Supply-side economics focuses on boosting economic growth by reducing taxes and regulatory burdens, encouraging businesses to increase production and investment. This approach argues that a more efficient supply chain and higher levels of entrepreneurship will lead to job creation and overall prosperity. Explore the full article to understand how supply-side policies may impact Your financial future and economic environment.

Table of Comparison

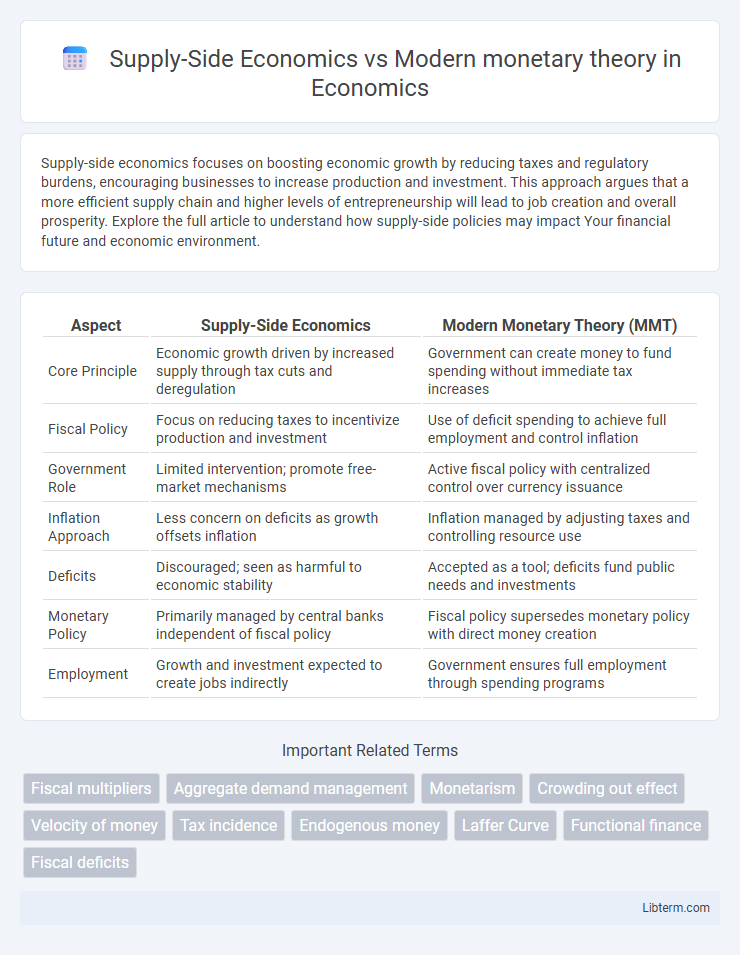

| Aspect | Supply-Side Economics | Modern Monetary Theory (MMT) |

|---|---|---|

| Core Principle | Economic growth driven by increased supply through tax cuts and deregulation | Government can create money to fund spending without immediate tax increases |

| Fiscal Policy | Focus on reducing taxes to incentivize production and investment | Use of deficit spending to achieve full employment and control inflation |

| Government Role | Limited intervention; promote free-market mechanisms | Active fiscal policy with centralized control over currency issuance |

| Inflation Approach | Less concern on deficits as growth offsets inflation | Inflation managed by adjusting taxes and controlling resource use |

| Deficits | Discouraged; seen as harmful to economic stability | Accepted as a tool; deficits fund public needs and investments |

| Monetary Policy | Primarily managed by central banks independent of fiscal policy | Fiscal policy supersedes monetary policy with direct money creation |

| Employment | Growth and investment expected to create jobs indirectly | Government ensures full employment through spending programs |

Introduction to Supply-Side Economics and Modern Monetary Theory

Supply-Side Economics emphasizes tax cuts, deregulation, and policies to stimulate production and economic growth by incentivizing businesses and entrepreneurs. Modern Monetary Theory (MMT) argues that governments controlling their currency can finance spending through money creation without the same constraints, focusing on full employment and inflation control rather than balanced budgets. Both frameworks propose distinct approaches to fiscal policy, with Supply-Side Economics prioritizing supply incentives and MMT emphasizing government spending and monetary sovereignty.

Historical Background of Both Economic Theories

Supply-Side Economics emerged prominently in the 1970s and 1980s, championed by economists like Arthur Laffer, advocating tax cuts and deregulation to stimulate production and economic growth. Modern Monetary Theory (MMT) draws from post-Keynesian thought, gaining traction in the 1990s and 2000s, emphasizing government spending financed by currency issuance without the immediate need for taxation. Both theories arose as responses to economic challenges: Supply-Side Economics as a reaction to stagflation and high taxes, and MMT addressing fiscal policy constraints and unemployment in developed economies.

