Emissions trading is a market-based approach designed to reduce greenhouse gas emissions by allowing companies to buy and sell emission permits, promoting cost-effective pollution control. This system incentivizes businesses to innovate and lower their carbon footprint while ensuring overall emissions stay within set limits. Discover how emissions trading can impact your industry and contribute to global sustainability by reading the full article.

Table of Comparison

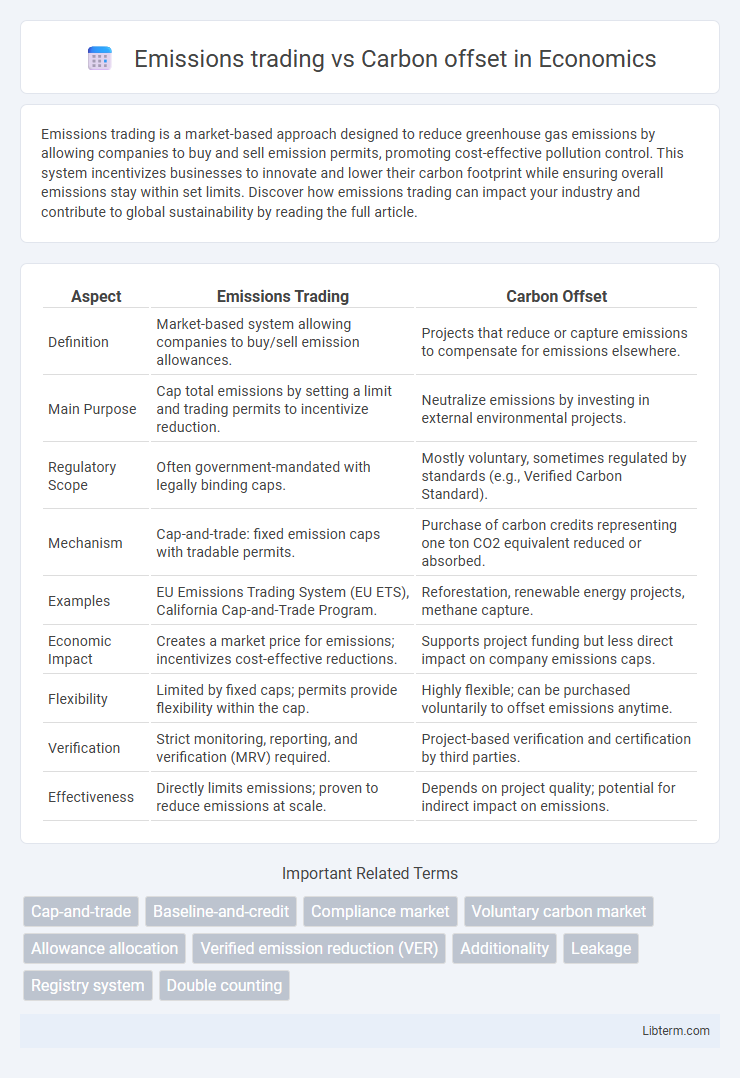

| Aspect | Emissions Trading | Carbon Offset |

|---|---|---|

| Definition | Market-based system allowing companies to buy/sell emission allowances. | Projects that reduce or capture emissions to compensate for emissions elsewhere. |

| Main Purpose | Cap total emissions by setting a limit and trading permits to incentivize reduction. | Neutralize emissions by investing in external environmental projects. |

| Regulatory Scope | Often government-mandated with legally binding caps. | Mostly voluntary, sometimes regulated by standards (e.g., Verified Carbon Standard). |

| Mechanism | Cap-and-trade: fixed emission caps with tradable permits. | Purchase of carbon credits representing one ton CO2 equivalent reduced or absorbed. |

| Examples | EU Emissions Trading System (EU ETS), California Cap-and-Trade Program. | Reforestation, renewable energy projects, methane capture. |

| Economic Impact | Creates a market price for emissions; incentivizes cost-effective reductions. | Supports project funding but less direct impact on company emissions caps. |

| Flexibility | Limited by fixed caps; permits provide flexibility within the cap. | Highly flexible; can be purchased voluntarily to offset emissions anytime. |

| Verification | Strict monitoring, reporting, and verification (MRV) required. | Project-based verification and certification by third parties. |

| Effectiveness | Directly limits emissions; proven to reduce emissions at scale. | Depends on project quality; potential for indirect impact on emissions. |

Understanding Emissions Trading

Emissions trading, also known as cap-and-trade, is a market-based approach designed to control pollution by providing economic incentives for reducing greenhouse gas emissions. Companies receive or buy emission allowances which they can trade with others, creating a financial motive to lower emissions below permitted levels. This system contrasts with carbon offsets, which involve investing in projects that reduce or capture emissions outside the regulated entity's immediate operations.

