The export multiplier measures how an increase in exports leads to a greater overall rise in a country's total economic output. It reveals the ripple effect of export growth on income, employment, and production across various sectors. Discover how understanding the export multiplier can enhance Your business strategies and economic policies by reading the full article.

Table of Comparison

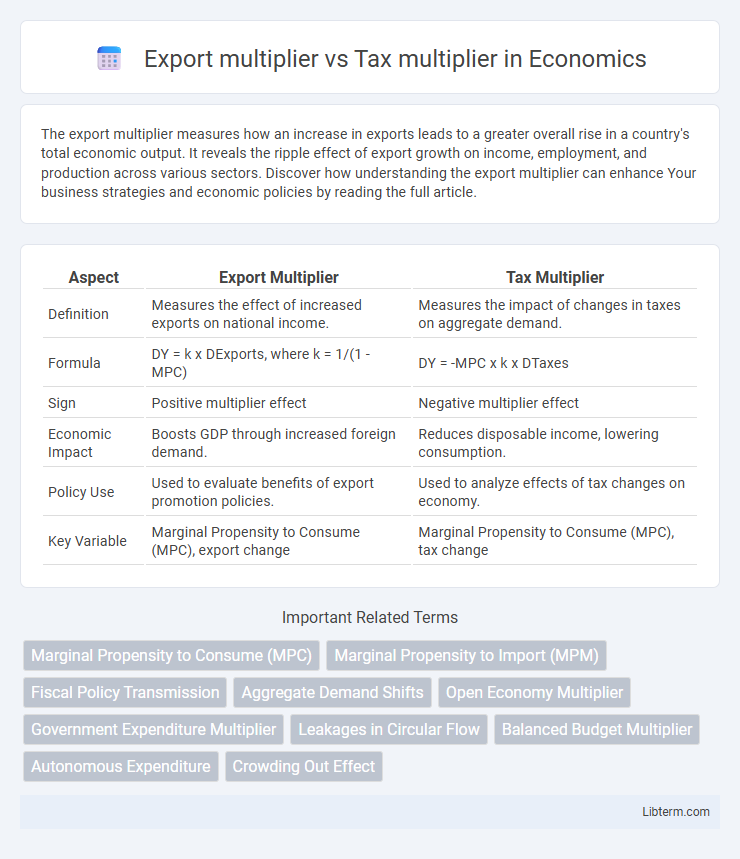

| Aspect | Export Multiplier | Tax Multiplier |

|---|---|---|

| Definition | Measures the effect of increased exports on national income. | Measures the impact of changes in taxes on aggregate demand. |

| Formula | DY = k x DExports, where k = 1/(1 - MPC) | DY = -MPC x k x DTaxes |

| Sign | Positive multiplier effect | Negative multiplier effect |

| Economic Impact | Boosts GDP through increased foreign demand. | Reduces disposable income, lowering consumption. |

| Policy Use | Used to evaluate benefits of export promotion policies. | Used to analyze effects of tax changes on economy. |

| Key Variable | Marginal Propensity to Consume (MPC), export change | Marginal Propensity to Consume (MPC), tax change |

Understanding Export Multiplier

The export multiplier measures the total economic impact generated by an increase in exports, reflecting how initial foreign spending leads to amplified domestic income and production growth. This multiplier captures the ripple effect of export revenue circulating through various sectors, boosting employment and consumption. Understanding the export multiplier is crucial for policymakers to enhance trade strategies that maximize GDP growth compared to the tax multiplier, which primarily shows changes in aggregate demand through fiscal policy adjustments.

Defining Tax Multiplier

The tax multiplier measures the change in aggregate demand resulting from a change in taxes, indicating how a $1 tax cut increases overall economic output by affecting disposable income and consumption. Unlike the export multiplier, which reflects the impact of increased exports on GDP through foreign demand, the tax multiplier primarily influences domestic consumption and investment. A higher marginal propensity to consume amplifies the tax multiplier's effect, making fiscal tax adjustments a powerful tool for managing economic fluctuations.

