Absolute return measures the gain or loss of an investment independent of market fluctuations, focusing solely on the actual profit or loss achieved. This performance metric is crucial for investors aiming to achieve positive returns regardless of overall market conditions. Explore the rest of the article to learn how absolute return strategies can enhance your investment portfolio.

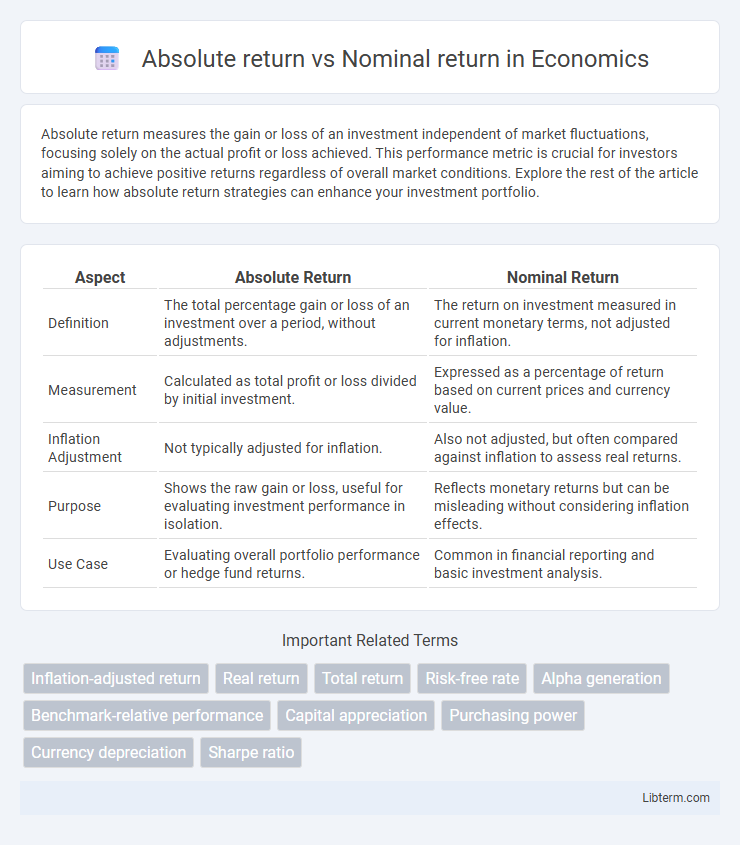

Table of Comparison

| Aspect | Absolute Return | Nominal Return |

|---|---|---|

| Definition | The total percentage gain or loss of an investment over a period, without adjustments. | The return on investment measured in current monetary terms, not adjusted for inflation. |

| Measurement | Calculated as total profit or loss divided by initial investment. | Expressed as a percentage of return based on current prices and currency value. |

| Inflation Adjustment | Not typically adjusted for inflation. | Also not adjusted, but often compared against inflation to assess real returns. |

| Purpose | Shows the raw gain or loss, useful for evaluating investment performance in isolation. | Reflects monetary returns but can be misleading without considering inflation effects. |

| Use Case | Evaluating overall portfolio performance or hedge fund returns. | Common in financial reporting and basic investment analysis. |

Understanding Absolute Return

Absolute return measures the total percentage gain or loss of an investment over a specific period without comparing it to any benchmark or inflation rate. It reflects the pure performance of the investment in nominal terms, capturing real profitability or loss regardless of market conditions. Investors use absolute return to evaluate the effectiveness of a strategy based solely on actual financial outcomes.

Defining Nominal Return

Nominal return refers to the total percentage increase in an investment's value without adjusting for inflation, taxes, or fees, representing the raw financial gain. It contrasts with absolute return, which measures the actual profit or loss in monetary terms regardless of benchmarks or inflation. Understanding nominal return is crucial for evaluating investment performance before considering real purchasing power or net profitability.

Key Differences: Absolute vs Nominal Return

Absolute return measures the total gain or loss of an investment over a specific period, expressed as a percentage without considering external factors like inflation. Nominal return represents the percentage increase in investment value before adjusting for inflation or taxes, reflecting the raw financial gain. The key difference lies in absolute return providing a clear measure of actual investment performance, while nominal return may overstate earnings by ignoring purchasing power changes.

Calculating Absolute Return: Step-by-Step

Calculating absolute return involves subtracting the initial investment value from the final investment value and dividing the result by the initial value, then multiplying by 100 to express it as a percentage. For example, if an investment grows from $1,000 to $1,200, the absolute return is (($1,200 - $1,000) / $1,000) x 100 = 20%. This calculation provides a clear measure of total gain or loss without adjusting for inflation or other factors.

How to Compute Nominal Return

Nominal return is calculated by subtracting the initial investment value from the final investment value and then dividing by the initial investment value, typically expressed as a percentage. This formula captures the raw percentage increase or decrease without adjusting for inflation or other factors. Investors use nominal return to measure the growth of their investment over a specified period before considering real purchasing power changes.

Impact of Inflation on Returns

Absolute return measures the total gain or loss of an investment without adjusting for inflation, whereas nominal return represents the raw percentage increase or decrease in value. Inflation erodes the purchasing power of nominal returns, making it essential to consider real returns, which adjust nominal returns for inflation to reflect true investment performance. Ignoring inflation can lead to overestimating the profitability of an investment, especially during periods of high inflation.

Practical Examples: Absolute and Nominal Returns

An absolute return is the total gain or loss on an investment without adjusting for inflation, expressed as a percentage of the initial investment, such as earning $1,200 on a $10,000 investment resulting in a 12% absolute return. Nominal return refers to the return measured in current dollars, not accounting for the loss in purchasing power due to inflation; for instance, if inflation is 3% during the year, a 12% nominal return translates to a real return of approximately 9%. Practical examples show that understanding both absolute and nominal returns helps investors assess the actual value gained or lost, especially when inflation rates fluctuate and impact real wealth growth.

Which Metric Matters for Investors?

Absolute return measures the total gain or loss of an investment over a specific period without adjusting for inflation or market benchmarks, providing a straightforward view of performance. Nominal return reflects the percentage increase in investment value, unadjusted for inflation, which can mislead investors about real purchasing power gains. Investors prioritize absolute return for understanding actual profit outcomes, but nominal return remains essential for comparing investment growth trends over time.

Common Pitfalls in Measuring Returns

Absolute return measures the total gain or loss of an investment without adjusting for factors like inflation or risk, often leading to misleading conclusions about real performance. Nominal return reflects the raw percentage change in investment value but ignores the impact of inflation, taxes, and fees, which can erode actual earnings. Common pitfalls in measuring returns include failing to account for time value of money, overlooking compounding effects, and confusing nominal returns with real returns, which can distort investment performance analysis.

Absolute Return vs Nominal Return: Final Comparison

Absolute return measures the total gain or loss of an investment without adjusting for inflation, providing a clear view of investment performance in raw terms. Nominal return represents the percentage increase in money value, ignoring purchasing power changes caused by inflation, which can distort the actual economic benefit. Comparing absolute return versus nominal return highlights the importance of considering inflation effects for true investment profitability analysis and decision-making.

Absolute return Infographic

libterm.com

libterm.com