Monopoly is a classic board game that challenges players to strategize property acquisition and financial management to dominate the market. Mastery of negotiation, investment, and luck can turn your initial assets into a thriving real estate empire. Explore the detailed strategies and tips in this article to boost your chances of winning Monopoly.

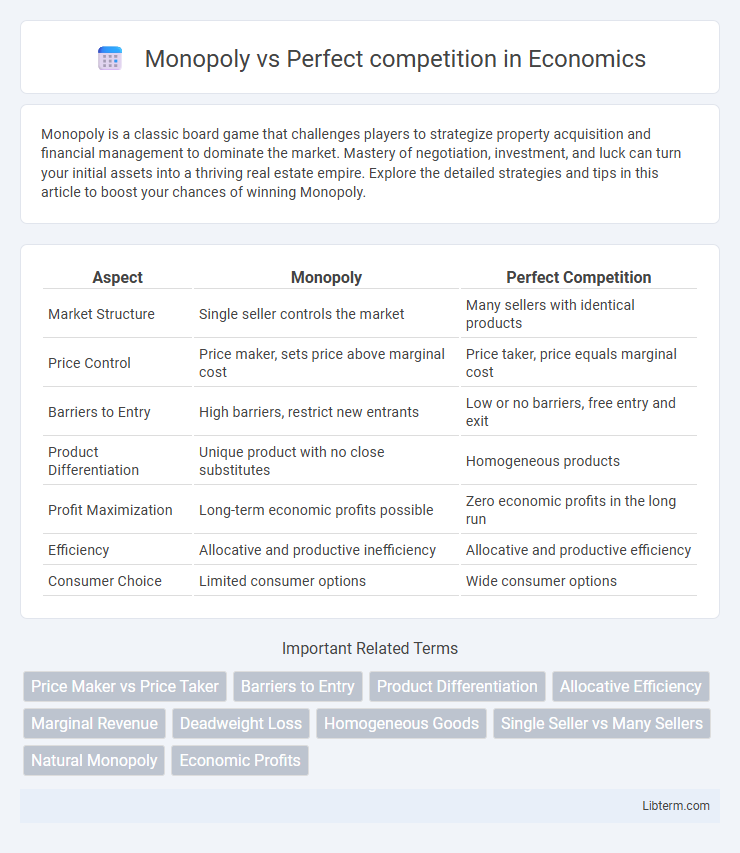

Table of Comparison

| Aspect | Monopoly | Perfect Competition |

|---|---|---|

| Market Structure | Single seller controls the market | Many sellers with identical products |

| Price Control | Price maker, sets price above marginal cost | Price taker, price equals marginal cost |

| Barriers to Entry | High barriers, restrict new entrants | Low or no barriers, free entry and exit |

| Product Differentiation | Unique product with no close substitutes | Homogeneous products |

| Profit Maximization | Long-term economic profits possible | Zero economic profits in the long run |

| Efficiency | Allocative and productive inefficiency | Allocative and productive efficiency |

| Consumer Choice | Limited consumer options | Wide consumer options |

Introduction to Market Structures

Monopoly is a market structure characterized by a single seller with significant control over price, high barriers to entry, and unique products, resulting in limited consumer choices. Perfect competition features numerous small firms offering identical products, with no single firm able to influence market price due to free entry and exit. These contrasting structures illustrate the range of market dynamics that affect pricing, output, and efficiency in different economic environments.

Defining Monopoly

Monopoly is a market structure characterized by a single seller who controls the entire supply of a unique product with no close substitutes, giving the firm significant market power to set prices. Unlike perfect competition, where many firms offer identical products and price takers exist, a monopoly faces a downward-sloping demand curve and can influence market price by adjusting output levels. Barriers to entry such as high startup costs, exclusive resource ownership, or government regulation sustain monopolies by preventing potential competitors from entering the market.

Understanding Perfect Competition

Perfect competition features numerous small firms selling identical products, ensuring no single firm can influence market prices, which are determined purely by supply and demand. The market exhibits free entry and exit, leading to zero economic profits in the long run as firms earn just enough to cover opportunity costs. Perfect competition maximizes consumer welfare by promoting allocative and productive efficiency, where resources are optimally distributed, and production costs are minimized.

Barriers to Entry: Monopoly vs Perfect Competition

Monopoly markets exhibit high barriers to entry, including exclusive control over key resources, significant capital requirements, and legal restrictions such as patents or licenses, which prevent new firms from entering the market. In contrast, perfect competition is characterized by zero or very low barriers to entry, allowing numerous firms to freely enter and exit the market in response to profit opportunities. These differences in entry barriers directly impact market dynamics, pricing power, and long-term economic efficiency in each market structure.

Price Setting Mechanisms

In a monopoly, the single seller has significant control over the price, setting it above marginal cost to maximize profits due to the lack of close substitutes and entry barriers. In perfect competition, numerous small firms are price takers, accepting the market price determined by the intersection of industry supply and demand, which equals marginal cost in equilibrium. Price setting in monopoly leads to allocative inefficiency and consumer surplus loss, whereas perfect competition results in efficient resource allocation and maximum total surplus.

Efficiency and Resource Allocation

Monopoly markets often result in allocative inefficiency as the single seller restricts output to raise prices above marginal cost, causing deadweight loss and underutilization of resources. In perfect competition, firms produce at the point where price equals marginal cost, achieving allocative efficiency and optimal resource allocation. Productive efficiency is also higher in perfect competition, as firms operate at the lowest average cost, unlike monopolies that may lack incentives to minimize costs.

Consumer Choice and Welfare

Monopoly limits consumer choice by offering a single product or service, often leading to higher prices and reduced welfare compared to perfect competition where multiple firms provide diverse options at competitive prices. Perfect competition enhances consumer welfare through efficient allocation of resources, driving innovation and lower prices, whereas monopolies may result in allocative inefficiency and deadweight loss. Consumer surplus is maximized in perfect competition due to price equaling marginal cost, while monopoly pricing creates a welfare loss by setting prices above marginal cost.

Innovation and Product Development

Monopolies often allocate substantial resources to innovation and product development due to their guaranteed market power and higher profits, enabling long-term research investments. In contrast, perfect competition limits firms' ability to invest in innovation since intense price competition drives profits toward zero, reducing incentives for costly development. However, competitive markets can foster incremental innovation as firms strive to differentiate products marginally to gain a slight edge.

Real-World Examples

Monopoly markets often feature dominant firms like utility companies or tech giants such as Microsoft, which control pricing and limit competition due to high entry barriers. In contrast, perfect competition is exemplified by agricultural markets, where numerous small farmers sell identical products like wheat, resulting in price-taking behavior and efficient resource allocation. Real-world deviations from perfect competition include product differentiation and market power that influence consumer choice and economic outcomes.

Conclusion: Key Differences and Implications

Monopoly markets are characterized by a single seller with significant market power, leading to higher prices and restricted output compared to perfect competition, where many sellers ensure price equals marginal cost and maximum consumer surplus. The lack of competition in monopoly results in allocative inefficiency and potential welfare losses, while perfect competition promotes efficient resource allocation and innovation incentives. Understanding these differences highlights the need for regulatory policies to balance market power and protect consumer interests.

Monopoly Infographic

libterm.com

libterm.com