Value-added tax (VAT) is a consumption tax levied on the incremental value added to goods and services at each stage of production or distribution. This tax applies whenever value is added, making it a key revenue source for governments worldwide. Explore the rest of the article to understand how VAT impacts your purchasing decisions and business operations.

Table of Comparison

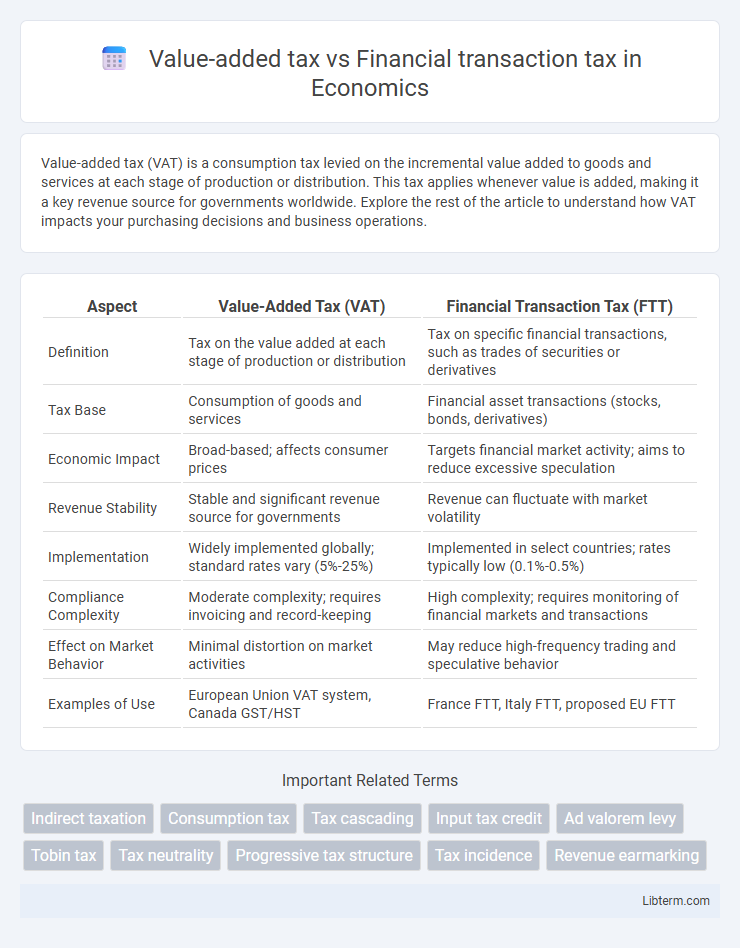

| Aspect | Value-Added Tax (VAT) | Financial Transaction Tax (FTT) |

|---|---|---|

| Definition | Tax on the value added at each stage of production or distribution | Tax on specific financial transactions, such as trades of securities or derivatives |

| Tax Base | Consumption of goods and services | Financial asset transactions (stocks, bonds, derivatives) |

| Economic Impact | Broad-based; affects consumer prices | Targets financial market activity; aims to reduce excessive speculation |

| Revenue Stability | Stable and significant revenue source for governments | Revenue can fluctuate with market volatility |

| Implementation | Widely implemented globally; standard rates vary (5%-25%) | Implemented in select countries; rates typically low (0.1%-0.5%) |

| Compliance Complexity | Moderate complexity; requires invoicing and record-keeping | High complexity; requires monitoring of financial markets and transactions |

| Effect on Market Behavior | Minimal distortion on market activities | May reduce high-frequency trading and speculative behavior |

| Examples of Use | European Union VAT system, Canada GST/HST | France FTT, Italy FTT, proposed EU FTT |

Understanding Value-Added Tax (VAT)

Value-Added Tax (VAT) is a consumption tax levied on the value added at each stage of the production and distribution process, typically expressed as a percentage of the sale price. It differs from Financial Transaction Tax (FTT), which is imposed on specific financial transactions such as stock trades or currency exchanges. VAT enhances government revenue through broad-based taxing of goods and services, promoting transparency and reducing tax evasion in comparison to FTT's narrower financial sector focus.

