The classical model of economics emphasizes markets' natural equilibrium through supply and demand forces, advocating minimal government intervention. It assumes rational behavior, flexible prices, and full employment, forming the foundation for many economic policies. Discover how this model shapes modern economic thought and how it applies to your financial decisions in the full article.

Table of Comparison

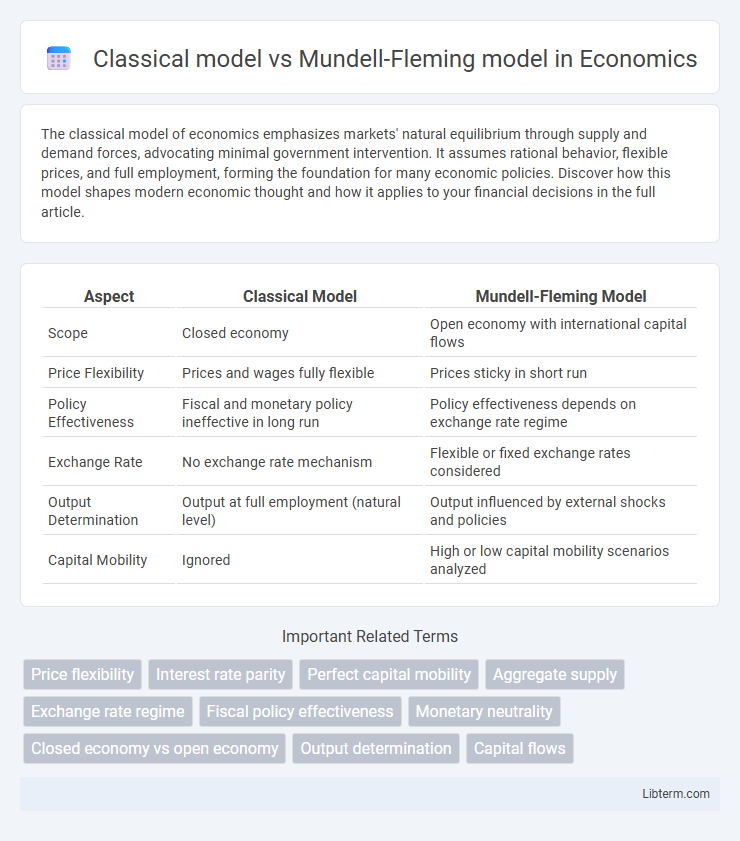

| Aspect | Classical Model | Mundell-Fleming Model |

|---|---|---|

| Scope | Closed economy | Open economy with international capital flows |

| Price Flexibility | Prices and wages fully flexible | Prices sticky in short run |

| Policy Effectiveness | Fiscal and monetary policy ineffective in long run | Policy effectiveness depends on exchange rate regime |

| Exchange Rate | No exchange rate mechanism | Flexible or fixed exchange rates considered |

| Output Determination | Output at full employment (natural level) | Output influenced by external shocks and policies |

| Capital Mobility | Ignored | High or low capital mobility scenarios analyzed |

Introduction to Macroeconomic Models

The Classical model emphasizes long-run economic equilibrium with flexible prices and wages, highlighting full employment and market-clearing mechanisms. In contrast, the Mundell-Fleming model extends the IS-LM framework to an open economy, incorporating exchange rates, capital mobility, and short-run policy effectiveness under different exchange rate regimes. These macroeconomic models provide foundational insights into policy impacts on output, interest rates, and exchange rates in closed versus open economies.

Overview of the Classical Model

The Classical model emphasizes flexible prices and wages that quickly adjust to maintain full employment and equilibrium in goods and labor markets. It assumes perfect competition, rational expectations, and that monetary policy is neutral in the long run, affecting only nominal variables. This framework contrasts with the Mundell-Fleming model, which incorporates short-run price rigidities and open economy dynamics, highlighting the roles of fiscal and monetary policy under different exchange rate regimes.

