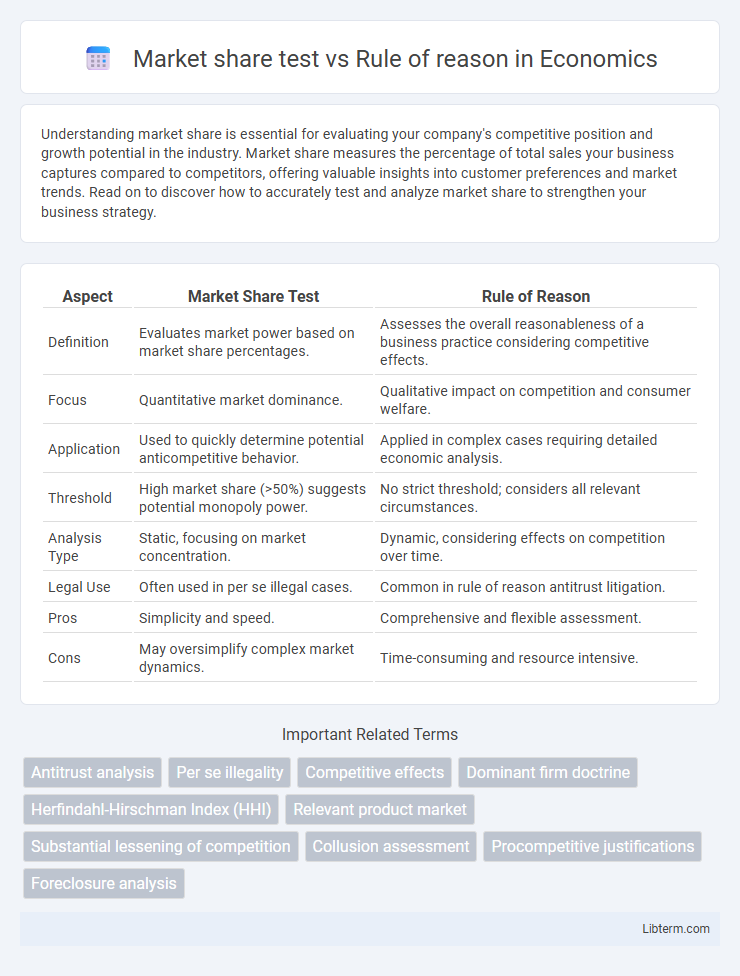

Understanding market share is essential for evaluating your company's competitive position and growth potential in the industry. Market share measures the percentage of total sales your business captures compared to competitors, offering valuable insights into customer preferences and market trends. Read on to discover how to accurately test and analyze market share to strengthen your business strategy.

Table of Comparison

| Aspect | Market Share Test | Rule of Reason |

|---|---|---|

| Definition | Evaluates market power based on market share percentages. | Assesses the overall reasonableness of a business practice considering competitive effects. |

| Focus | Quantitative market dominance. | Qualitative impact on competition and consumer welfare. |

| Application | Used to quickly determine potential anticompetitive behavior. | Applied in complex cases requiring detailed economic analysis. |

| Threshold | High market share (>50%) suggests potential monopoly power. | No strict threshold; considers all relevant circumstances. |

| Analysis Type | Static, focusing on market concentration. | Dynamic, considering effects on competition over time. |

| Legal Use | Often used in per se illegal cases. | Common in rule of reason antitrust litigation. |

| Pros | Simplicity and speed. | Comprehensive and flexible assessment. |

| Cons | May oversimplify complex market dynamics. | Time-consuming and resource intensive. |

Introduction to Market Share Test and Rule of Reason

The Market Share Test assesses competitive impact by quantifying a firm's control over a market through its sales percentage relative to competitors, serving as a straightforward metric in antitrust cases. Rule of Reason involves a comprehensive analysis of market context, evaluating the pro-competitive and anti-competitive effects of business conduct beyond mere market share figures. Together, they represent contrasting approaches: Market Share Test offers a quantitative threshold for dominance, while Rule of Reason requires balanced, qualitative judicial scrutiny.

