Public goods externality occurs when the consumption or provision of a good benefits individuals beyond the direct consumer, leading to positive spillover effects in society. This often results in underproduction or undersupply by private markets since the benefits cannot be fully captured by producers, affecting economic efficiency. Explore how public goods externalities impact resource allocation and what solutions can address these challenges in the full article.

Table of Comparison

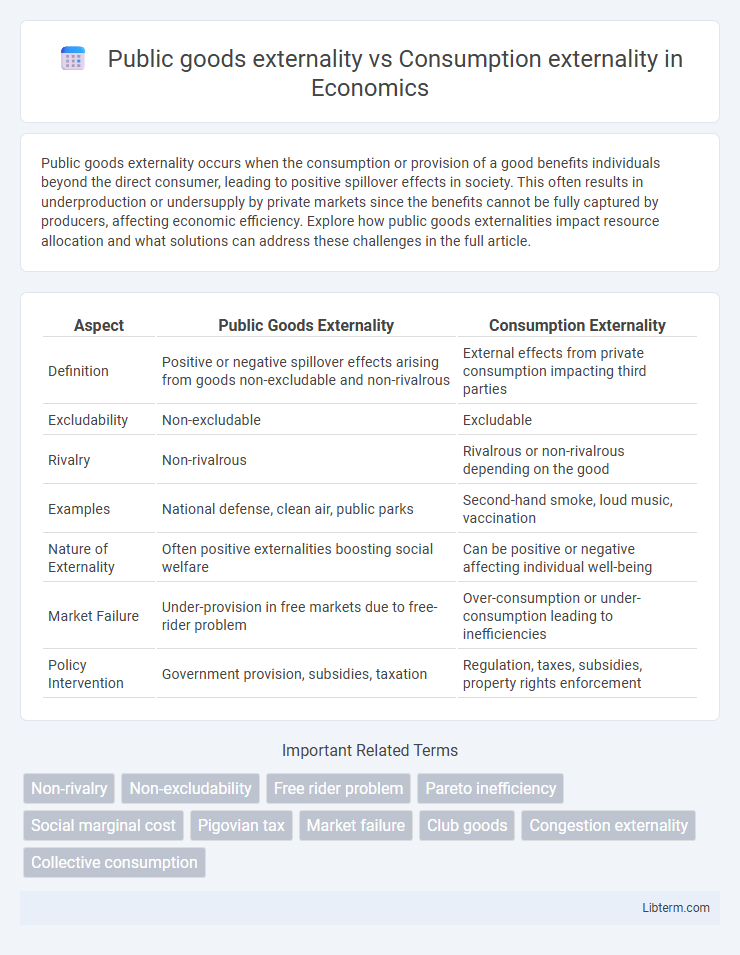

| Aspect | Public Goods Externality | Consumption Externality |

|---|---|---|

| Definition | Positive or negative spillover effects arising from goods non-excludable and non-rivalrous | External effects from private consumption impacting third parties |

| Excludability | Non-excludable | Excludable |

| Rivalry | Non-rivalrous | Rivalrous or non-rivalrous depending on the good |

| Examples | National defense, clean air, public parks | Second-hand smoke, loud music, vaccination |

| Nature of Externality | Often positive externalities boosting social welfare | Can be positive or negative affecting individual well-being |

| Market Failure | Under-provision in free markets due to free-rider problem | Over-consumption or under-consumption leading to inefficiencies |

| Policy Intervention | Government provision, subsidies, taxation | Regulation, taxes, subsidies, property rights enforcement |

Introduction to Economic Externalities

Economic externalities arise when a third party experiences benefits or costs from an economic transaction without being directly involved. Public goods externalities occur because public goods, such as clean air or national defense, are non-excludable and non-rivalrous, causing benefits or costs to spill over to others. Consumption externalities involve individual consumption decisions that affect others, like secondhand smoke or vaccination, where the positive or negative impacts extend beyond the consumer.

