Disequilibrium occurs when a system or market is out of balance, causing instability or inefficiency in resource allocation. In economics, it often refers to a state where supply and demand are not equal, leading to surpluses or shortages. Explore the article to understand how disequilibrium affects markets and your financial decisions.

Table of Comparison

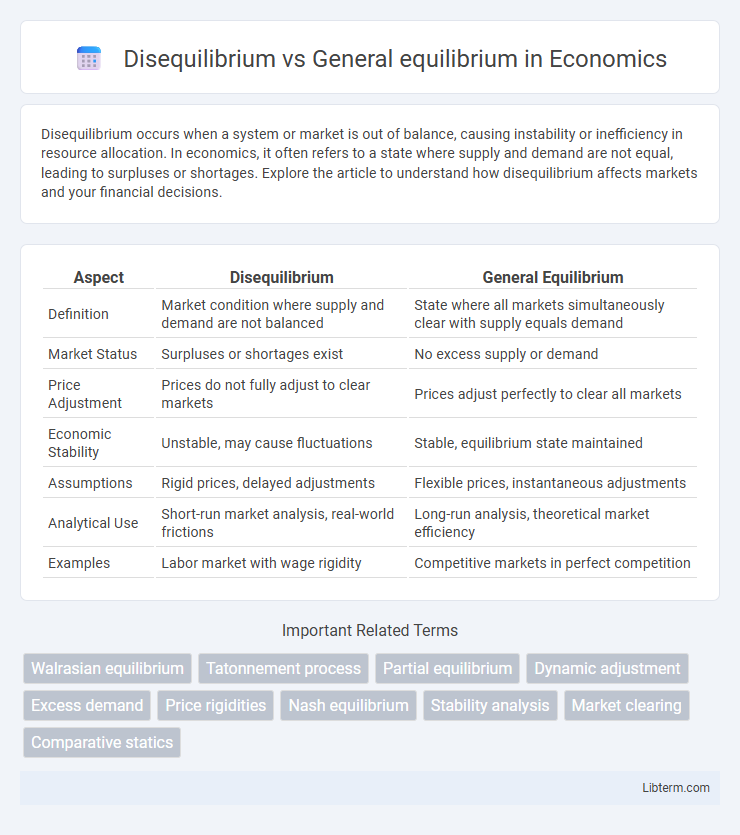

| Aspect | Disequilibrium | General Equilibrium |

|---|---|---|

| Definition | Market condition where supply and demand are not balanced | State where all markets simultaneously clear with supply equals demand |

| Market Status | Surpluses or shortages exist | No excess supply or demand |

| Price Adjustment | Prices do not fully adjust to clear markets | Prices adjust perfectly to clear all markets |

| Economic Stability | Unstable, may cause fluctuations | Stable, equilibrium state maintained |

| Assumptions | Rigid prices, delayed adjustments | Flexible prices, instantaneous adjustments |

| Analytical Use | Short-run market analysis, real-world frictions | Long-run analysis, theoretical market efficiency |

| Examples | Labor market with wage rigidity | Competitive markets in perfect competition |

Introduction to Economic Equilibrium Concepts

Economic equilibrium represents a state where supply equals demand, resulting in stable prices and market balance, while disequilibrium occurs when supply and demand are mismatched, causing price fluctuations and market inefficiencies. General equilibrium theory analyzes the simultaneous equilibrium across all markets in an economy, capturing the interdependencies between goods, factors of production, and agents. Disequilibrium models focus on short-term adjustments and market frictions that prevent immediate balance, providing insights into unemployment, price stickiness, and dynamic economic processes.

Defining Disequilibrium in Economics

Disequilibrium in economics refers to a state where market supply and demand are not balanced, resulting in excess supply or demand and price adjustments. It contrasts with general equilibrium, where all markets simultaneously clear, and no shortages or surpluses exist. Disequilibrium often signals market inefficiencies and can lead to price volatility and resource misallocation until equilibrium is restored.

Understanding General Equilibrium Theory

General Equilibrium Theory examines how supply and demand across multiple markets simultaneously reach a state of balance where all agents optimize their decisions, resulting in an overall allocation of resources. In contrast, Disequilibrium refers to temporary imbalances where prices or quantities have not yet adjusted, causing market inefficiencies or shortages. Understanding these dynamics helps explain the conditions necessary for markets to clear and the potential frictions preventing instantaneous equilibrium.

Key Differences Between Disequilibrium and General Equilibrium

Disequilibrium occurs when supply and demand are not balanced, resulting in shortages or surpluses, while general equilibrium represents a state where all markets simultaneously clear with supply equaling demand. Disequilibrium is characterized by price rigidity and adjustment processes, whereas general equilibrium assumes flexible prices allowing markets to reach optimal allocation efficiently. Key differences include stability conditions, market clearance, and the dynamic adjustment mechanisms inherent in disequilibrium versus the static efficiency found in general equilibrium models.

Causes of Disequilibrium in Markets

Disequilibrium in markets arises when supply and demand are misaligned due to factors such as sudden shifts in consumer preferences, unexpected changes in production costs, or external shocks like policy changes or technological disruptions. Price rigidities, imperfect information, and delayed market adjustments further contribute to persistent imbalances. In contrast, general equilibrium assumes all markets simultaneously clear through flexible prices, eliminating such disequilibria.

Market Adjustment Mechanisms Toward Equilibrium

Market adjustment mechanisms toward equilibrium involve price changes driven by excess demand or supply, where disequilibrium occurs when quantity demanded does not equal quantity supplied. In disequilibrium, prices fluctuate rapidly as buyers and sellers react to shortages or surpluses, prompting shifts in production and consumption until the market clears. General equilibrium considers the simultaneous adjustment of multiple interconnected markets, where price and quantity adjustments in one market affect others, leading to an overall balanced economic state.

Real-World Examples of Disequilibrium

Disequilibrium occurs when market supply and demand are out of balance, resulting in unemployment, inflation, or asset bubbles, as seen during the 2008 global financial crisis where mortgage defaults triggered widespread market instability. Currency crises, like the 1997 Asian financial crisis, exemplify disequilibrium with sharp exchange rate devaluations disrupting trade and investment flows. In contrast, general equilibrium models assume all markets simultaneously clear, providing an idealized framework rarely observed in real-world economic conditions.

Applications of General Equilibrium Analysis

General equilibrium analysis is extensively applied in policy evaluation, enabling economists to assess the economy-wide impacts of fiscal, monetary, and trade policies by modeling interactions across multiple markets simultaneously. It aids in welfare analysis by quantifying changes in consumer and producer surplus, thereby providing comprehensive insights into resource allocation efficiency. Moreover, general equilibrium models support environmental economics through evaluating the economic effects of environmental regulations and resource management strategies on interconnected sectors.

Impacts on Policy and Economic Stability

Disequilibrium in economic markets signals imbalances such as unemployment or inflation, prompting policymakers to implement corrective measures like monetary easing or fiscal stimulus to restore stability. General equilibrium portrays a state where supply and demand across all markets are balanced, allowing for more predictable policy outcomes and sustainable economic growth. Understanding the divergence between these states guides governments in designing interventions that minimize volatility and enhance long-term economic resilience.

Conclusion: Balancing Disequilibrium and General Equilibrium

Balancing disequilibrium and general equilibrium involves managing market adjustments to achieve optimal resource allocation without prolonged imbalances. Disequilibrium reflects real-world market frictions and transition phases that require flexible policy responses to restore stability. Emphasizing dynamic equilibrium models enhances understanding of how economies evolve toward sustainable states amidst shocks and external changes.

Disequilibrium Infographic

libterm.com

libterm.com