GDP growth measures the increase in the value of goods and services produced by a country over time, reflecting economic health and prosperity. Monitoring GDP growth helps policymakers and businesses make informed decisions about investment and resource allocation. Discover how understanding GDP growth can impact your perspectives on the economy by reading the full article.

Table of Comparison

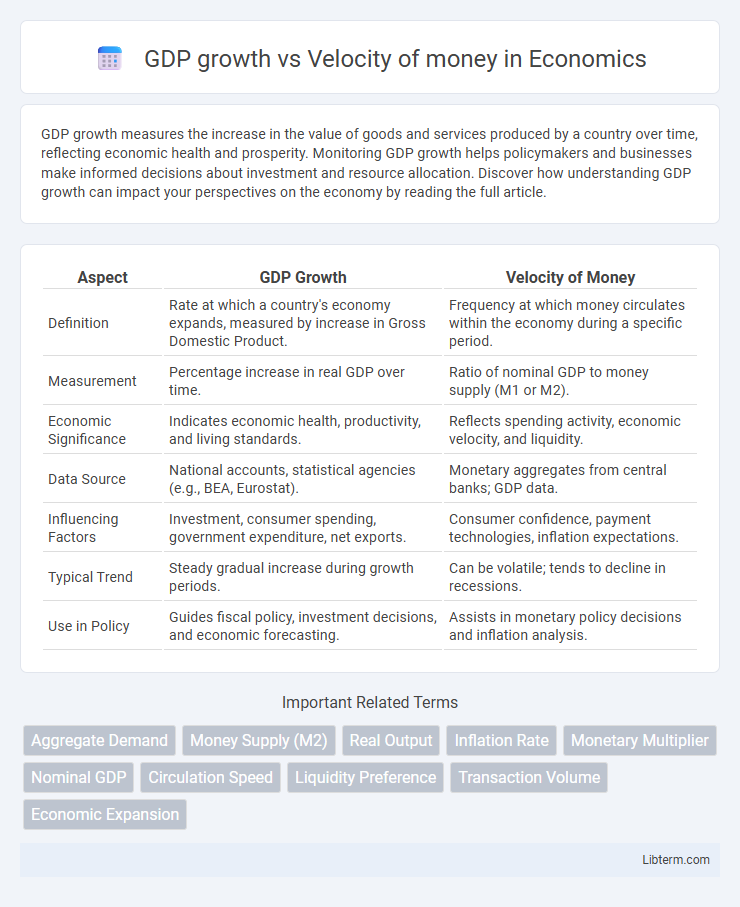

| Aspect | GDP Growth | Velocity of Money |

|---|---|---|

| Definition | Rate at which a country's economy expands, measured by increase in Gross Domestic Product. | Frequency at which money circulates within the economy during a specific period. |

| Measurement | Percentage increase in real GDP over time. | Ratio of nominal GDP to money supply (M1 or M2). |

| Economic Significance | Indicates economic health, productivity, and living standards. | Reflects spending activity, economic velocity, and liquidity. |

| Data Source | National accounts, statistical agencies (e.g., BEA, Eurostat). | Monetary aggregates from central banks; GDP data. |

| Influencing Factors | Investment, consumer spending, government expenditure, net exports. | Consumer confidence, payment technologies, inflation expectations. |

| Typical Trend | Steady gradual increase during growth periods. | Can be volatile; tends to decline in recessions. |

| Use in Policy | Guides fiscal policy, investment decisions, and economic forecasting. | Assists in monetary policy decisions and inflation analysis. |

Understanding GDP Growth: A Macroeconomic Overview

GDP growth measures the increase in the value of goods and services produced over time, reflecting economic expansion and improved living standards. Velocity of money indicates how frequently money circulates in the economy, influencing inflation and demand dynamics. A rising GDP growth coupled with high velocity of money typically signals robust economic activity, whereas discrepancies may point to inflationary pressures or liquidity issues.

Defining the Velocity of Money in Modern Economies

The velocity of money measures how quickly money circulates through an economy, calculated as the ratio of nominal GDP to the money supply (M1 or M2). In modern economies, a high velocity indicates rapid spending and economic activity, while a low velocity suggests money is held rather than spent, potentially slowing GDP growth. Understanding velocity is crucial for analyzing monetary policy effectiveness and predicting inflationary pressures.

Key Differences: GDP Growth vs Velocity of Money

GDP growth measures the increase in the value of goods and services produced by an economy over a specific period, reflecting economic expansion and development. Velocity of money indicates the frequency at which currency circulates in the economy, representing how quickly money changes hands to facilitate transactions. While GDP growth focuses on output and production levels, velocity of money emphasizes the efficiency and speed of money usage within the economy.

How Changes in Velocity Affect Economic Growth

Changes in the velocity of money directly influence GDP growth by determining how quickly money circulates within the economy, affecting overall demand and output. An increase in velocity typically signals higher consumer spending and investment, which can accelerate economic growth, while a decrease indicates slower circulation, potentially leading to stagnation or contraction. Therefore, monitoring velocity trends alongside monetary supply offers critical insights into real-time economic momentum and inflationary pressures.

The Role of Money Supply in GDP Expansion

Money supply plays a crucial role in GDP expansion by influencing the velocity of money, which measures the frequency at which money circulates in the economy. A stable or increasing velocity of money combined with a growing money supply typically leads to higher GDP growth, as more transactions reflect increased economic activity. Conversely, if the velocity of money declines despite an expanding money supply, GDP growth may stagnate, indicating that additional money is not translating into proportional economic output.

Historical Trends: GDP Growth and Money Velocity

Historical trends reveal that GDP growth often correlates with changes in the velocity of money, as periods of robust economic expansion typically coincide with increased money circulation rates. In the post-World War II era, high GDP growth in the United States paralleled a relatively stable or rising velocity of money, reflecting active consumer spending and investment. However, since the early 2000s, declining velocity despite fluctuating GDP growth signals structural shifts in financial behavior and monetary policy impacts.

Factors Influencing the Velocity of Money

The velocity of money, influenced by factors such as consumer confidence, interest rates, and technological advancements in payment systems, directly impacts GDP growth by determining how quickly money circulates within the economy. Higher consumer confidence leads to increased spending, boosting the velocity of money and thereby accelerating GDP expansion. Conversely, lower interest rates reduce the cost of borrowing, encouraging transactions and investments that enhance the velocity of money, further supporting economic growth.

Policy Implications: Managing GDP and Money Velocity

Effective policy management of GDP growth and money velocity requires precise calibration of monetary supply to balance economic expansion without triggering inflation. Central banks must monitor velocity fluctuations to adjust interest rates and liquidity injections, ensuring sustainable demand and investment levels. Targeted fiscal policies complement these efforts by stimulating production capacity and consumer spending, stabilizing velocity while promoting steady GDP increases.

Case Studies: Real-World Examples of Velocity Impacting GDP

Case studies such as Japan in the 1990s demonstrate that a declining velocity of money can hinder GDP growth despite expansionary monetary policies. In contrast, the United States during the post-World War II era experienced high velocity, which amplified GDP growth and economic expansion. These real-world examples highlight that fluctuations in the velocity of money critically influence GDP dynamics beyond mere money supply changes.

Future Outlook: Predicting GDP Growth through Money Velocity

Future GDP growth can be significantly influenced by the velocity of money, as increased circulation often signals rising economic activity and consumer confidence. Economists use velocity trends alongside monetary supply data to forecast economic expansions or contractions with greater precision. Monitoring velocity metrics provides valuable insights into future economic momentum and potential inflationary pressures.

GDP growth Infographic

libterm.com

libterm.com