Key Assumptions of the Classical Model

The Classical model assumes perfect competition, flexible prices and wages, and complete information, leading to automatic market clearing without government intervention. It posits that output is determined solely by supply-side factors such as technology and resources, with full employment as the norm. In contrast, the Mundell-Fleming model incorporates short-run price rigidity, capital mobility, and exchange rate regimes, emphasizing open economy macroeconomic dynamics.

Policy Implications in the Classical Model

The Classical model assumes perfect capital mobility and flexible prices, leading to policy implications that fiscal and monetary policies have limited long-term effects on output and employment, as markets self-adjust. In this framework, government intervention is often viewed as ineffective for stimulating economic growth because price and wage flexibility restore equilibrium automatically. Monetary policy changes primarily influence price levels without altering real variables, while fiscal policy shifts are offset by crowding out through interest rates or exchange rate adjustments.

Overview of the Mundell-Fleming Model

The Mundell-Fleming model extends the classical IS-LM framework to an open economy, incorporating the effects of exchange rates and capital mobility on output and interest rates. It assumes perfect capital mobility and distinguishes outcomes under fixed versus flexible exchange rate regimes, emphasizing the role of monetary and fiscal policy in influencing aggregate demand. This model provides crucial insights into how short-term economic fluctuations interact with international financial markets, contrasting with the closed-economy assumptions of the classical model.

Key Features of the Mundell-Fleming Model

The Mundell-Fleming model extends the classical model by incorporating an open economy framework with international capital mobility, addressing short-term macroeconomic fluctuations under fixed and flexible exchange rates. It emphasizes the roles of monetary and fiscal policy effectiveness depending on exchange rate regimes, highlighting that monetary policy is potent under flexible exchange rates while fiscal policy is more effective under fixed rates. This model integrates interest rates, exchange rates, and output simultaneously, capturing the interactions between domestic and foreign economic variables.

Open Economy Dynamics: Mundell-Fleming vs Classical Model

The Classical model assumes perfect capital mobility with flexible prices and wages, leading to instant adjustment in exchange rates and trade balance in an open economy. In contrast, the Mundell-Fleming model incorporates sticky prices and distinguishes between fixed and flexible exchange rate regimes, emphasizing short-run dynamics where monetary and fiscal policies have different impacts on output and exchange rates. Empirical evidence highlights the Mundell-Fleming model's superior capacity to capture the complexities of open economy adjustments under nominal rigidities and external shocks.

Exchange Rate Regimes and Policy Effectiveness

The Classical model assumes flexible exchange rates that adjust to equilibrate trade balances, rendering monetary policy ineffective in influencing output under perfect capital mobility. In contrast, the Mundell-Fleming model differentiates policy effectiveness based on exchange rate regimes: monetary policy is potent under floating exchange rates, while fiscal policy dominates under fixed exchange rates due to constraints on capital flows. Under fixed exchange rates, the Mundell-Fleming framework highlights the necessity of abandoning independent monetary policy to maintain exchange rate stability.

Comparative Analysis: Strengths and Limitations

The Classical model assumes perfect price and wage flexibility, enabling automatic adjustment of output and employment but lacks realism in short-run dynamics and monetary effects. The Mundell-Fleming model incorporates open economy aspects, highlighting exchange rate regimes' impact on fiscal and monetary policy effectiveness, yet relies on assumptions like fixed prices and capital mobility that may not hold universally. While the Classical model excels in long-term neutrality of money, the Mundell-Fleming framework provides valuable insights for short-term policy analysis under different exchange rate systems.

Conclusion: Choosing the Right Model for Economic Analysis

The choice between the Classical model and the Mundell-Fleming model depends on the economic context, particularly the openness of the economy and exchange rate flexibility. The Classical model suits closed economies with price and wage flexibility, emphasizing long-run equilibrium, while the Mundell-Fleming model better captures short-run dynamics in open economies with fixed or floating exchange rates. Policymakers should select the model that aligns with their specific economic environment and policy objectives to ensure accurate analysis and effective decision-making.

Classical model Infographic

libterm.com

libterm.com