Dividend policy determines how a company allocates its earnings between dividends paid to shareholders and retained earnings for growth. An effective dividend policy balances rewarding investors with ensuring sufficient funds for future expansion and stability. Explore the rest of this article to understand how the right dividend strategy can impact your investment decisions.

Table of Comparison

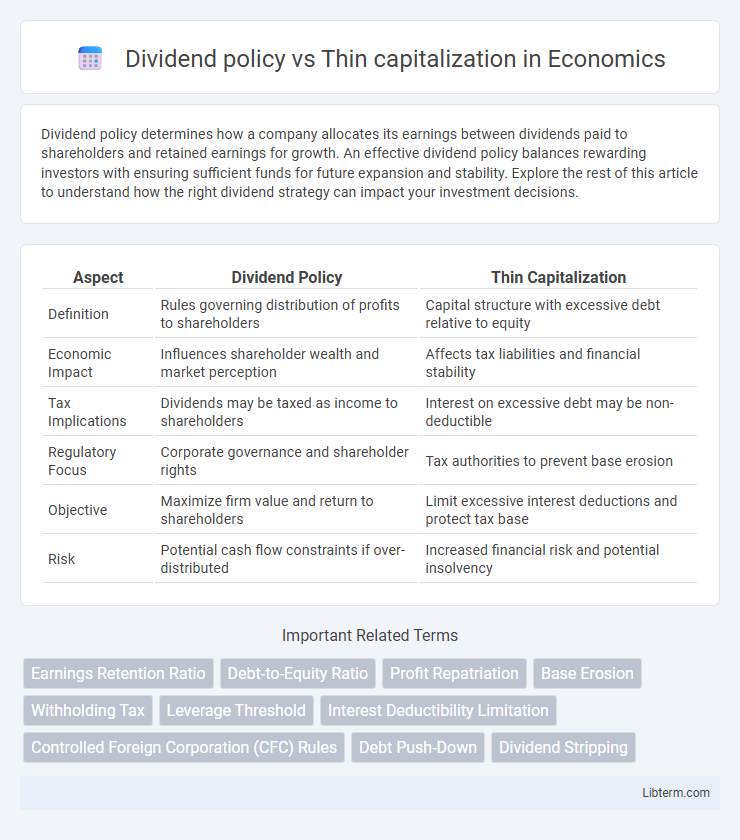

| Aspect | Dividend Policy | Thin Capitalization |

|---|---|---|

| Definition | Rules governing distribution of profits to shareholders | Capital structure with excessive debt relative to equity |

| Economic Impact | Influences shareholder wealth and market perception | Affects tax liabilities and financial stability |

| Tax Implications | Dividends may be taxed as income to shareholders | Interest on excessive debt may be non-deductible |

| Regulatory Focus | Corporate governance and shareholder rights | Tax authorities to prevent base erosion |

| Objective | Maximize firm value and return to shareholders | Limit excessive interest deductions and protect tax base |

| Risk | Potential cash flow constraints if over-distributed | Increased financial risk and potential insolvency |

Introduction to Dividend Policy and Thin Capitalization

Dividend policy determines the distribution of earnings to shareholders, balancing retained earnings for growth and payouts to investors, which directly influences company valuation and investor confidence. Thin capitalization occurs when a company is financed through excessive debt relative to equity, primarily to reduce taxable income via interest deductions, potentially triggering tax regulations that limit deductible interest. Both dividend policy and thin capitalization strategies significantly impact corporate financial management, tax planning, and regulatory compliance frameworks.

Key Definitions: Dividend Policy and Thin Capitalization

Dividend policy defines how a corporation distributes profits to shareholders through dividends, balancing retained earnings and payout ratio to maximize shareholder value. Thin capitalization occurs when a company is financed through a high level of debt compared to equity, risking higher interest expenses and tax implications due to limited equity capital. Understanding the distinction between dividend policy and thin capitalization is crucial for optimizing financial structure and ensuring compliance with tax regulations.

