Purchasing Power Parity (PPP) is an economic theory that compares different countries' currencies through a "basket of goods" approach to determine the relative value of currencies. It helps assess whether a currency is undervalued or overvalued based on the cost of living and inflation rates. Explore the rest of this article to understand how PPP impacts exchange rates and global economic analysis.

Table of Comparison

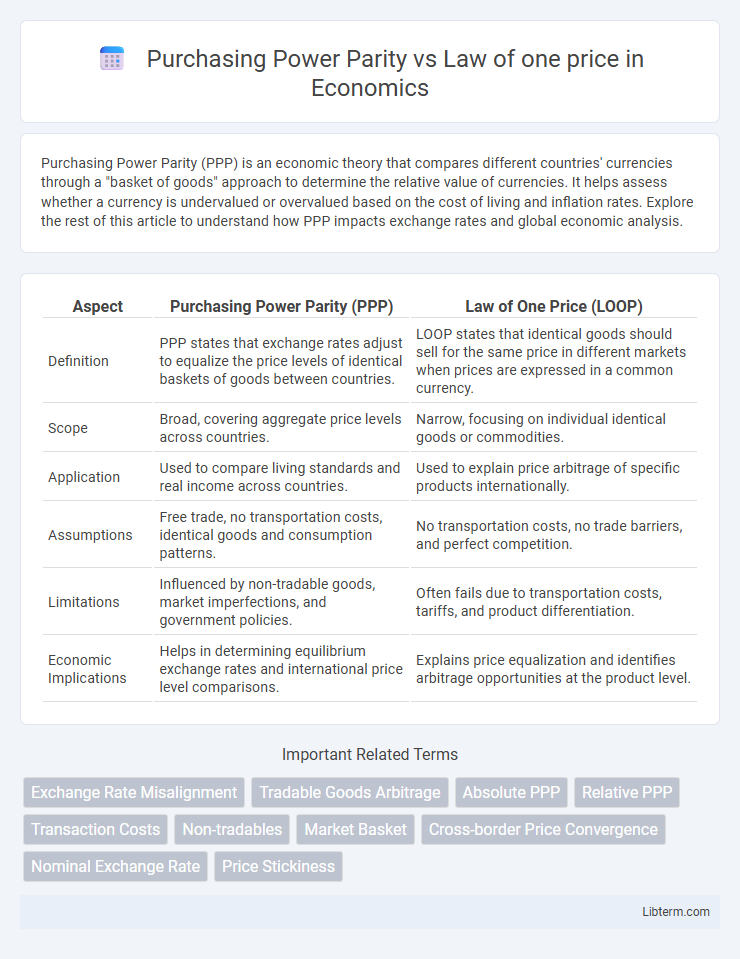

| Aspect | Purchasing Power Parity (PPP) | Law of One Price (LOOP) |

|---|---|---|

| Definition | PPP states that exchange rates adjust to equalize the price levels of identical baskets of goods between countries. | LOOP states that identical goods should sell for the same price in different markets when prices are expressed in a common currency. |

| Scope | Broad, covering aggregate price levels across countries. | Narrow, focusing on individual identical goods or commodities. |

| Application | Used to compare living standards and real income across countries. | Used to explain price arbitrage of specific products internationally. |

| Assumptions | Free trade, no transportation costs, identical goods and consumption patterns. | No transportation costs, no trade barriers, and perfect competition. |

| Limitations | Influenced by non-tradable goods, market imperfections, and government policies. | Often fails due to transportation costs, tariffs, and product differentiation. |

| Economic Implications | Helps in determining equilibrium exchange rates and international price level comparisons. | Explains price equalization and identifies arbitrage opportunities at the product level. |

Introduction to Purchasing Power Parity and Law of One Price

Purchasing Power Parity (PPP) is an economic theory stating that in the absence of transaction costs and barriers, the exchange rate between two currencies should equal the ratio of their price levels, ensuring that a basket of goods costs the same in both countries. The Law of One Price underpins PPP by asserting that identical goods must have the same price in different markets when prices are expressed in a common currency, assuming no transportation costs or trade barriers. While PPP applies this principle to aggregate price levels across countries, the Law of One Price focuses specifically on individual goods or commodities in a single market.