Core Principles of Supply-Side Economics

Supply-Side Economics centers on reducing taxes and deregulating markets to stimulate investment, increase production, and drive economic growth. It posits that lower marginal tax rates enhance work incentives, leading to higher employment and expanded economic output. This theory emphasizes the role of supply factors, such as labor productivity and capital investment, over demand management in achieving sustained prosperity.

Foundational Concepts of Modern Monetary Theory

Modern Monetary Theory (MMT) is founded on the principle that sovereign currency-issuing governments can create money to fund public spending without relying solely on taxation or borrowing, as they control their own currency supply. Unlike Supply-Side Economics, which emphasizes tax cuts and deregulation to stimulate production and economic growth, MMT argues that inflation is the primary constraint, not budget deficits, and advocates managing inflation through strategic fiscal policy rather than balanced budgets. Central to MMT is the understanding that unemployment results from insufficient government spending and that full employment can be achieved through a government job guarantee program, positioning the state as an employer of last resort.

Policy Recommendations: Taxation, Spending, and Regulation

Supply-Side Economics advocates for lower taxes, reduced government spending, and deregulation to stimulate economic growth by increasing incentives for production and investment. Modern Monetary Theory recommends flexible government spending financed by sovereign currency issuance, prioritizing full employment, with less emphasis on tax increases except to control inflation, and supports targeted regulation to address social and economic goals. Both frameworks offer contrasting approaches where Supply-Side focuses on supply incentives and Market freedom, while Modern Monetary Theory emphasizes fiscal policy's role in managing demand and resource utilization.

Effects on Economic Growth and Employment

Supply-side economics emphasizes tax cuts and deregulation to stimulate investment, leading to increased economic growth and job creation by enhancing production incentives. Modern Monetary Theory (MMT) advocates for increased government spending financed by money creation to achieve full employment and boost economic output, particularly during downturns. Empirical evidence shows supply-side policies often accelerate growth in the long run, while MMT strategies can effectively reduce unemployment but risk inflation if mismanaged.

Approaches to Inflation and Monetary Policy

Supply-Side Economics emphasizes reducing taxes and regulatory barriers to stimulate production, asserting that increased supply curbs inflation by boosting output and economic growth. Modern Monetary Theory (MMT) argues that sovereign governments can control inflation primarily through strategic taxation and government spending, rather than relying solely on interest rates, highlighting the role of fiscal policy in managing aggregate demand. While Supply-Side policies prioritize long-term supply expansion to prevent inflation, MMT focuses on balancing fiscal deficits with inflationary pressures via targeted monetary operations and regulatory controls.

Criticisms and Controversies of Each Theory

Supply-side economics faces criticism for disproportionately benefiting wealthy individuals and increasing income inequality by advocating tax cuts on high earners and businesses, which critics argue can lead to budget deficits without guaranteed economic growth. Modern Monetary Theory (MMT) is controversial because it suggests that governments with sovereign currency can finance deficits without inflationary risks, prompting concerns about potential hyperinflation and fiscal irresponsibility if monetary expansion is not carefully managed. Both theories generate debate among economists regarding their practical implications, with supply-side economics often challenged for fiscal sustainability and MMT scrutinized for underestimating inflationary pressures.

Real-World Case Studies and Applications

Supply-Side Economics has been prominently applied in the 1980s Reagan administration, where tax cuts and deregulation aimed to stimulate investment and economic growth, resulting in mixed outcomes including budget deficits and income inequality. Modern Monetary Theory (MMT) gained attention in countries like Japan and during the COVID-19 pandemic response in the United States, emphasizing government spending funded by money creation to achieve full employment without immediate inflation, though critics warn about long-term fiscal imbalance risks. Real-world applications demonstrate that Supply-Side policies often prioritize tax incentives for wealthier individuals and corporations, while MMT focuses on direct fiscal expansion to support public programs and infrastructure.

Future Implications and Policy Debates

Supply-Side Economics advocates for tax cuts and deregulation to stimulate investment and economic growth, potentially leading to increased government deficits if growth does not offset revenue losses. Modern Monetary Theory (MMT) suggests that sovereign currency issuers can finance government spending without the same constraints, emphasizing inflation control over balanced budgets. Future policy debates hinge on balancing growth incentivization with inflation risks, fiscal sustainability, and the effectiveness of monetary financing in promoting equitable economic outcomes.

Supply-Side Economics Infographic

libterm.com

libterm.com