Marginal cost pricing involves setting the price of a product equal to the additional cost of producing one more unit, which helps businesses optimize resource allocation and boost efficiency. This strategy is crucial in competitive markets to ensure prices reflect true production costs without unnecessary markups. Explore the rest of the article to understand how marginal cost pricing can impact your business decisions and market dynamics.

Table of Comparison

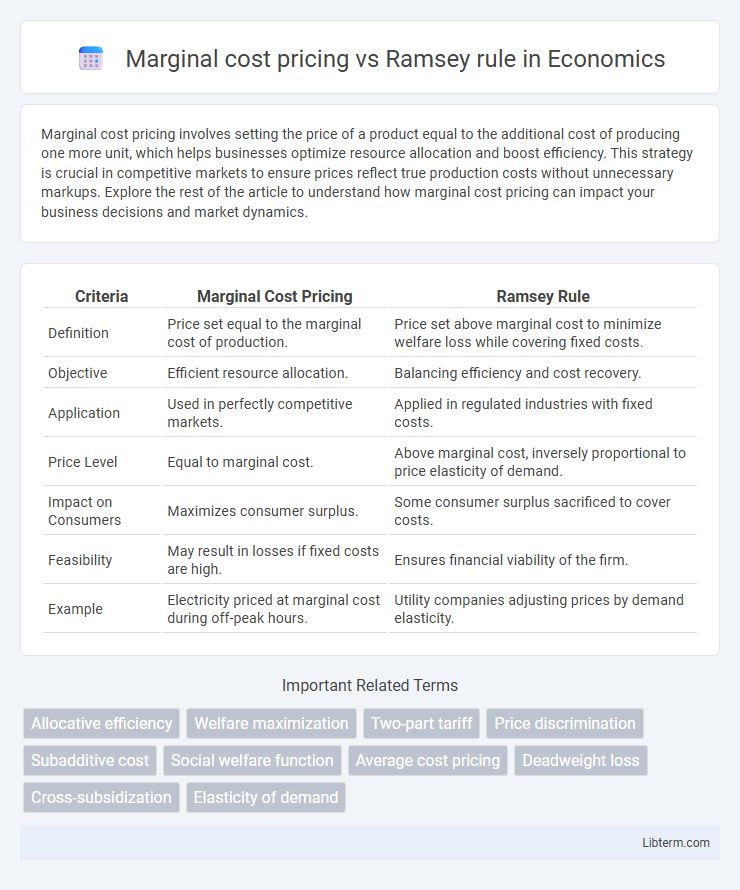

| Criteria | Marginal Cost Pricing | Ramsey Rule |

|---|---|---|

| Definition | Price set equal to the marginal cost of production. | Price set above marginal cost to minimize welfare loss while covering fixed costs. |

| Objective | Efficient resource allocation. | Balancing efficiency and cost recovery. |

| Application | Used in perfectly competitive markets. | Applied in regulated industries with fixed costs. |

| Price Level | Equal to marginal cost. | Above marginal cost, inversely proportional to price elasticity of demand. |

| Impact on Consumers | Maximizes consumer surplus. | Some consumer surplus sacrificed to cover costs. |

| Feasibility | May result in losses if fixed costs are high. | Ensures financial viability of the firm. |

| Example | Electricity priced at marginal cost during off-peak hours. | Utility companies adjusting prices by demand elasticity. |

Introduction to Marginal Cost Pricing and Ramsey Rule

Marginal cost pricing involves setting the price of a good or service equal to the additional cost of producing one more unit, promoting efficiency by reflecting true production costs. The Ramsey rule adjusts prices above marginal cost based on consumers' price elasticities of demand to achieve efficient resource allocation while covering fixed costs. Both frameworks aim to balance economic efficiency and financial viability in pricing strategies within regulated industries.

Understanding Marginal Cost Pricing

Marginal cost pricing sets the price of a product equal to the additional cost of producing one more unit, promoting allocative efficiency by reflecting the true cost of resources consumed. It often results in prices lower than average costs, potentially causing firms to incur losses without subsidies. Understanding marginal cost pricing is essential for regulating natural monopolies where socially optimal output occurs at marginal cost but financial viability requires alternative pricing strategies.