Defining Public Goods Externality

Public goods externality arises when the consumption or provision of a good by one individual affects others without reducing availability, characterized by non-excludability and non-rivalrous consumption. This externality differs from consumption externality, which involves the impact on third parties from the consumption of a good that may be rivalrous or excludable. Understanding public goods externality is essential for addressing market failures where private incentives do not align with social welfare, often necessitating government intervention or collective action.

Understanding Consumption Externality

Consumption externality occurs when an individual's consumption of a good or service directly impacts the well-being or utility of others without compensation. Unlike public goods, which are non-excludable and non-rivalrous, consumption externalities can be either positive or negative, such as pollution from smoking (negative) or vaccination benefits (positive). Understanding consumption externality is essential for designing effective policies that internalize these external effects through taxes, subsidies, or regulations to improve social welfare.

Key Differences Between Public Goods and Consumption Externalities

Public goods externalities occur when the consumption or provision of a good benefits or harms third parties without exclusion or rivalry, such as clean air or national defense. Consumption externalities specifically arise when an individual's use of a good directly affects the well-being of others, like secondhand smoke from cigarettes impacting non-smokers. The key difference lies in public goods being non-excludable and non-rivalrous, creating spillover effects on society, whereas consumption externalities involve individual consumption choices influencing external welfare, often leading to overconsumption or underconsumption without market intervention.

Examples of Public Goods Externalities

Public goods externalities occur when the consumption or provision of non-excludable and non-rivalrous goods, such as clean air or national defense, benefits people who do not pay for them, leading to free-rider problems. An example is public fireworks displays, which provide enjoyment to all community members without reducing availability to others. Another instance is street lighting, which enhances safety for all residents regardless of individual contributions to its cost.

Real-World Cases of Consumption Externalities

Consumption externalities occur when an individual's use of a good affects others' well-being without market compensation, exemplified by secondhand smoke from cigarettes causing health issues for bystanders. Public goods externalities involve non-excludable and non-rivalrous benefits or costs, such as national defense or clean air, where individual consumption does not diminish availability for others. Real-world cases of consumption externalities include noise pollution from parties disturbing neighbors and vaccination decisions impacting herd immunity, demonstrating the need for regulatory interventions to address social costs or benefits not reflected in private choices.

Social and Economic Impacts

Public goods externalities occur when non-excludable and non-rivalrous goods, like clean air or public parks, generate positive or negative effects on society without direct compensation, leading to inefficiencies in resource allocation and challenges in funding. Consumption externalities arise when individual consumption affects others' welfare, such as secondhand smoke causing health costs or vaccinations providing herd immunity, impacting public health and economic productivity. Both types of externalities require government intervention, through policies like taxes, subsidies, or regulations, to correct market failures and enhance social welfare.

Policy Responses and Interventions

Policy responses to public goods externalities often involve government provision or funding to ensure non-excludable and non-rivalrous goods are available, addressing underproduction in the private market. Consumption externalities, where an individual's consumption affects others, are typically managed through corrective taxes, subsidies, or regulation to internalize social costs or benefits. Interventions targeting public goods focus on collective financing mechanisms, while those for consumption externalities emphasize behavior modification and market-based incentives.

Challenges in Managing Externalities

Public goods externalities pose challenges due to their non-excludable and non-rivalrous nature, leading to free-rider problems and under-provision of optimal resources by markets. Consumption externalities create difficulties in regulation as individual consumption affects third parties without market compensation, often resulting in overconsumption or underconsumption of goods. Effective management requires tailored policy instruments like subsidies, taxes, or tradable permits to address the specific externality type and internalize social costs or benefits.

Conclusion: Addressing Externality Issues

Addressing externality issues requires tailored solutions depending on the type of externality involved. Public goods externalities often necessitate government intervention through funding or regulation to ensure optimal provision and avoid free-rider problems. Consumption externalities, such as those related to health or pollution, are effectively managed through taxes, subsidies, or corrective policies that align private incentives with social welfare.

Public goods externality Infographic

libterm.com

libterm.com