Gross return represents the total profit generated from an investment before deducting any expenses, taxes, or fees. It provides a clear picture of the investment's initial performance and helps you gauge its potential profitability. Explore the rest of the article to learn how gross return factors into your overall financial strategy.

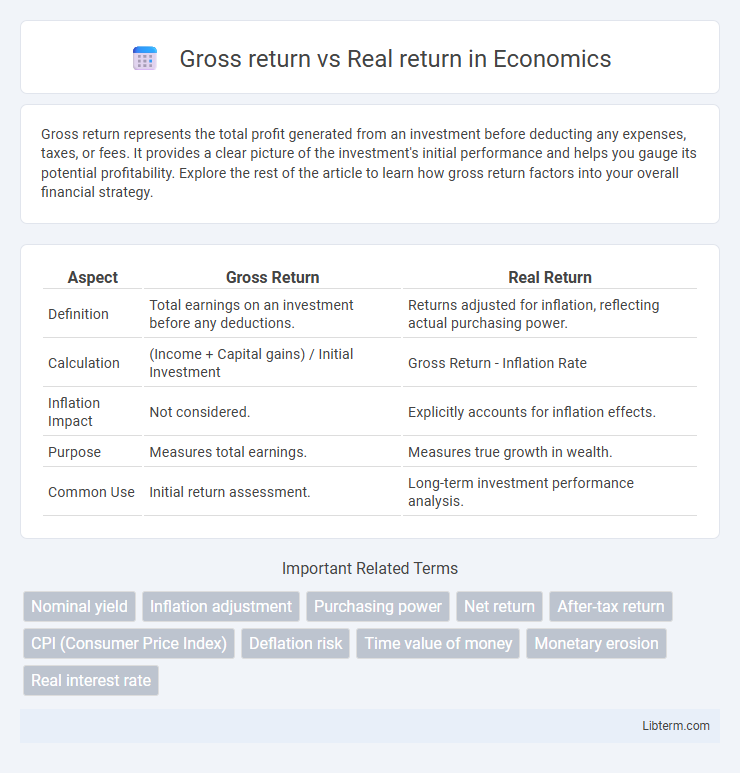

Table of Comparison

| Aspect | Gross Return | Real Return |

|---|---|---|

| Definition | Total earnings on an investment before any deductions. | Returns adjusted for inflation, reflecting actual purchasing power. |

| Calculation | (Income + Capital gains) / Initial Investment | Gross Return - Inflation Rate |

| Inflation Impact | Not considered. | Explicitly accounts for inflation effects. |

| Purpose | Measures total earnings. | Measures true growth in wealth. |

| Common Use | Initial return assessment. | Long-term investment performance analysis. |

Introduction to Gross Return and Real Return

Gross return represents the total investment gain or loss before deducting any expenses, taxes, or inflation effects, providing a raw measure of asset performance. Real return adjusts the gross return by accounting for inflation, reflecting the true increase in purchasing power from the investment. Understanding the distinction between gross and real returns is essential for evaluating investment profitability and preserving wealth over time.

Key Definitions: Gross Return vs Real Return

Gross return represents the total investment gain before any deductions, reflecting the raw percentage increase in value over a specific period. Real return adjusts the gross return for inflation effects, indicating the true increase in purchasing power and investment profitability. Understanding the distinction between gross return and real return is essential for accurate assessment of an investment's performance.

Importance of Understanding Investment Returns

Understanding the difference between gross return and real return is crucial for accurate investment analysis and decision-making. Gross return reflects total earnings before adjusting for inflation, while real return accounts for inflation's impact, revealing the true increase in purchasing power. Investors prioritizing real returns can better assess their portfolio's growth and make informed strategies to preserve and enhance wealth over time.

Calculating Gross Return: The Basics

Gross return represents the total investment gain or loss before accounting for inflation and taxes, calculated by dividing the ending value of an investment by its initial value, then subtracting one. This measure includes dividends, interest, and capital gains, providing a straightforward view of overall performance. Accurate gross return calculation lays the foundation for further analysis like determining the real return, which adjusts for inflation to reflect the true increase in purchasing power.

Understanding Real Return: Adjusting for Inflation

Real return measures the actual purchasing power gained from an investment by adjusting the gross return for inflation, providing a more accurate reflection of investment performance. Gross return represents the total earnings before accounting for inflation or taxes, often overstating the true economic benefit. Understanding real return is crucial for investors aiming to preserve wealth and achieve long-term financial goals in an inflationary environment.

Major Factors Affecting Real Return

Gross return represents the total investment gain before any deductions, while real return accounts for inflation and taxes, reflecting the true increase in purchasing power. Major factors affecting real return include inflation rates, which erode nominal gains, tax policies that reduce net income, and investment fees that lower overall profitability. Understanding the impact of these variables is crucial for accurately assessing investment performance and making informed financial decisions.

Real-World Examples: Gross vs Real Return

Gross return represents the total investment gains before accounting for inflation, taxes, and fees, while real return reflects the net gain after adjusting for inflation, providing a more accurate measure of purchasing power growth. For example, if an investment yields a 10% gross return but inflation is 3%, the real return drops to approximately 7%, illustrating how inflation erodes nominal gains. Real-world cases such as the 1970s US stock market, with double-digit inflation rates, highlight the importance of focusing on real returns to assess true investment performance.

Impact of Taxes and Fees on Returns

Gross return represents the total investment gain before taxes and fees, while real return accounts for inflation, taxes, and fees, providing a more accurate measure of purchasing power growth. Taxes and fees can significantly erode gross returns, with capital gains taxes, dividend taxes, and fund management fees reducing the effective earnings investors receive. Understanding the impact of these costs is crucial for evaluating the true profitability of investments and optimizing portfolio strategies.

Why Real Return Matters for Long-Term Investors

Real return represents the investment gain after adjusting for inflation, reflecting the true increase in purchasing power over time. Long-term investors prioritize real return to ensure their portfolio growth outpaces inflation, preserving wealth and enabling meaningful financial goals like retirement or education funding. Focusing on real return helps investors avoid the illusion of nominal gains that can be eroded by rising costs, securing sustained economic value.

Conclusion: Making Informed Investment Decisions

Understanding the difference between gross return and real return is crucial for making informed investment decisions because gross return does not account for inflation's impact on purchasing power. Real return provides a more accurate measure of an investment's profitability by reflecting the actual increase in value after adjusting for inflation. Prioritizing real return allows investors to evaluate true growth and preserve wealth effectively over time.

Gross return Infographic

libterm.com

libterm.com