Disposable personal income reflects the amount of money individuals have available to spend or save after taxes are deducted from their total earnings. It plays a crucial role in determining consumer behavior, economic growth, and personal financial planning. Discover how understanding your disposable personal income can empower you to make smarter financial decisions by reading the rest of this article.

Table of Comparison

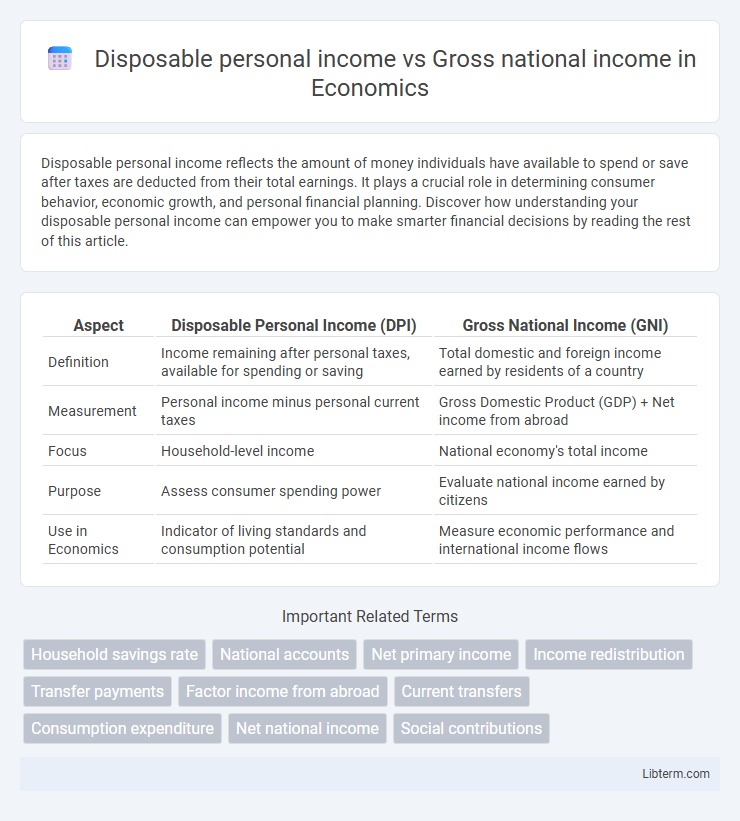

| Aspect | Disposable Personal Income (DPI) | Gross National Income (GNI) |

|---|---|---|

| Definition | Income remaining after personal taxes, available for spending or saving | Total domestic and foreign income earned by residents of a country |

| Measurement | Personal income minus personal current taxes | Gross Domestic Product (GDP) + Net income from abroad |

| Focus | Household-level income | National economy's total income |

| Purpose | Assess consumer spending power | Evaluate national income earned by citizens |

| Use in Economics | Indicator of living standards and consumption potential | Measure economic performance and international income flows |

Introduction to Disposable Personal Income and Gross National Income

Disposable Personal Income (DPI) represents the net income available to individuals after taxes, directly influencing consumer spending and savings patterns. Gross National Income (GNI) measures the total monetary value earned by a country's residents and businesses, including overseas income, reflecting the overall economic strength. Understanding the distinction between DPI and GNI is crucial for assessing personal financial health versus national economic performance.

Defining Disposable Personal Income

Disposable personal income represents the amount of money individuals have available after paying taxes, reflecting the actual funds for consumption and savings. It differs from gross national income, which measures the total income earned by a country's residents and businesses, including overseas earnings before taxes and deductions. Understanding disposable personal income is crucial for analyzing consumer spending patterns and economic health within a nation.

Understanding Gross National Income

Gross National Income (GNI) measures the total domestic and foreign output claimed by residents of a country, including wages, rents, interest, and profits, providing a comprehensive view of economic activity. Disposable personal income, by contrast, reflects the amount of money individuals have available for spending and saving after taxes, focusing on consumer-level economic power. Understanding GNI is crucial for assessing a country's overall economic stability and comparing income generated by residents irrespective of where the production occurs.

Key Differences Between DPI and GNI

Disposable Personal Income (DPI) measures the amount of money households have available for spending and saving after income taxes, reflecting actual consumer purchasing power. Gross National Income (GNI) calculates the total income earned by a country's residents and businesses, including net income from abroad, emphasizing overall economic production and income generation. While DPI highlights individual financial well-being, GNI provides a broader economic perspective on national income.

Calculation Methods for DPI and GNI

Disposable personal income (DPI) is calculated by subtracting personal taxes and adding transfer payments from an individual's gross income, reflecting the actual amount available for spending and saving. Gross national income (GNI) is determined by summing the total domestic and foreign output claimed by residents of a country, including net income from abroad such as wages and investments. The primary distinction lies in DPI focusing on individual after-tax earnings, while GNI aggregates national economic performance including international income flows.

Economic Significance of Disposable Personal Income

Disposable personal income measures the actual amount of money households have available for spending and saving after taxes, reflecting consumer purchasing power and driving individual consumption patterns directly impacting economic growth. Gross national income (GNI) accounts for the total income earned by a nation's residents, including earnings from abroad, providing a broad measure of economic productivity and residents' economic well-being. The economic significance of disposable personal income lies in its influence on demand-side economic activities, serving as a key indicator for assessing consumer confidence, retail sales trends, and overall economic health.

Importance of Gross National Income in Economic Analysis

Gross National Income (GNI) represents the total income earned by a country's residents and businesses, including net income from abroad, providing a comprehensive measure of economic performance beyond domestic production reflected in Disposable Personal Income (DPI). GNI is crucial for economic analysis because it captures the full economic strength of a nation, informing policy decisions related to development, international trade, and income distribution. Unlike DPI, which focuses on household disposable earnings after taxes and transfers, GNI integrates all income sources to better assess economic health and guide national and international economic strategies.

Impact on Policy: DPI vs GNI

Disposable personal income (DPI) directly influences consumer spending and savings behavior, guiding policymakers in setting tax rates and social welfare programs to stimulate economic growth or provide financial relief. Gross national income (GNI) reflects the total economic output including international income flows, shaping broader fiscal policies related to trade, investment, and national economic planning. Understanding the disparity between DPI and GNI assists governments in balancing domestic income distribution with external economic dependencies for sustainable development.

Practical Applications: Business and Personal Finance

Disposable personal income directly influences consumer spending patterns, enabling businesses to tailor marketing strategies and product offerings to target high-spending demographics effectively. Gross national income (GNI) helps multinational corporations assess economic stability and investment potential across countries, guiding decisions related to market entry and resource allocation. Personal finance advisors use disposable income data to develop budgeting plans and savings strategies, while GNI trends inform macroeconomic forecasting and long-term financial planning.

Summary: Choosing the Right Indicator

Disposable personal income measures the amount of money individuals have available for spending and saving after taxes, reflecting household financial well-being. Gross national income (GNI) accounts for the total income earned by a nation's residents and businesses, including income from abroad, offering a broader view of economic performance. Selecting between disposable personal income and GNI depends on whether the focus is on individual economic welfare or overall national economic strength.

Disposable personal income Infographic

libterm.com

libterm.com