What Are Carbon Offsets?

Carbon offsets represent measurable and verifiable emission reductions from projects like reforestation, renewable energy, or methane capture that compensate for emissions produced elsewhere. Unlike emissions trading, which involves trading pollution permits within a capped system, carbon offsets allow individuals or companies to fund environmental initiatives to balance out their carbon footprint. These offsets contribute to global carbon neutrality efforts by directly supporting sustainable projects that reduce greenhouse gases.

Key Differences Between Emissions Trading and Carbon Offsets

Emissions trading involves a regulated cap-and-trade system where companies buy and sell emission permits to stay within legal limits, ensuring an overall reduction in greenhouse gases. Carbon offsets allow businesses or individuals to compensate for their emissions by investing in projects that reduce or remove emissions elsewhere, typically outside regulatory frameworks. The key difference lies in emissions trading's market-based regulatory approach versus carbon offsets' voluntary, project-based mitigation method.

How Emissions Trading Works

Emissions trading operates through a cap-and-trade system where governments set a maximum allowable level of greenhouse gas emissions and issue emission permits or allowances to companies. Companies can trade these permits, selling excess allowances if they reduce emissions below their limits or buying additional permits if needed, creating a financial incentive to lower emissions. This market-driven approach aims to reduce overall emissions cost-effectively by allowing flexibility in how reductions are achieved across industries.

How Carbon Offsetting Operates

Carbon offsetting operates by allowing individuals or companies to compensate for their greenhouse gas emissions through projects that reduce or remove an equivalent amount of CO2 elsewhere, such as reforestation or renewable energy initiatives. These projects generate carbon credits, which can be purchased to balance out emissions that are difficult to eliminate directly. Unlike emissions trading systems that cap and trade allowances within regulated markets, carbon offsetting provides a voluntary mechanism to achieve carbon neutrality by funding environmental sustainability efforts globally.

Environmental Impact Comparison

Emissions trading markets incentivize companies to reduce greenhouse gas emissions by capping total emissions and allowing trading of emission permits, ensuring measurable and enforceable reductions within regulated sectors. Carbon offsets represent emissions reductions from projects outside the regulated sector, such as reforestation or renewable energy, but their environmental impact varies due to challenges in verification, permanence, and potential additionality issues. Emissions trading provides more direct, quantifiable reductions in industrial emissions, while carbon offsets complement these efforts by financing broader environmental projects, although their effectiveness depends heavily on rigorous monitoring and validation processes.

Economic Implications of Both Approaches

Emissions trading creates a market-driven mechanism where companies buy and sell emission permits, incentivizing cost-effective pollution reduction and fostering innovation in green technologies. Carbon offsets allow organizations to fund external projects that reduce emissions elsewhere, which can sometimes lead to variable economic benefits due to project verification and additionality concerns. The economic implications of emissions trading often include greater market liquidity and price discovery, while carbon offsets may offer flexibility but face challenges in ensuring measurable and permanent emission reductions.

Regulatory Frameworks and Compliance

Emissions trading operates within strict regulatory frameworks that set cap limits on greenhouse gas emissions, requiring companies to hold permits corresponding to their emission levels, ensuring compliance through government monitoring and enforcement mechanisms. Carbon offset programs function under both voluntary and regulated standards, where entities invest in projects reducing or capturing emissions elsewhere to compensate for their own, often verified by third-party certification bodies. Regulatory compliance in emissions trading directly involves permit acquisition and surrender, while carbon offsets provide supplementary pathways for meeting climate obligations under frameworks like the Kyoto Protocol and the Paris Agreement.

Challenges and Criticisms

Emissions trading faces challenges such as market volatility, regulatory complexity, and the risk of overallocation reducing its effectiveness in lowering greenhouse gas emissions. Carbon offsets are criticized for potential issues with additionality, permanence, and verification, leading to doubts about their genuine environmental benefits. Both mechanisms struggle with transparency and ensuring real, measurable climate impact, raising concerns about their role in sustainable climate policy.

Future Trends in Carbon Markets

Emissions trading systems (ETS) are expected to expand globally, driven by stricter regulatory frameworks and increased corporate commitments to net-zero targets, enhancing market liquidity and price stability. Carbon offset markets are likely to evolve with improved verification technologies and standardized methodologies, ensuring higher integrity and greater investor confidence. Both approaches will increasingly integrate digital tools like blockchain for transparency, fostering scalable and efficient carbon markets worldwide.

Emissions trading Infographic

libterm.com

libterm.com