Rentier state theory explains how countries that derive a significant portion of their national revenue from renting natural resources, like oil, often experience unique political and economic dynamics. This reliance on resource rents can lead to reduced incentives for developing diversified economies and may impact governance structures by weakening accountability to citizens. Explore the rest of this article to understand how your knowledge of rentier state theory can shed light on the challenges and opportunities faced by these nations.

Table of Comparison

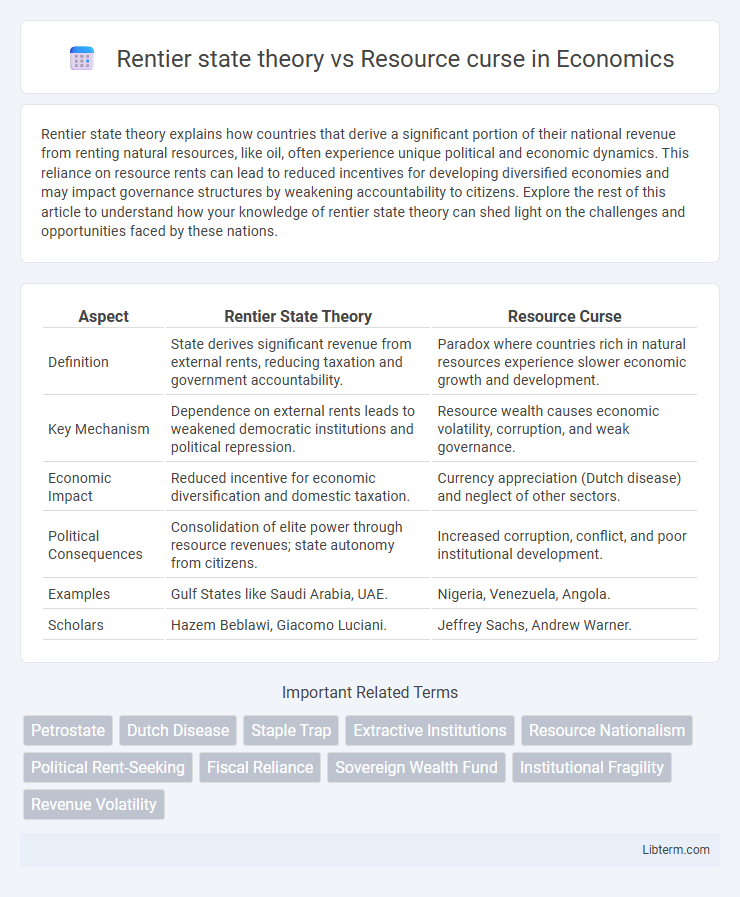

| Aspect | Rentier State Theory | Resource Curse |

|---|---|---|

| Definition | State derives significant revenue from external rents, reducing taxation and government accountability. | Paradox where countries rich in natural resources experience slower economic growth and development. |

| Key Mechanism | Dependence on external rents leads to weakened democratic institutions and political repression. | Resource wealth causes economic volatility, corruption, and weak governance. |

| Economic Impact | Reduced incentive for economic diversification and domestic taxation. | Currency appreciation (Dutch disease) and neglect of other sectors. |

| Political Consequences | Consolidation of elite power through resource revenues; state autonomy from citizens. | Increased corruption, conflict, and poor institutional development. |

| Examples | Gulf States like Saudi Arabia, UAE. | Nigeria, Venezuela, Angola. |

| Scholars | Hazem Beblawi, Giacomo Luciani. | Jeffrey Sachs, Andrew Warner. |

Introduction to Rentier State Theory and the Resource Curse

Rentier State Theory explains how countries that derive substantial revenue from renting natural resources to external clients often develop political and economic structures reliant on this income, leading to weakened institutional development and reduced public accountability. The Resource Curse refers to the paradox where nations rich in natural resources experience slower economic growth, poor governance, and increased conflict compared to resource-poor countries, often due to mismanagement of resource wealth and reliance on volatile commodity markets. Both theories emphasize the challenges resource-dependent states face, highlighting the interplay between resource wealth, state capacity, and development outcomes.

