Upper tail risk refers to the probability of extreme positive outcomes occurring in a probability distribution, often associated with significant gains or outliers in financial markets. Understanding and managing upper tail risk is crucial for investors aiming to capitalize on potentially lucrative opportunities without exposing their portfolios to unpredictable volatility. Explore the rest of this article to learn how upper tail risk influences investment decisions and strategies to harness it effectively.

Table of Comparison

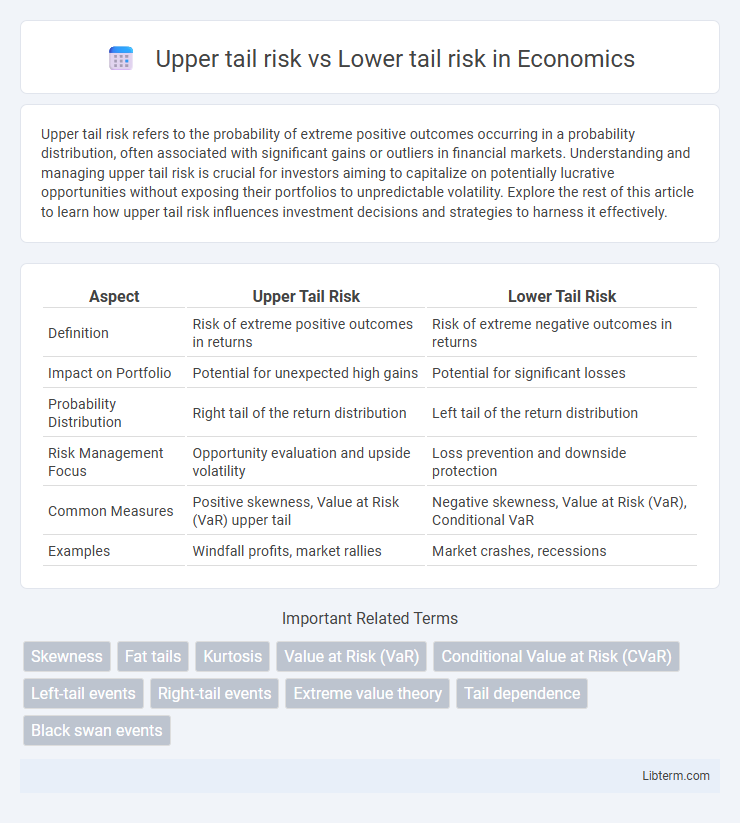

| Aspect | Upper Tail Risk | Lower Tail Risk |

|---|---|---|

| Definition | Risk of extreme positive outcomes in returns | Risk of extreme negative outcomes in returns |

| Impact on Portfolio | Potential for unexpected high gains | Potential for significant losses |

| Probability Distribution | Right tail of the return distribution | Left tail of the return distribution |

| Risk Management Focus | Opportunity evaluation and upside volatility | Loss prevention and downside protection |

| Common Measures | Positive skewness, Value at Risk (VaR) upper tail | Negative skewness, Value at Risk (VaR), Conditional VaR |

| Examples | Windfall profits, market rallies | Market crashes, recessions |

Understanding Tail Risk in Financial Markets

Upper tail risk represents the potential for extreme positive returns beyond typical expectations, often linked to rare market booms or unexpected gains. Lower tail risk involves the chance of severe negative outcomes, such as financial crashes or significant losses, that fall below standard risk models. Understanding tail risk in financial markets requires analyzing probability distributions' extremes to accurately assess the impact of rare but impactful events on portfolio performance.

Defining Upper Tail Risk

Upper tail risk refers to the potential for extreme positive outcomes in a probability distribution, capturing the likelihood of unusually high returns or gains. It is frequently analyzed in investment portfolios to assess opportunities for outsized profits beyond typical expectations. Understanding upper tail risk helps investors identify scenarios where large, beneficial deviations from the mean may significantly impact overall performance.

Defining Lower Tail Risk

Lower tail risk refers to the probability and potential impact of extreme negative returns or losses in a financial asset or portfolio, typically representing outcomes in the worst-performing percentile of the return distribution. It captures the likelihood of rare but severe downward events that can lead to significant financial distress or capital erosion. Managing lower tail risk involves strategies like diversification, hedging, and stress testing to mitigate exposure to these extreme adverse scenarios.

Key Differences Between Upper and Lower Tail Risks

Upper tail risk involves extreme positive returns or gains far above the mean, often associated with unexpected windfalls or bullish market surges, whereas lower tail risk refers to extreme negative returns, representing severe losses or market crashes below the average. Key differences include the impact on portfolio performance--upper tail risk can lead to outsized profits, while lower tail risk causes significant financial distress and necessitates robust risk management strategies. Statistical measures such as skewness and kurtosis help differentiate these risks, with upper tail risk contributing to positive skewness and lower tail risk linked to heavy-tailed distributions and negative skewness.

Statistical Tools for Measuring Tail Risks

Statistical tools for measuring upper tail risk include Value at Risk (VaR) and Expected Shortfall (ES), which quantify potential extreme losses in the distribution's right tail. Lower tail risk is similarly assessed with these metrics, focusing on negative tail events that signify severe adverse outcomes. Extreme Value Theory (EVT) and tail conditional expectations are crucial for capturing the behavior of distribution tails beyond traditional variance measures.

Examples of Upper Tail Risk Events

Upper tail risk events include extreme positive outcomes such as breakthrough technological innovations, sudden market booms, or unexpected regulatory approvals that lead to substantial asset price surges. Examples include the rapid rise of cryptocurrencies like Bitcoin in 2017, or the surge in tech stocks during the dot-com bubble. These events create opportunities for outsized gains but are often difficult to predict and can lead to market overheating.

Examples of Lower Tail Risk Events

Lower tail risk events include financial crises such as the 2008 global recession, where asset values plunged deeply and rapidly, causing severe market losses. Examples also encompass natural disasters like hurricanes and earthquakes that lead to substantial economic damage and insurance claim surges. These events highlight the probability of extreme negative outcomes on the lower end of a return distribution, significantly impacting portfolios and businesses.

Implications for Portfolio Management

Upper tail risk involves the potential for exceptionally high returns, while lower tail risk concerns the chance of extreme losses in a portfolio. Managing lower tail risk is critical for protecting capital and ensuring portfolio stability during market downturns. Incorporating strategies like diversification, hedging with options, and stress testing can optimize risk-adjusted returns by balancing exposure to both tail risks.

Strategies to Mitigate Tail Risks

Strategies to mitigate tail risks focus on diversification, hedging, and stress testing portfolios to manage extreme market events impacting the upper and lower tails of return distributions. Employing options such as protective puts or tail risk ETFs can specifically guard against severe downside or upside tail risks, while dynamic allocation models adjust exposure based on evolving market conditions. Risk managers incorporate scenario analysis and robust risk limits to reduce exposure and improve resilience against unpredictable tail events.

Importance of Tail Risk Awareness in Investment Decisions

Upper tail risk represents unexpected extreme gains, while lower tail risk involves severe losses in investment portfolios. Awareness of both tail risks is crucial for investors to design robust strategies that mitigate potential catastrophic losses and capitalize on rare positive events. Effective tail risk management enhances portfolio resilience and long-term financial stability.

Upper tail risk Infographic

libterm.com

libterm.com