Overview of the Ramsey Pricing Rule

The Ramsey pricing rule sets prices above marginal cost to balance efficiency and cost recovery in natural monopoly regulation by minimizing welfare loss subject to the firm's break-even constraint. It allocates markups inversely proportional to the price elasticity of demand, charging higher markups on inelastic goods and lower markups on elastic goods to reduce distortion. This approach contrasts with marginal cost pricing, which sets prices equal to marginal cost but may lead to financial losses without subsidies.

Key Differences Between Marginal Cost Pricing and Ramsey Rule

Marginal cost pricing sets prices equal to the additional cost of producing one more unit, promoting efficiency but potentially causing losses when fixed costs are high. The Ramsey rule adjusts prices above marginal cost based on price elasticities of demand to balance efficiency with revenue sufficiency, often used in regulated utilities. Key differences include the treatment of fixed costs and demand elasticity, with marginal cost pricing focusing solely on cost efficiency and Ramsey pricing aiming to minimize welfare loss while covering total costs.

Economic Efficiency: Comparing Both Approaches

Marginal cost pricing promotes economic efficiency by setting prices equal to the additional cost of producing one more unit, ensuring optimal resource allocation and consumer welfare. The Ramsey rule modifies marginal cost pricing by incorporating demand elasticity, allowing for above-marginal-cost prices on less elastic goods to efficiently cover fixed costs while minimizing welfare loss. Comparing both, marginal cost pricing achieves allocative efficiency in theory, whereas the Ramsey rule balances efficiency with cost recovery in practical regulatory contexts.

Impact on Consumer Welfare and Producer Revenues

Marginal cost pricing sets prices equal to the additional cost of producing one more unit, maximizing consumer welfare by ensuring efficient consumption but often results in financial losses for producers due to prices falling below average costs. The Ramsey rule allows for price markups above marginal cost differentiated by demand elasticities, balancing consumer welfare with the need to cover fixed costs and maintain producer revenues. This approach minimizes welfare loss by imposing higher markups on inelastic demand goods, thereby preserving producer profitability while sustaining broader economic efficiency.

Application in Natural Monopoly and Public Utilities

Marginal cost pricing sets prices equal to the additional cost of producing one more unit, promoting allocative efficiency but often leading to losses for natural monopolies due to high fixed costs. The Ramsey rule adjusts prices above marginal cost to ensure the monopolist covers total costs while minimizing welfare loss, balancing efficiency and financial viability in public utilities. Applying these pricing strategies helps regulate natural monopolies by providing affordable services without compromising economic sustainability.

Challenges and Limitations of Each Pricing Method

Marginal cost pricing often struggles with covering fixed costs, leading to sustainability issues for utilities or public services, while the Ramsey rule addresses this by allowing price markups based on demand elasticity but assumes perfect information and consumer rationality. Both methods face difficulties in accurately estimating demand elasticity, which affects the fairness and efficiency of pricing outcomes. Implementing these pricing models can be administratively complex and politically contentious, limiting their practical application in real-world regulatory environments.

Policy Implications and Regulatory Perspectives

Marginal cost pricing ensures efficiency by setting prices equal to the cost of producing an additional unit, promoting optimal resource allocation but often leading to revenue shortfalls for public utilities. The Ramsey rule adjusts prices above marginal cost based on demand elasticities to achieve cost recovery while minimizing welfare loss, offering a pragmatic regulatory framework for utility pricing. Policymakers must balance efficiency and financial viability by integrating Ramsey pricing into regulatory policies, ensuring sustainable service provision without compromising economic welfare.

Conclusion: Choosing the Optimal Pricing Strategy

Marginal cost pricing promotes allocative efficiency by setting prices equal to the cost of producing one additional unit, ideal in perfectly competitive markets with negligible fixed costs. The Ramsey rule adjusts prices above marginal cost based on demand elasticity to ensure cost recovery and minimize welfare loss in natural monopolies or industries with high fixed costs. Selecting the optimal pricing strategy depends on market structure, cost characteristics, and the goal of balancing efficiency with financial sustainability.

Marginal cost pricing Infographic

libterm.com

libterm.com