The life-cycle hypothesis explains how individuals plan their consumption and savings behavior over their lifetime to maintain a stable standard of living. It suggests that people save during their working years and dissave during retirement to balance income fluctuations. Explore the rest of the article to understand how this theory impacts financial planning and economic policies.

Table of Comparison

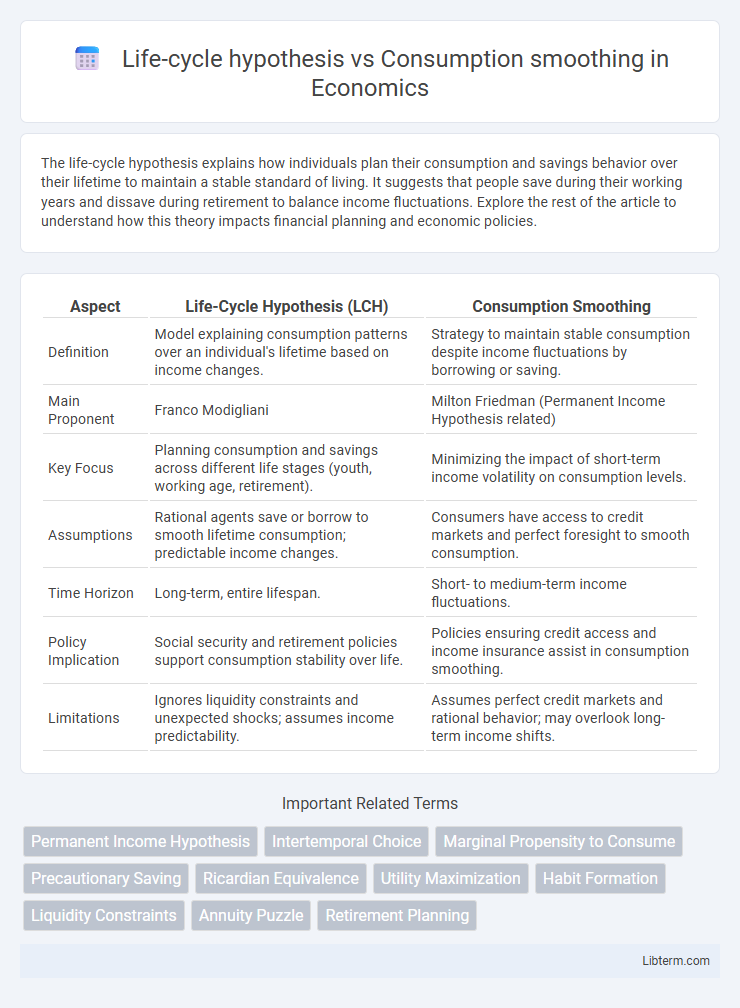

| Aspect | Life-Cycle Hypothesis (LCH) | Consumption Smoothing |

|---|---|---|

| Definition | Model explaining consumption patterns over an individual's lifetime based on income changes. | Strategy to maintain stable consumption despite income fluctuations by borrowing or saving. |

| Main Proponent | Franco Modigliani | Milton Friedman (Permanent Income Hypothesis related) |

| Key Focus | Planning consumption and savings across different life stages (youth, working age, retirement). | Minimizing the impact of short-term income volatility on consumption levels. |

| Assumptions | Rational agents save or borrow to smooth lifetime consumption; predictable income changes. | Consumers have access to credit markets and perfect foresight to smooth consumption. |

| Time Horizon | Long-term, entire lifespan. | Short- to medium-term income fluctuations. |

| Policy Implication | Social security and retirement policies support consumption stability over life. | Policies ensuring credit access and income insurance assist in consumption smoothing. |

| Limitations | Ignores liquidity constraints and unexpected shocks; assumes income predictability. | Assumes perfect credit markets and rational behavior; may overlook long-term income shifts. |

Introduction to Life-Cycle Hypothesis and Consumption Smoothing

The Life-Cycle Hypothesis (LCH) explains how individuals plan their consumption and savings behavior over their lifetime to maintain stable living standards by balancing income fluctuations. Consumption smoothing refers to the economic strategy where consumers strive to maintain consistent consumption levels despite variations in income, often supported by borrowing and saving mechanisms. Both concepts are central to understanding intertemporal consumption decisions and financial planning dynamics.