Mechanism of the Export Multiplier

The export multiplier operates by increasing aggregate demand through higher foreign spending on domestic goods and services, which stimulates production and income within the economy. This initial rise in exports leads to successive rounds of increased consumption and investment as businesses and households respond to greater income, amplifying the overall economic impact. Unlike the tax multiplier, which reduces disposable income and consumption when taxes rise, the export multiplier directly injects new demand without diminishing domestic income levels.

How the Tax Multiplier Works

The tax multiplier measures the change in national income resulting from a change in taxes, typically showing a negative relationship because higher taxes reduce disposable income and consumption. When taxes increase, households and businesses have less spending power, leading to a decrease in aggregate demand and total output. This effect contrasts with the export multiplier, where an increase in exports directly raises national income through higher foreign demand for domestic goods.

Key Factors Influencing Export Multiplier

The export multiplier is significantly influenced by factors such as the marginal propensity to import, the marginal propensity to consume domestically produced goods, and the overall openness of the economy, which determines how much of the export income circulates within the domestic market. In contrast, the tax multiplier depends heavily on the marginal propensity to consume and the structure of the tax system, affecting disposable income and spending behavior. Understanding the elasticity of imports and the degree of economic interdependence is crucial for accurately estimating the export multiplier's impact on economic growth.

Determinants of the Tax Multiplier

The tax multiplier depends primarily on the marginal propensity to consume (MPC), with a higher MPC leading to a larger tax multiplier effect due to increased consumer spending from tax changes. Factors such as the existing tax structure, the degree of openness of the economy, and the responsiveness of labor markets also influence the magnitude of the tax multiplier. In contrast, the export multiplier is mainly driven by the marginal propensity to import and the global demand for domestic goods, making it less sensitive to domestic tax policies.

Comparative Impact on National Income

The export multiplier typically generates a larger impact on national income compared to the tax multiplier due to its direct stimulation of aggregate demand through increased foreign expenditure on domestic goods and services. The tax multiplier primarily influences national income by altering disposable income, which affects consumer spending but often yields a smaller overall change since some portion of tax cuts may be saved rather than spent. Empirical studies suggest export multipliers can exceed tax multipliers, especially in open economies with high marginal propensities to import and consume domestically produced goods.

Policy Implications: Export vs Tax Multipliers

Export multipliers typically generate higher economic growth compared to tax multipliers due to their direct impact on aggregate demand through increased foreign spending, which stimulates domestic production and employment. Tax multipliers influence the economy by altering disposable income and consumption patterns, but their effect can be dampened by savings and imports, reducing the overall fiscal stimulus. Policymakers aiming to boost growth should prioritize export-oriented strategies for a more potent multiplier effect, while tax policies serve better as tools for income redistribution and demand management.

Real-World Examples and Case Studies

The export multiplier quantifies the total economic impact generated by an increase in exports, as seen in countries like China, where export growth significantly boosted GDP through expanded production and employment. In contrast, the tax multiplier measures changes in aggregate demand resulting from fiscal policy shifts; for instance, the United States experienced varying tax multiplier effects during the 2008 financial crisis, with tax cuts stimulating consumption but with less impact than direct spending. Case studies from emerging economies such as India reveal that export multipliers often exceed tax multipliers, highlighting the greater effectiveness of export-led growth strategies over tax policy adjustments in driving economic expansion.

Conclusion: Choosing Between Export and Tax Multipliers

The export multiplier generally generates a stronger economic impact by increasing aggregate demand through foreign consumption, whereas the tax multiplier influences domestic spending by altering disposable income. Policymakers should prioritize the export multiplier in open economies with significant trade linkages to stimulate growth from external sources, while the tax multiplier is more effective for immediate domestic fiscal adjustments. Strategic selection depends on the economic context, target sectors, and desired macroeconomic outcomes such as growth, inflation control, or employment enhancement.

Export multiplier Infographic

libterm.com

libterm.com