Defining Purchasing Power Parity (PPP)

Purchasing Power Parity (PPP) is an economic theory stating that in the absence of transaction costs and trade barriers, identical goods should have the same price when expressed in a common currency across different countries. It extends the Law of One Price, which applies to individual products, by comparing the general price levels of entire baskets of goods and services. PPP serves as a fundamental tool for comparing economic productivity and living standards between nations.

Understanding the Law of One Price (LOOP)

The Law of One Price (LOOP) states that identical goods should sell for the same price in different markets when prices are expressed in a common currency, assuming no transportation costs and trade barriers. LOOP is fundamental to the theory of Purchasing Power Parity (PPP), which extends the concept to compare price levels across countries for a basket of goods and services. Understanding LOOP helps explain how arbitrage ensures price equalization and influences exchange rate determination in global markets.

Theoretical Foundations: PPP vs LOOP

Purchasing Power Parity (PPP) extends the Law of One Price (LOOP) by applying it to a broad basket of goods and services rather than individual items, establishing that exchange rates should adjust to equalize purchasing power across countries. While LOOP asserts that identical goods must sell for the same price in different markets after accounting for exchange rates, PPP addresses aggregate price levels, thus incorporating factors such as transportation costs, tariffs, and consumption patterns. Theoretical foundations of PPP rely on the assumption of perfect competition and no transaction costs, making it a macroeconomic generalization of the microeconomic principle embedded in LOOP.

Key Assumptions Behind Each Theory

Purchasing Power Parity (PPP) assumes that identical goods in different countries should have the same price when expressed in a common currency, relying on the absence of transportation costs, tariffs, and trade barriers. The Law of One Price (LOOP) is based on the assumption that arbitrage opportunities eliminate price differences for identical goods across locations, requiring perfect competition and no transaction costs. Both theories depend on market efficiency but differ as PPP applies broadly to price levels while LOOP targets individual goods.

Real-World Applications of PPP and LOOP

Purchasing Power Parity (PPP) is widely used for comparing economic productivity and standards of living between countries by adjusting for price level differences, thus guiding international investment and policy decisions. The Law of One Price (LOOP) underpins arbitrage in goods markets, ensuring price convergence for identical products across borders, which is essential for multinational pricing strategies and trade regulations. Real-world applications of PPP are evident in currency valuation and inflation adjustments, while LOOP drives market integration and influences exchange rate movements in global trade.

Limitations and Criticisms of PPP and LOOP

Purchasing Power Parity (PPP) faces limitations due to differences in consumption patterns, transportation costs, and trade barriers that prevent identical goods from having uniform prices across countries. The Law of One Price (LOOP) is criticized for assuming perfect market efficiency and ignoring factors such as tariffs, taxes, and product heterogeneity that cause price disparities. Both PPP and LOOP struggle to accurately reflect real-world pricing dynamics because of market imperfections and varying economic conditions.

Factors Affecting the Validity of Each Concept

Purchasing Power Parity (PPP) validity is influenced by factors like transportation costs, trade barriers, and differences in consumption patterns across countries, which can distort price comparisons. The Law of One Price (LOOP) assumes identical goods sell for the same price globally, but its accuracy is challenged by market imperfections, product differentiation, and exchange rate fluctuations. Both concepts are affected by market integration levels and the extent of arbitrage opportunities available in international trade.

Empirical Evidence: Case Studies and Data

Empirical evidence comparing Purchasing Power Parity (PPP) and the Law of One Price (LOOP) reveals mixed results across case studies, with PPP often holding better in the long run for aggregate price levels among countries, while LOOP finds stronger support for homogeneous goods in localized markets. Data from multinational datasets, such as the Penn World Table and IMF's International Financial Statistics, show deviations from PPP due to transportation costs, tariffs, and market segmentation. Case studies in regions like the European Union display convergence towards LOOP for tradable goods, but divergence for non-tradable sectors, underscoring the complexities of empirical validation.

Conclusion: Comparing PPP and the Law of One Price

Purchasing Power Parity (PPP) and the Law of One Price (LOOP) both explain price relationships across countries but differ in scope and application. PPP addresses the overall price level of a basket of goods to compare currency values, while LOOP focuses on individual identical goods' prices being equal when expressed in a common currency. PPP provides a broader macroeconomic framework for exchange rate determination, whereas LOOP serves as a microeconomic foundation underlying PPP assumptions.

Purchasing Power Parity Infographic

libterm.com

libterm.com