption and Abandonment Trends

The global adoption of fiat money began in the 20th century, with most countries abandoning the gold standard due to its limitations on monetary policy and economic flexibility. By the 1970s, the United States formally ended the convertibility of the dollar to gold, triggering a worldwide shift toward fiat currencies controlled by central banks. Despite periodic calls for a return to gold-backed currency, fiat money remains the dominant system, facilitating global trade and economic growth through flexible monetary regulation.

Impact on International Trade and Exchange Rates

Fiat money enables flexible monetary policies and exchange rates, allowing countries to adjust currency values in response to economic conditions, which can facilitate smoother international trade by reducing currency mismatches. In contrast, the gold standard offers fixed exchange rates, promoting stability and predictability in global trade but limiting monetary policy flexibility and potentially causing trade imbalances during gold supply fluctuations. Fiat currencies can lead to exchange rate volatility, influencing import and export prices, whereas the gold standard's rigid framework restricts such fluctuations at the expense of dynamic trade adjustments.

Future Perspectives: Fiat Money or Return to Gold?

The future of monetary systems hinges on the ongoing debate between fiat money and a return to the gold standard, with fiat currency offering flexibility to central banks in economic policymaking and gold providing long-term stability and protection against inflation. Advances in digital currencies and blockchain technology may strengthen fiat systems by enhancing transparency and security, while persistent inflation concerns and currency devaluation risks fuel arguments for gold-backed currencies. Central banks' balance sheets, global reserves, and sovereign debt levels will be crucial factors influencing whether economies continue relying on fiat money or transition back to a commodity-backed standard.

Fiat money Infographic

libterm.com

libterm.com