Mental accounting shapes how you perceive and manage your finances by categorizing money into different "accounts" based on subjective criteria rather than objective value. This cognitive bias influences spending, saving, and investing decisions, often leading to suboptimal financial outcomes. Explore the rest of the article to understand how mental accounting affects your financial behavior and learn strategies to improve your money management.

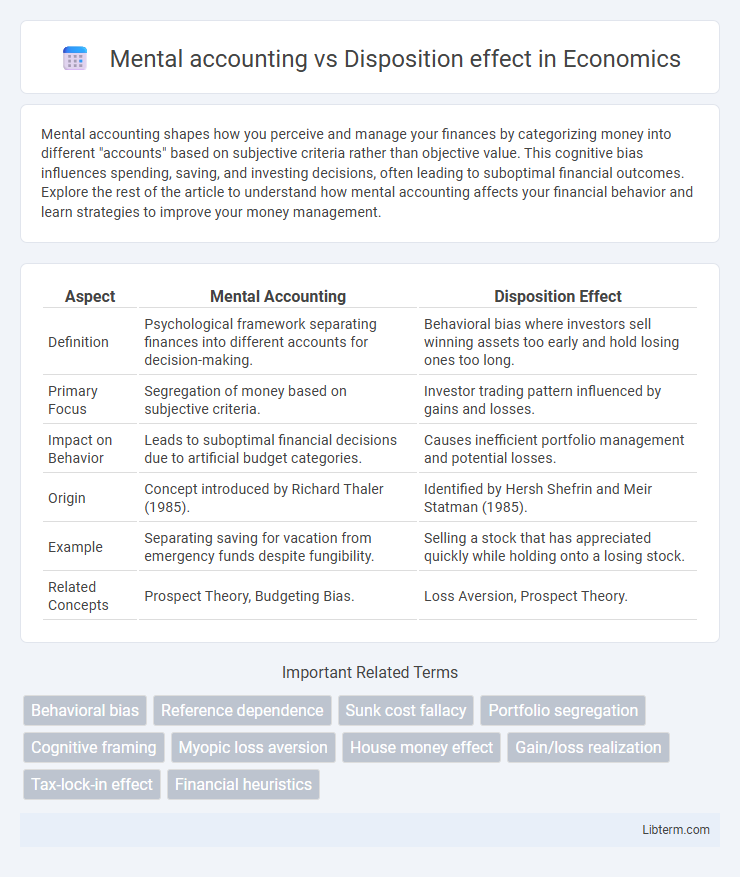

Table of Comparison

| Aspect | Mental Accounting | Disposition Effect |

|---|---|---|

| Definition | Psychological framework separating finances into different accounts for decision-making. | Behavioral bias where investors sell winning assets too early and hold losing ones too long. |

| Primary Focus | Segregation of money based on subjective criteria. | Investor trading pattern influenced by gains and losses. |

| Impact on Behavior | Leads to suboptimal financial decisions due to artificial budget categories. | Causes inefficient portfolio management and potential losses. |

| Origin | Concept introduced by Richard Thaler (1985). | Identified by Hersh Shefrin and Meir Statman (1985). |

| Example | Separating saving for vacation from emergency funds despite fungibility. | Selling a stock that has appreciated quickly while holding onto a losing stock. |

| Related Concepts | Prospect Theory, Budgeting Bias. | Loss Aversion, Prospect Theory. |

Understanding Mental Accounting: An Overview

Mental accounting is a cognitive framework where individuals categorize and treat money differently based on subjective criteria, such as the source or intended use of funds, impacting financial decisions and behavior. This concept contrasts with the disposition effect, which describes the tendency of investors to sell winning investments too early while holding on to losers, driven by emotional biases. Understanding mental accounting provides insights into how people irrationally segregate financial resources, influencing risk assessment and investment strategies.