Regulatory Framework and Legal Considerations

Dividend policy and thin capitalization intersect within regulatory frameworks governing corporate finance to ensure compliance with tax laws and creditor protection. Dividend distribution rules often limit payouts based on retained earnings, while thin capitalization rules restrict excessive debt levels to prevent tax base erosion through interest deductions. Legal considerations include adherence to jurisdiction-specific statutes, transfer pricing regulations, and anti-avoidance provisions aimed at maintaining equitable financial practices and safeguarding stakeholder interests.

Objectives of Implementing Dividend Policies

Implementing dividend policies aims to balance shareholder returns with retained earnings to support sustainable growth and investment opportunities. Clear dividend strategies help manage corporate liquidity while signaling financial health and stability to investors. Effective dividend policies also prevent excessive debt accumulation, which can mitigate risks associated with thin capitalization and ensure compliance with tax regulations.

Thin Capitalization: Concepts and Mechanisms

Thin capitalization refers to a company's capital structure characterized by a high level of debt compared to equity, often used to maximize tax benefits through deductible interest expenses. Tax authorities implement thin capitalization rules to prevent excessive interest deductions that erode taxable income, typically by setting limits on the debt-to-equity ratio or interest deductibility thresholds. These mechanisms aim to balance legitimate financing needs with the enforcement of fair tax practices, contrasting with dividend policy, which governs profit distribution to shareholders without directly affecting tax deductions on debt.

Impact on Corporate Financial Structure

Dividend policy directly influences a firm's retained earnings and equity base, affecting its leverage and financial stability. Thin capitalization arises when a company is financed predominantly through debt rather than equity, leading to increased interest expenses and potential tax implications. Both factors critically shape the corporate financial structure by balancing debt levels, equity funding, and overall cost of capital, impacting long-term solvency and operational flexibility.

Tax Implications: Dividend Distribution vs Debt Financing

Dividend policy decisions impact corporate tax liabilities as dividend distributions are typically paid from after-tax profits, often triggering withholding taxes for shareholders and offering no tax deductions to the company. Thin capitalization rules limit excessive debt financing by restricting interest expense deductions, which can reduce taxable income, encouraging companies to balance debt and equity to optimize tax efficiency. Understanding the interplay between dividend payouts and debt structuring is crucial for multinational corporations aiming to minimize global tax burdens while complying with anti-avoidance regulations.

Risks and Challenges: Dividend Policy Versus Thin Capitalization

Dividend policy decisions risk attracting thin capitalization scrutiny when excessive dividends reduce equity below regulatory thresholds, triggering tax adjustments and penalties. Thin capitalization rules impose challenges by limiting deductible interest expenses, complicating the balance between leveraging debt and maintaining sustainable dividend payouts. Navigating these risks requires aligning capital structure with tax compliance to avoid adverse financial consequences and regulatory audits.

Practical Examples and Case Studies

Dividend policy can significantly impact a company's financial structure, especially when analyzed alongside thin capitalization rules that limit excessive debt financing. For example, in the case of multinational corporations like Apple and Amazon, adhering to thin capitalization regulations has influenced their dividend payout strategies to maintain optimal debt-to-equity ratios and minimize tax liabilities. Practical case studies demonstrate that companies resolving thin capitalization issues often adjust dividend policies to avoid triggering interest disallowances, ensuring sustainable capital allocation and compliance with tax authorities.

Best Practices for Balancing Dividend Policy and Capital Structure

Balancing dividend policy and capital structure involves maintaining an optimal mix of retained earnings and external debt to support sustainable growth while avoiding thin capitalization risks that may trigger tax penalties or restrictions. Best practices include regularly analyzing leverage ratios to ensure debt levels remain within regulatory and market tolerances, and setting dividend payout ratios that preserve sufficient equity for reinvestment and financial flexibility. Corporations should also coordinate dividend decisions with capital structure planning to optimize tax efficiency and shareholder value without compromising creditworthiness.

Dividend policy Infographic

libterm.com

libterm.com