Historical Background and Theoretical Foundations

The Life-cycle hypothesis (LCH), developed by Franco Modigliani in the 1950s, posits that individuals plan their consumption and savings behavior over their lifetime to maintain stable consumption despite fluctuating income. Consumption smoothing theory, rooted in the permanent income hypothesis by Milton Friedman, emphasizes the optimization of consumption by spreading expenditures evenly over time to avoid sharp drops due to temporary income shocks. Both theories share a foundation in intertemporal choice and rational expectations, with LCH incorporating age-specific income variations and consumption smoothing focusing on income predictability and risk management.

Key Concepts: Defining Life-Cycle Hypothesis

The Life-Cycle Hypothesis posits that individuals plan their consumption and savings behavior over their lifetime to maintain stable living standards, anticipating changes in income during different life stages. Consumption smoothing under this hypothesis involves adjusting savings and spending to balance resources, avoiding significant fluctuations in consumption despite income variability. Key concepts include intertemporal choice, expected lifetime income, and the trade-off between present and future consumption to achieve optimal consumption patterns across life phases.

Key Concepts: Understanding Consumption Smoothing

The Life-cycle hypothesis explains consumption smoothing as the process individuals maintain stable consumption levels by saving during high-income periods and dissaving during low-income stages, ensuring lifetime utility optimization. Key concepts include intertemporal budget constraints, predictable income fluctuations, and the role of savings in balancing consumption over time. Understanding consumption smoothing involves recognizing how people adjust spending habits to mitigate income volatility and maintain economic stability throughout their life span.

Mathematical Models and Assumptions

The Life-cycle hypothesis models consumption as a function of expected lifetime income, assuming individuals optimize utility by allocating resources to maintain stable consumption over their lifespan through intertemporal budget constraints. Consumption smoothing mathematically emphasizes minimizing variance in consumption over time, often modeled using stochastic processes and utility functions with diminishing marginal utility to hedge against income fluctuations. Both frameworks rely on assumptions of rational behavior, perfect capital markets, and foresight of future income streams, but the life-cycle model explicitly incorporates age-dependent income profiles, while consumption smoothing focuses on volatility management in consumption patterns.

Differences and Similarities Between the Two Theories

The Life-cycle hypothesis posits that individuals plan their consumption and savings behavior over their lifetime to maintain a stable standard of living, anticipating changes in income during different life stages. Consumption smoothing emphasizes minimizing fluctuations in consumption by adjusting savings and borrowing in response to short-term income variability. Both theories share the principle of optimizing consumption over time, but the life-cycle hypothesis focuses on long-term planning aligned with predictable income changes, while consumption smoothing addresses short-term income shocks and the desire for stable consumption levels.

Empirical Evidence and Real-World Applications

Empirical evidence supporting the Life-cycle hypothesis (LCH) highlights patterns of consumption and saving behavior that align with individuals planning their lifetime resources, while real-world applications include retirement planning and social security policy design. Studies comparing LCH with consumption smoothing reveal that while both models explain expenditure stabilization, consumption smoothing emphasizes short-term income shocks, validated by observations of households maintaining stable consumption despite income volatility. Financial institutions leverage these insights for developing credit products and savings schemes tailored to support consumers through income fluctuations and long-term financial goals.

Policy Implications and Economic Impact

The Life-cycle hypothesis suggests that individuals plan their consumption and savings behavior over their lifetime to smooth consumption, which informs policies targeting retirement savings and social security systems. Consumption smoothing emphasizes the importance of access to credit and insurance markets, highlighting the need for policies that ensure liquidity and risk-sharing to stabilize consumption against income shocks. Understanding the distinctions between these concepts helps design economic policies that promote financial stability, reduce poverty, and support long-term economic growth by optimizing household consumption patterns.

Criticisms and Limitations

The Life-cycle hypothesis assumes rational, forward-looking consumers who plan consumption based on predictable income changes, but it often overlooks behavioral biases and liquidity constraints that affect real-world spending. Consumption smoothing models face criticism for insufficiently accounting for unexpected income shocks or emergencies, which can disrupt stable consumption patterns. Both theories tend to simplify heterogeneity among consumers, ignoring differences in financial literacy, access to credit, and precautionary saving motives.

Conclusion: Integrating Insights for Modern Economic Analysis

The Life-cycle hypothesis explains consumption patterns by predicting individuals smooth consumption based on expected lifetime income, while consumption smoothing emphasizes short-term adjustments to maintain stable living standards. Integrating these insights allows modern economic analysis to capture both long-term planning and immediate responses to income fluctuations, providing a comprehensive understanding of consumer behavior. This synthesis enhances policy design targeting savings, retirement planning, and social safety nets.

Life-cycle hypothesis Infographic

libterm.com

libterm.com