Defining Market Share Test in Antitrust Law

The Market Share Test in antitrust law measures a firm's control within a relevant market by quantifying its percentage of total sales or output, serving as a preliminary indicator of market power. This test assesses whether a firm's market share is sufficiently large to potentially harm competition or create a monopoly, often spotlighting dominant players exceeding 50% market share. Unlike the broader Rule of Reason approach, which examines the comprehensive competitive effects and context of a business practice, the Market Share Test provides a quantitative baseline for initiating further antitrust analysis.

Understanding the Rule of Reason Approach

The Rule of Reason approach in antitrust law evaluates market behavior by analyzing the context and effects on competition rather than relying solely on market share thresholds. It assesses whether a business practice unreasonably restrains trade by considering factors like the intent, market power, and competitive effects within the relevant market. This method contrasts with strict market share tests by allowing a more nuanced understanding of competitive harm in dynamic markets.

Key Differences: Market Share Test vs Rule of Reason

The Market Share Test simplifies antitrust analysis by focusing primarily on the defendant's percentage of control in the relevant market, often assuming high market share indicates monopolistic power or anticompetitive harm. Rule of Reason, in contrast, involves a comprehensive evaluation of the facts including market structure, business practices, and competitive effects to determine whether conduct is unreasonable and harmful to competition. Key differences lie in Market Share Test's quantitative threshold versus Rule of Reason's qualitative, case-by-case balancing of pro-competitive and anticompetitive factors.

Importance of Market Definition in Both Approaches

Market definition is crucial in both Market Share Test and Rule of Reason as it determines the boundaries within which competition is analyzed, impacting the assessment of market power and competitive effects. In the Market Share Test, a precisely defined market allows for accurate calculation of market shares, which serve as proxies for market dominance. The Rule of Reason relies heavily on a well-defined market to evaluate the pro-competitive and anti-competitive effects of business conduct, ensuring a balanced and context-specific competition analysis.

Criteria and Thresholds for Market Share Analysis

Market share test evaluates market dominance primarily through quantitative thresholds, often considering a firm with 50% or more market share as presumptively dominant. Rule of reason involves a qualitative assessment, examining factors like competitive effects, market structure, and entry barriers without fixed share thresholds. Criteria in rule of reason include market power, anticompetitive effects, and procompetitive justifications, providing a flexible framework beyond the rigid market share benchmarks used in the market share test.

Assessing Competitive Effects: The Role of Rule of Reason

Market share serves as a quantitative indicator in antitrust cases, but the Rule of Reason provides a comprehensive framework for assessing competitive effects by evaluating market context, firm behavior, and consumer impact. This approach balances potential anticompetitive harms against procompetitive benefits, considering factors such as market structure, barriers to entry, and actual or probable effects on competition. The Rule of Reason enables courts to analyze nuanced economic evidence beyond mere market share metrics, ensuring a fair assessment of whether conduct violates antitrust laws.

Advantages and Limitations of Market Share Test

The Market Share Test simplifies antitrust analysis by quantifying a firm's control over a specific market, offering a clear metric to gauge potential anti-competitive behavior. Its advantages include straightforward application and objectivity, facilitating swift assessments of market dominance. However, limitations arise as it may overlook qualitative factors like market dynamics and barriers to entry, possibly misrepresenting competitive effects in nuanced cases compared to the more comprehensive Rule of Reason approach.

Practical Applications in Antitrust Cases

Market share tests provide a quantifiable measure of a firm's dominance by assessing its percentage of total sales within a relevant market, offering straightforward evidence in antitrust investigations. The Rule of Reason evaluates the competitive effects of business practices by examining market context, intent, and pro-competitive justifications, allowing for a more nuanced and flexible analysis. Practical applications often combine these approaches, using market share as an initial threshold indicator while relying on the Rule of Reason to determine the legality and impact of conduct on consumer welfare and market competition.

Choosing the Right Approach: Market Share Test or Rule of Reason

Choosing between the Market Share Test and the Rule of Reason involves evaluating the nature of the competitive issue and available evidence; the Market Share Test offers a straightforward metric by quantifying a firm's control over market percentage, ideal for clear dominance cases. The Rule of Reason provides a comprehensive analysis of competitive effects, considering market context, firm conduct, and consumer impact, suitable for nuanced scenarios with complex economic factors. Selecting the appropriate approach depends on the need for simplicity and precision versus a deeper investigation into market dynamics and economic outcomes.

Market share test Infographic

libterm.com

libterm.com