Historical Background and Development of Both Concepts

The Rentier state theory originated in the 1970s, primarily through the work of scholars like Hazem Beblawi, emphasizing how states reliant on external rents from natural resources, particularly oil, develop distinct political and economic structures. The Resource Curse, also known as the Paradox of Plenty, emerged from economic analyses in the 1980s, highlighting the counterintuitive phenomenon where countries rich in natural resources often experience slower economic growth, authoritarianism, and conflict. Both concepts evolved from empirical observations of oil-rich states in the Middle East and resource-abundant countries, providing frameworks to understand the socio-political challenges linked to resource dependency.

Defining Rentier States: Key Features

Rentier states are characterized by substantial external rent income, primarily from natural resources, enabling the government to fund itself without relying heavily on domestic taxation. Key features include centralized state control over resource revenues, limited economic diversification, and a dependency on resource rents that shapes political and social structures. This contrasts with the resource curse concept, which emphasizes economic and developmental challenges arising from resource wealth, while rentier state theory focuses on the political economy and governance implications of external rent dependence.

Understanding the Resource Curse Phenomenon

Resource Curse and Rentier State Theory both explain how natural resource wealth can negatively impact a country's economic and political development. The Resource Curse highlights the paradox where countries rich in resources experience slower growth, conflict, and weak institutions due to overreliance on commodity exports and volatile prices. Rentier State Theory emphasizes the state's dependency on resource rents, which reduces accountability, undermines democratic governance, and fosters corruption by disconnecting government revenue from taxation.

Economic Impacts: Growth, Diversification, and Dependency

Rentier state theory highlights how states reliant on external rent, particularly from natural resources, experience slow economic growth due to weakened incentives for diversification and innovation. The resource curse explains how resource-rich countries often face economic dependency, volatility, and stunted development as resource revenues crowd out other sectors and create governance challenges. Both theories emphasize that overdependence on resource rents undermines sustainable growth and economic diversification, increasing vulnerability to global commodity price fluctuations.

Political Consequences: Governance, Corruption, and Stability

Rentier state theory emphasizes how governments dependent on resource rents often experience weakened political institutions, leading to authoritarian governance and limited public accountability. The resource curse highlights the negative political consequences of resource wealth, including increased corruption, rent-seeking behavior, and reduced state capacity to provide public goods. Both frameworks reveal that reliance on natural resources can undermine political stability by fostering clientelism, weakening democratic processes, and exacerbating internal conflicts.

Case Studies: Comparing Rentier States and Resource-Cursed Nations

Case studies reveal that rentier states like Saudi Arabia rely heavily on oil revenues to finance public spending and maintain political stability, often resulting in limited economic diversification and autocratic governance. In contrast, resource-cursed nations such as Nigeria experience economic volatility, corruption, and weak institutions due to overdependence on natural resources without effective redistribution mechanisms. Comparative analysis highlights that rentier states often use resource wealth to consolidate state power, while resource-cursed countries struggle with governance challenges and developmental stagnation.

Interrelations and Overlaps between the Two Theories

Rentier state theory and resource curse share significant overlaps, as both explain the adverse economic and political effects of natural resource dependence, particularly oil and minerals, on state stability and development. Rentier states primarily rely on external rent from resource exports, leading to weakened institutions, reduced taxation, and authoritarian governance, while resource curse highlights broader economic distortions like Dutch disease, corruption, and conflict. Their interrelations emphasize how resource wealth can entrench autocratic rule and hinder diversification, demonstrating complementary dimensions of the same problem in resource-rich countries.

Policy Responses and Mitigation Strategies

Rentier state theory and resource curse analyses highlight the challenges governments face in managing natural resource wealth, often leading to economic volatility and governance issues. Policy responses emphasize diversification of the economy, strengthening institutional quality, and transparent management of resource revenues through mechanisms like sovereign wealth funds and fiscal rules. Mitigation strategies involve enhancing accountability, investing in human capital, and promoting inclusive political institutions to reduce dependency on resource rents and foster sustainable development.

Conclusion: Reassessing the Debate on Resource Wealth

Reevaluating resource wealth reveals complexities beyond Rentier State Theory and the Resource Curse, emphasizing governance quality and institutional strength as pivotal factors in determining economic and political outcomes. Effective management of natural resources can transform potential wealth into sustainable development, while mismanagement exacerbates vulnerability to corruption, conflict, and economic instability. Consequently, policy focus should shift from resource abundance itself to institutional capacity and strategic governance to mitigate negative impacts and harness resource potential.

Rentier state theory Infographic

libterm.com

libterm.com