Fiscal deficit occurs when a government's total expenditure exceeds its total revenue, excluding borrowings, highlighting a gap between spending and income. Managing this deficit is crucial for economic stability, as persistent fiscal deficits can lead to increased public debt and inflationary pressures. Explore the rest of the article to understand how fiscal deficit impacts your economy and the strategies used to control it.

Table of Comparison

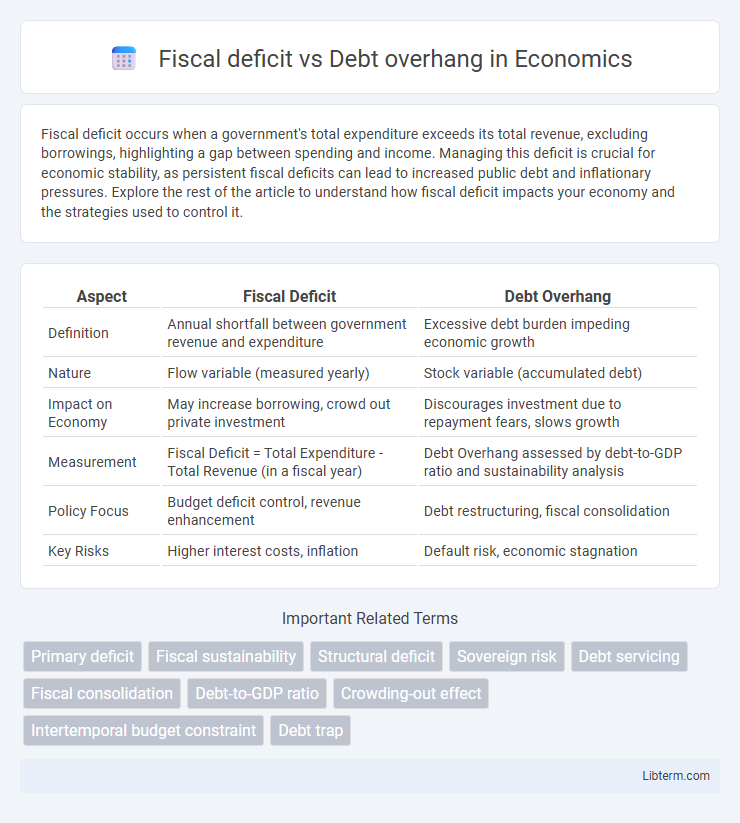

| Aspect | Fiscal Deficit | Debt Overhang |

|---|---|---|

| Definition | Annual shortfall between government revenue and expenditure | Excessive debt burden impeding economic growth |

| Nature | Flow variable (measured yearly) | Stock variable (accumulated debt) |

| Impact on Economy | May increase borrowing, crowd out private investment | Discourages investment due to repayment fears, slows growth |

| Measurement | Fiscal Deficit = Total Expenditure - Total Revenue (in a fiscal year) | Debt Overhang assessed by debt-to-GDP ratio and sustainability analysis |

| Policy Focus | Budget deficit control, revenue enhancement | Debt restructuring, fiscal consolidation |

| Key Risks | Higher interest costs, inflation | Default risk, economic stagnation |

Introduction to Fiscal Deficit and Debt Overhang

Fiscal deficit occurs when a government's total expenditures exceed its total revenue, excluding borrowings, indicating the need for additional funding to cover the gap. Debt overhang refers to a situation where a country's existing debt burden is so large that it hinders economic growth by discouraging investment and making it difficult to take on new debt. Understanding the differences between fiscal deficit and debt overhang is crucial for assessing a nation's fiscal health and long-term economic sustainability.

Defining Fiscal Deficit: Key Concepts

Fiscal deficit represents the gap between a government's total expenditures and its total revenues, excluding borrowing, within a specific fiscal year. It highlights the need for external financing to cover spending beyond income, influencing short-term economic stability and monetary policy decisions. Understanding fiscal deficit is crucial for assessing a country's budgetary discipline and anticipating future debt accumulation risks.