The Disposition Effect Explained

The Disposition Effect explains investors' tendency to sell winning assets too quickly while holding onto losing assets longer, driven by an emotional bias to avoid losses and realize gains prematurely. This behavioral finance phenomenon contrasts with mental accounting, which categorizes money into separate mental accounts influencing spending and investment decisions. Understanding the Disposition Effect helps in developing strategies to counteract irrational selling patterns and improve portfolio performance.

Key Psychological Mechanisms Behind Both Biases

Mental accounting involves the psychological categorization of money into separate mental accounts, influencing decision-making by segregating gains and losses, while the disposition effect is driven by investors' tendency to sell winning assets prematurely and hold onto losers due to loss aversion and prospect theory. Both biases are rooted in cognitive mechanisms such as framing effects, emotional attachment to investments, and the mental separation of gains from losses, which distort rational evaluation of financial outcomes. These psychological factors lead to suboptimal portfolio management by skewing risk perception and valuation processes.

Mental Accounting vs Disposition Effect: Core Differences

Mental accounting refers to the cognitive process where individuals categorize and treat money differently based on its source or intended use, influencing spending and investment decisions. The disposition effect describes the tendency of investors to sell winning assets too early while holding onto losing assets too long due to emotional biases. The core difference lies in mental accounting framing financial decisions through subjective mental categories, whereas the disposition effect specifically addresses behavioral patterns in asset trading related to gains and losses.

Behavioral Finance: How These Biases Influence Decisions

Mental accounting separates money into different mental categories, leading investors to treat gains and losses inconsistently, while the disposition effect causes investors to sell winning stocks too early and hold onto losing stocks too long. Both biases disrupt rational decision-making by influencing risk assessment and portfolio management in behavioral finance. Understanding these biases helps investors mitigate emotional interference and improve investment strategies.

Real-World Examples of Mental Accounting

Mental accounting influences investor behavior by compartmentalizing finances, such as treating a tax refund as "extra" money for discretionary spending instead of saving or investing it. Real-world examples include individuals allocating gambling winnings separately from savings, leading to riskier bets despite overall wealth. This contrasts with the disposition effect, where investors irrationally hold losing stocks too long and sell winners too quickly due to emotional biases tied to specific investment outcomes.

Real-World Examples of the Disposition Effect

The disposition effect describes investors' tendency to sell assets that have increased in value while holding on to losing investments, often leading to suboptimal financial decisions. Real-world examples include stock market traders refusing to cut losses in declining stocks, which diminishes portfolio performance, and homeowners delaying property sales to avoid realizing losses during market downturns. Understanding this behavioral bias is crucial for improving investment strategies and mitigating irrational decision-making in financial markets.

Impact on Investment and Financial Planning

Mental accounting leads investors to separate money into different mental "accounts," often causing suboptimal allocation and reluctance to rebalance portfolios, which can hinder long-term financial growth. The disposition effect causes investors to prematurely sell winning stocks and hold onto losing ones due to emotional biases, resulting in impaired portfolio performance and increased risk exposure. Both biases negatively impact investment decisions by promoting irrational behaviors that compromise effective financial planning and wealth accumulation.

Strategies to Overcome Mental Accounting and Disposition Effect

Implementing diversified investment portfolios and adopting a holistic view of wealth can mitigate mental accounting by preventing compartmentalization of assets. To overcome the disposition effect, investors should establish predetermined selling rules based on objective criteria rather than emotional attachment to gains or losses. Utilizing behavioral nudges, such as automated rebalancing and loss aversion training, enhances decision-making consistency and reduces biases related to mental accounting and disposition effects.

Conclusion: Navigating Behavioral Biases in Finance

Mental accounting frames financial decisions by categorizing money into separate mental accounts, influencing how gains and losses are perceived. The disposition effect leads investors to irrationally hold losing stocks and sell winning ones prematurely, driven by emotional biases rather than market fundamentals. Effective financial strategies require recognizing these biases to improve decision-making, optimize portfolio performance, and avoid common pitfalls associated with emotional investing.

Mental accounting Infographic

libterm.com

libterm.com