Defining Financial Transaction Tax (FTT)

Financial Transaction Tax (FTT) is a levy imposed on specific financial market transactions, such as trades of stocks, bonds, derivatives, and currencies. Unlike Value-added Tax (VAT), which is applied at each stage of the production and distribution chain on goods and services, FTT targets financial activities to curb excessive speculation and generate revenue. This tax is designed to enhance market stability and reduce high-frequency trading by imposing a small percentage fee on the value of transactions.

Key Differences Between VAT and FTT

Value-added tax (VAT) is a consumption tax applied at each stage of the production and distribution process based on the value added to goods and services, typically charged as a percentage of the final retail price. Financial transaction tax (FTT) targets specific financial transactions such as stock trades, derivatives, or currency exchanges, aiming to reduce market volatility and generate revenue from high-frequency trading. Unlike VAT, which affects end consumers broadly across sectors, FTT focuses narrowly on financial market activities and does not tax physical goods or everyday consumer purchases.

Economic Impact of VAT

Value-added tax (VAT) significantly influences economic behavior by broadening the tax base and promoting efficiency through its multi-stage collection process, reducing tax evasion compared to consumption taxes. Unlike the financial transaction tax (FTT), which directly targets financial market activities and may decrease transaction volumes, VAT generates stable government revenue without distorting investment decisions. Empirical studies show VAT positively impacts fiscal stability and economic growth by encouraging formalization and compliance in both goods and services sectors.

Economic Consequences of FTT

Financial transaction tax (FTT) imposes a levy on trades of financial instruments, potentially reducing market liquidity and increasing transaction costs for investors. Unlike value-added tax (VAT), which targets consumption broadly, FTT can lead to decreased trading volumes and hinder price discovery efficiency in financial markets. Empirical studies suggest that FTT may discourage short-term speculative trading but also risks lower market participation and increased costs passed on to end-users.

Administration and Collection Challenges

Value-added tax (VAT) administration requires comprehensive invoicing systems and real-time tracking to prevent evasion, posing challenges in ensuring compliance across diverse businesses. Financial transaction tax (FTT) faces complexity in accurately identifying taxable transactions due to the high volume and rapid pace of financial trades, making monitoring and enforcement difficult for tax authorities. Both taxes demand robust technological infrastructure and international cooperation to effectively manage collection and reduce avoidance.

Global Adoption of VAT and FTT

Value-added tax (VAT) has been widely adopted globally, with over 160 countries implementing it as a primary source of government revenue, reflecting its efficiency in taxing consumption at multiple stages of production. Financial transaction tax (FTT), by contrast, remains less prevalent, with limited adoption mainly in the European Union and a few other countries aiming to curb speculative trading and generate revenue from financial markets. The global embrace of VAT highlights its role in stabilizing fiscal systems, while FTT faces challenges due to concerns over market liquidity and competitiveness.

Effects on Consumers and Businesses

Value-added tax (VAT) directly increases the price of goods and services, impacting consumers by raising their overall expenditure and potentially reducing consumption, while businesses face compliance costs but can often reclaim VAT on inputs. Financial transaction tax (FTT) primarily affects investors and trading firms by increasing transaction costs, which may reduce market liquidity and increase the cost of capital for businesses without directly raising consumer prices. Both taxes influence economic behavior, but VAT has a more immediate effect on consumer spending patterns, whereas FTT mainly alters financial market dynamics and investment strategies.

Revenue Generation Potential

Value-added tax (VAT) generates substantial revenue by taxing consumption at multiple stages of production, resulting in a broad tax base and relatively stable income for governments. Financial transaction tax (FTT) targets specific financial market activities, often yielding lower but more volatile revenue streams due to fluctuating trading volumes. VAT's consistent application across goods and services typically provides higher and more predictable revenue generation potential compared to the narrower scope and variability of FTT collections.

Policy Considerations and Future Trends

Value-added tax (VAT) imposes a consumption-based levy on goods and services at each production stage, promoting stable government revenue streams, while financial transaction tax (FTT) targets specific financial market trades, aiming to curb excessive speculation and increase market transparency. Policymakers must balance VAT's broad-based efficiency and lower compliance costs against FTT's potential to deter short-term trading and financial volatility without hindering market liquidity. Future trends indicate rising interest in digital economy taxation mechanisms, evolving FTT proposals to encompass cryptocurrency transactions, and international coordination efforts to minimize tax evasion and double taxation risks.

Value-added tax Infographic

libterm.com

libterm.com