Discretion is the ability to make decisions with careful judgment, maintaining confidentiality and respecting privacy. It plays a crucial role in professional and personal settings where sensitive information must be handled thoughtfully. Discover how discretion can enhance your decision-making and trustworthiness by reading further in the article.

Table of Comparison

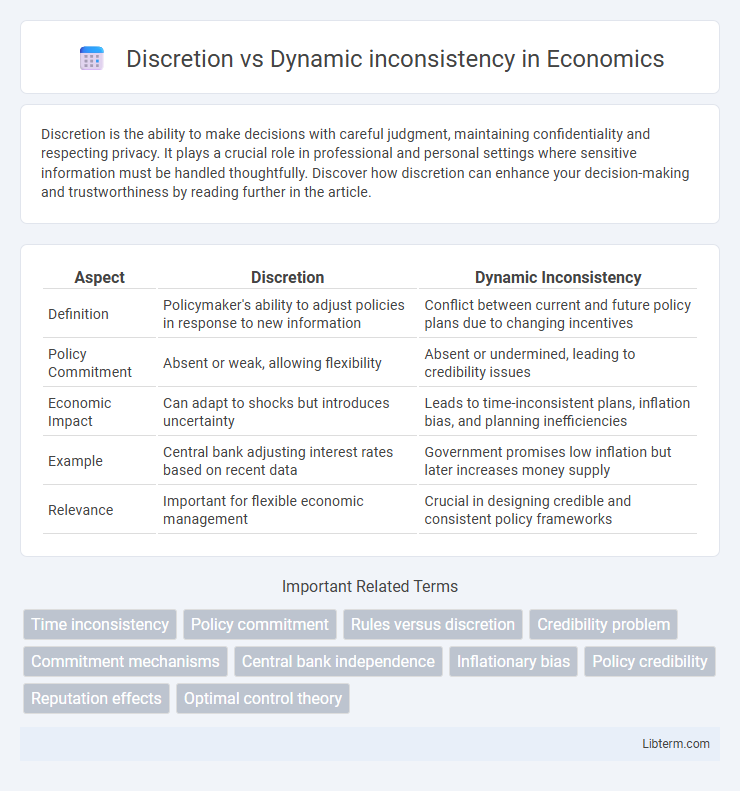

| Aspect | Discretion | Dynamic Inconsistency |

|---|---|---|

| Definition | Policymaker's ability to adjust policies in response to new information | Conflict between current and future policy plans due to changing incentives |

| Policy Commitment | Absent or weak, allowing flexibility | Absent or undermined, leading to credibility issues |

| Economic Impact | Can adapt to shocks but introduces uncertainty | Leads to time-inconsistent plans, inflation bias, and planning inefficiencies |

| Example | Central bank adjusting interest rates based on recent data | Government promises low inflation but later increases money supply |

| Relevance | Important for flexible economic management | Crucial in designing credible and consistent policy frameworks |

Understanding Discretion in Economic Policy

Discretion in economic policy involves allowing policymakers the flexibility to respond adaptively to unforeseen economic changes rather than adhering to fixed rules. This approach contrasts with the concept of dynamic inconsistency, where policymakers may face incentives to deviate from previously announced plans, undermining credibility and long-term effectiveness. Understanding discretion is crucial in designing policies that balance responsiveness with commitment to maintain investor and public confidence.

Defining Dynamic Inconsistency

Dynamic inconsistency occurs when a decision-maker's preferences change over time in a way that leads to conflicting choices and non-commitment to previously planned actions. This phenomenon contrasts with discretion, which allows flexible decision-making based on current information without binding future preferences. Understanding dynamic inconsistency is crucial in behavioral economics and game theory, as it explains why individuals or institutions may fail to follow through on long-term plans.

Historical Context: Evolution of Economic Policy Approaches

Economic policy approaches have evolved from discretionary measures, allowing policymakers flexible responses to economic changes, to frameworks addressing dynamic inconsistency, where short-term incentives conflict with long-term objectives. The recognition of time-inconsistency problems in the 1970s and 1980s, particularly through Kydland and Prescott's work, shifted emphasis towards commitment mechanisms like rules-based policies to enhance credibility and stability. This historical evolution highlights the tension between adaptive discretion and the need for predictable policies to anchor expectations and avoid policy-induced economic fluctuations.

Theoretical Foundations of Discretion

Discretion in economic policy refers to the ability of policymakers to adjust decisions based on current information and changing economic conditions, contrasting with predetermined rules. Theoretical foundations of discretion emphasize its role in responding flexibly to shocks, but this flexibility often leads to dynamic inconsistency, where optimal plans change over time, undermining credibility. Kydland and Prescott's seminal work highlights the time-inconsistency problem, showing that without commitment mechanisms, discretionary policies may result in suboptimal outcomes like higher inflation and reduced economic stability.

The Logic Behind Dynamic Inconsistency

Dynamic inconsistency arises when an agent's preferences change over time, leading to decisions that contradict earlier plans made at prior stages. This occurs because the agent evaluates future outcomes differently at each point, undermining the credibility of long-term commitments and causing time-inconsistent behavior. The logic behind dynamic inconsistency hinges on the shifting valuation of future payoffs, which contrasts with discretion, where decision-makers have flexibility but maintain coherent intertemporal preferences.

Discretion vs Commitment: Core Differences

Discretion allows policymakers to adapt decisions based on current economic conditions, enabling flexibility in monetary and fiscal policy implementation. Commitment, however, restricts policymakers to predetermined rules or targets, ensuring policy credibility and reducing time-inconsistency problems. The core difference lies in discretion's emphasis on flexibility versus commitment's focus on credibility and predictability in economic decision-making.

Real-World Examples of Policy Dynamic Inconsistency

Governments often face dynamic inconsistency when policies, such as inflation targeting, are optimal in theory but proven unsustainable in practice due to changing economic conditions or political pressures, leading to higher inflation expectations and reduced credibility. A classic example is the 1970s U.S. monetary policy where initial commitments to low inflation were abandoned in favor of expansionary measures, resulting in stagflation. Similarly, currency pegs, as seen in the 1997 Asian financial crisis, often fail when governments deviate from promised exchange rates to maintain short-term stability, causing capital flight and economic turmoil.

The Impact on Credibility and Policy Effectiveness

Discretion in policymaking allows flexibility to respond to changing economic conditions, enhancing short-term credibility by adapting strategies to current realities. However, dynamic inconsistency arises when policymakers deviate from previously announced plans, undermining long-term credibility and diminishing policy effectiveness due to expectations of future policy reversals. The tension between discretion and dynamic inconsistency critically influences the trust of markets and economic agents, shaping the overall success and stability of monetary and fiscal policies.

Strategies to Mitigate Dynamic Inconsistency Risks

Implementing commitment devices such as binding contracts or automated savings plans reduces dynamic inconsistency by aligning future behaviors with current intentions. Designing incentive-compatible mechanisms, including delayed rewards and penalty clauses, encourages adherence to optimal decision-making over time. Leveraging transparent information systems and regular self-assessment further strengthens discretion, minimizing the risk of preference reversals in intertemporal choices.

Future Directions in Policy Design: Balancing Discretion and Consistency

Future policy design must integrate mechanisms that balance discretionary flexibility with dynamic consistency to improve economic outcomes and credibility. Incorporating adaptive frameworks like state-contingent rules or robust control methods can help policymakers respond effectively to evolving economic conditions without undermining commitment. Advances in algorithmic decision-making and real-time data analytics offer promising tools to optimize the trade-off between discretion and time-consistent policy implementation.

Discretion Infographic

libterm.com

libterm.com