Understanding Debt Overhang: An Overview

Debt overhang occurs when a country's existing debt burden discourages new investments because potential lenders fear insufficient returns due to the heavy repayment obligations. Unlike a fiscal deficit, which represents a shortfall between government revenue and expenditure within a specific period, debt overhang reflects the cumulative debt stock that hinders economic growth. Understanding debt overhang involves analyzing how excessive sovereign debt reduces incentives for economic expansion and complicates fiscal sustainability.

Core Differences Between Fiscal Deficit and Debt Overhang

Fiscal deficit refers to the shortfall where government expenditures exceed revenues within a fiscal year, reflecting immediate budgetary imbalances, whereas debt overhang describes a situation in which existing debt is so large that it hinders economic growth and future borrowing capacity. Fiscal deficit impacts current fiscal policy and requires financing through borrowing or printing money, while debt overhang indicates long-term debt sustainability issues that can lower investor confidence and slow economic development. Core differences include the temporal scope--fiscal deficit is a flow variable measured annually, whereas debt overhang is a stock variable representing accumulated debt burden.

Causes of Rising Fiscal Deficits

Rising fiscal deficits often stem from excessive government spending and declining tax revenues during economic downturns, resulting in larger budget shortfalls. Structural factors such as inefficient public sector management and persistent fiscal imbalances exacerbate the fiscal deficit, leading to unsustainable borrowing needs. This accumulation of deficits contributes to a debt overhang, where high debt levels hinder economic growth and increase the risk of default.

Triggers and Consequences of Debt Overhang

Fiscal deficit occurs when a government's expenditures exceed its revenues, leading to increased borrowing. Debt overhang arises when existing debt levels are so high that they discourage new investment, as potential returns are expected to be absorbed by debt repayments. This situation triggers reduced economic growth and fiscal distress, impairing the government's ability to finance development and exacerbating long-term financial instability.

Fiscal Deficits’ Impact on Economic Growth

Fiscal deficits occur when government expenditures exceed revenues, leading to increased borrowing that can crowd out private investment and slow economic growth. Persistent high fiscal deficits contribute to debt overhang, where unsustainable debt levels deter investment due to uncertainty about future tax burdens and fiscal adjustment. Empirical studies show that beyond certain thresholds--often cited around 90% of GDP--debt overhang significantly hampers growth by raising interest rates and limiting fiscal space for productive spending.

Debt Overhang’s Effects on Investment and Development

Debt overhang occurs when a country's existing debt is so large that investors fear new investments will primarily serve to repay old creditors rather than generate returns, deterring fresh capital inflow. This situation stifles economic growth by reducing funds available for productive investment and infrastructure development. Persistent debt overhang undermines a nation's creditworthiness, limits access to international financial markets, and hampers long-term development prospects.

Policy Responses: Addressing Deficits and Debt Overhang

Fiscal deficit reduction requires targeted policy responses such as expenditure rationalization, revenue enhancement through tax reforms, and improved fiscal discipline to restore macroeconomic stability. In contrast, addressing debt overhang involves restructuring debt obligations, extending maturities, or seeking debt forgiveness to alleviate the burden on public finances and stimulate investment. Sound fiscal management combined with credible debt restructuring programs enables governments to regain market confidence and ensure sustainable economic growth.

Fiscal Sustainability: Balancing Deficits and Debt for the Future

Fiscal deficit represents the yearly gap between government revenue and expenditures, indicating immediate borrowing needs, while debt overhang reflects the cumulative burden of existing debt that hampers economic growth and fiscal flexibility. Maintaining fiscal sustainability requires balancing annual deficits to prevent the accumulation of unsustainable debt levels that could trigger a debt overhang crisis. Effective fiscal management involves setting deficit targets aligned with GDP growth and debt thresholds to ensure long-term economic stability and reduce refinancing risks.

Fiscal deficit Infographic

libterm.com

libterm.com