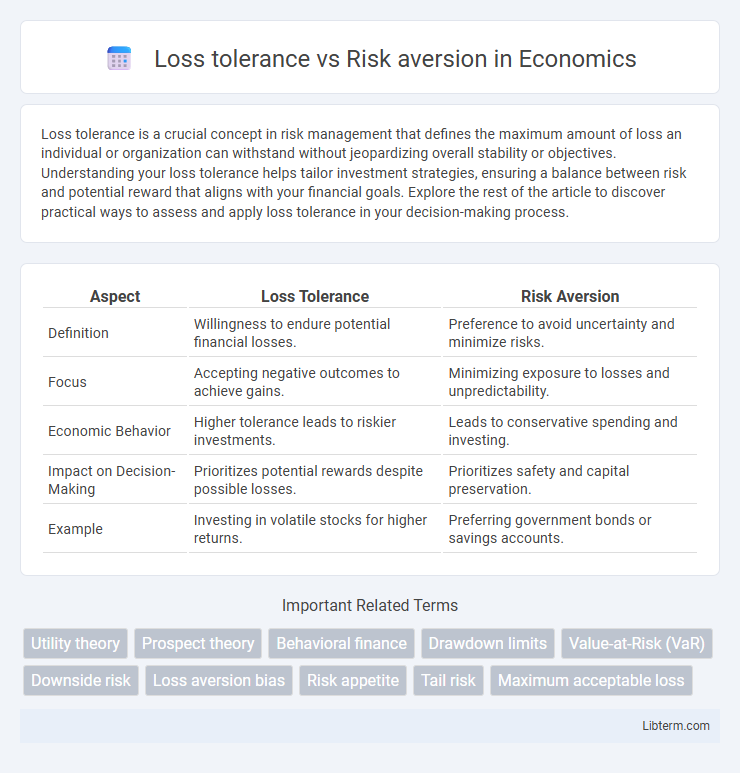

Loss tolerance is a crucial concept in risk management that defines the maximum amount of loss an individual or organization can withstand without jeopardizing overall stability or objectives. Understanding your loss tolerance helps tailor investment strategies, ensuring a balance between risk and potential reward that aligns with your financial goals. Explore the rest of the article to discover practical ways to assess and apply loss tolerance in your decision-making process.

Table of Comparison

| Aspect | Loss Tolerance | Risk Aversion |

|---|---|---|

| Definition | Willingness to endure potential financial losses. | Preference to avoid uncertainty and minimize risks. |

| Focus | Accepting negative outcomes to achieve gains. | Minimizing exposure to losses and unpredictability. |

| Economic Behavior | Higher tolerance leads to riskier investments. | Leads to conservative spending and investing. |

| Impact on Decision-Making | Prioritizes potential rewards despite possible losses. | Prioritizes safety and capital preservation. |

| Example | Investing in volatile stocks for higher returns. | Preferring government bonds or savings accounts. |

Understanding Loss Tolerance and Risk Aversion

Loss tolerance reflects an investor's capacity to endure financial setbacks without emotional distress, directly influencing portfolio decisions and long-term investment strategies. Risk aversion denotes the preference to avoid uncertainty and potential losses, often resulting in conservative asset allocation and lower expected returns. Understanding these distinct but related concepts enables tailored financial planning that aligns emotional comfort with investment goals.

Key Differences Between Loss Tolerance and Risk Aversion

Loss tolerance refers to the degree an investor can withstand potential losses in their portfolio without deviating from their financial goals, whereas risk aversion is the inherent preference to avoid uncertainty and potential negative outcomes in investment decisions. Key differences include that loss tolerance measures actual financial capacity and emotional resilience during downturns, while risk aversion represents a psychological disposition affecting investment choices regardless of financial situation. Investors with high loss tolerance may accept volatile assets for higher returns, while risk-averse individuals prefer stable, low-risk investments even if returns are lower.

Psychological Foundations of Risk-Related Behaviors

Loss tolerance reflects an individual's psychological capacity to endure financial or emotional setbacks without significant distress, shaped by cognitive biases such as loss aversion and framing effects. Risk aversion involves a preference for certainty over uncertain outcomes, driven by neural mechanisms highlighting the emotional weight of potential losses compared to equivalent gains. These behaviors are underpinned by prospect theory, where the asymmetry in valuing losses and gains influences decision-making under uncertainty.

Measuring Loss Tolerance in Decision-Making

Measuring loss tolerance in decision-making involves assessing an individual's or organization's willingness to endure potential losses relative to anticipated gains through quantitative tools like utility functions or value-at-risk (VaR) models. Behavioral metrics such as psychometric risk questionnaires provide qualitative insights into loss tolerance by capturing emotional and cognitive responses to hypothetical loss scenarios. Combining these approaches allows decision-makers to calibrate strategies that balance potential risks with desired outcomes effectively.

Risk Aversion: Definition and Implications

Risk aversion refers to an individual's preference to avoid uncertainty and potential losses in financial decisions, prioritizing stability over high returns. This behavioral trait impacts investment strategies, leading to conservative portfolio allocations with lower volatility and reduced exposure to risky assets. Understanding risk aversion is crucial for financial advisors to tailor investment plans that align with clients' comfort levels and long-term goals.

Factors Influencing Loss Tolerance and Risk Aversion

Loss tolerance and risk aversion are influenced by factors such as an individual's financial stability, investment experience, and psychological traits. Age, income level, and investment goals also play critical roles in shaping one's willingness to accept losses or avoid risks. Behavioral factors including past financial losses and personal risk perception further determine the balance between loss tolerance and risk aversion.

Impact on Investment Strategies

Loss tolerance directly influences the level of risk investors are willing to accept, shaping their asset allocation between volatile equities and stable bonds. Risk-averse investors typically opt for conservative portfolios prioritizing capital preservation, while those with higher loss tolerance pursue aggressive strategies to maximize returns. Understanding these behavioral traits enables the formulation of tailored investment plans that balance potential gains against acceptable downside exposure.

Loss Tolerance and Risk Aversion in Business Decisions

Loss tolerance in business decisions reflects a company's capacity to absorb financial setbacks without compromising long-term goals, often enabling bolder investments and innovation. Risk aversion involves a preference for minimizing uncertainty and potential losses, leading businesses to adopt conservative strategies to protect assets. Balancing loss tolerance with risk aversion is crucial for optimizing growth opportunities while safeguarding financial stability.

Real-World Examples of Risk Behavior

Loss tolerance reflects an investor's ability to endure declines in portfolio value without panic-selling, exemplified by long-term value investors who hold stocks through downturns to capitalize on eventual recovery. Risk aversion, common among retirees, leads to preference for stable assets like government bonds that minimize potential losses despite lower returns. Real-world examples include market participants during the 2008 financial crisis, where high risk aversion caused a flight to safety, contrasting with tech entrepreneurs exhibiting loss tolerance by reinvesting in volatile startups.

Enhancing Outcomes by Balancing Risk and Loss

Balancing loss tolerance and risk aversion enhances decision-making by optimizing financial outcomes and minimizing potential setbacks. Individuals with moderate loss tolerance can pursue higher returns by accepting calculated risks, while strict risk aversion often results in conservative strategies with limited growth. Effective risk management integrates loss thresholds with risk appetite, enabling strategic investments that align with long-term goals and improve overall portfolio performance.

Loss tolerance Infographic

libterm.com

libterm.com