Status quo bias is a cognitive tendency where people prefer things to remain the same rather than change, even when alternatives might offer better outcomes. This bias can hinder decision-making and innovation by causing individuals or organizations to stick with familiar options. Discover how understanding status quo bias can help you make more informed and effective choices by reading the rest of the article.

Table of Comparison

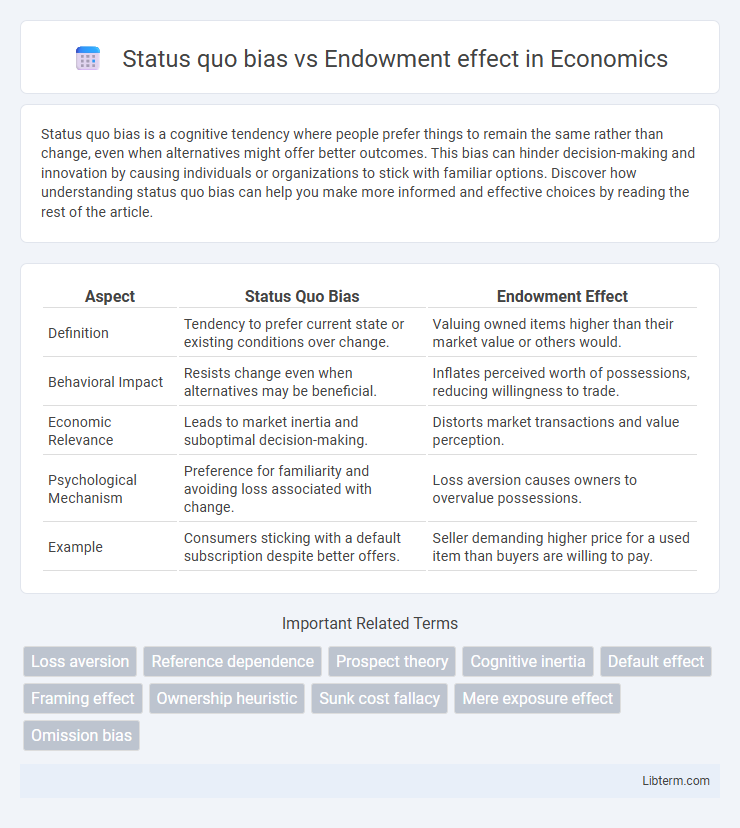

| Aspect | Status Quo Bias | Endowment Effect |

|---|---|---|

| Definition | Tendency to prefer current state or existing conditions over change. | Valuing owned items higher than their market value or others would. |

| Behavioral Impact | Resists change even when alternatives may be beneficial. | Inflates perceived worth of possessions, reducing willingness to trade. |

| Economic Relevance | Leads to market inertia and suboptimal decision-making. | Distorts market transactions and value perception. |

| Psychological Mechanism | Preference for familiarity and avoiding loss associated with change. | Loss aversion causes owners to overvalue possessions. |

| Example | Consumers sticking with a default subscription despite better offers. | Seller demanding higher price for a used item than buyers are willing to pay. |

Introduction to Status Quo Bias and Endowment Effect

Status quo bias refers to the preference for maintaining current conditions or decisions, resisting change even when alternatives may offer better outcomes. The endowment effect describes the phenomenon where individuals ascribe higher value to objects they own compared to identical items they do not possess. Both cognitive biases significantly influence decision-making processes by reinforcing attachment to existing possessions or states, often leading to suboptimal choices.

Defining Status Quo Bias

Status quo bias is a cognitive preference for maintaining current conditions and resisting change, even when alternatives might offer better outcomes. This bias leads individuals to disproportionately favor their existing situation over potential improvements due to perceived losses or uncertainties. It differs from the endowment effect, which specifically values owned possessions more highly than their market value.

Understanding the Endowment Effect

The endowment effect describes the tendency for individuals to value an owned item higher than its market value, often leading to reluctance in trading or selling. This cognitive bias stems from loss aversion, where giving up a possession feels more painful than acquiring it feels pleasurable. Understanding the endowment effect is crucial in behavioral economics, as it explains consumer behavior anomalies and resistance to change in decision-making contexts.

Key Differences Between Status Quo Bias and Endowment Effect

Status quo bias refers to the preference for maintaining the current state of affairs, often leading individuals to resist change even when alternatives may be beneficial. The endowment effect describes the phenomenon where people assign higher value to items simply because they own them, inflating perceived worth beyond market value. Key differences include that status quo bias centers on aversion to change irrespective of ownership, while the endowment effect specifically involves increased valuation due to personal possession.

Psychological Mechanisms Behind Each Bias

Status quo bias arises from a preference for maintaining current conditions due to loss aversion and cognitive inertia, where individuals fear the potential losses associated with change more than they value equivalent gains. The endowment effect involves an increased valuation of objects simply because they are owned, driven by emotional attachment and a psychological sense of possession that amplifies perceived value. Both biases are rooted in the brain's aversion to loss and a desire to avoid regret, but status quo bias emphasizes resistance to change, whereas the endowment effect emphasizes ownership-induced preference.

Real-World Examples of Status Quo Bias

Status quo bias is evident in consumer behavior where individuals prefer keeping their current phone plan despite better offers, highlighting resistance to change even when financially advantageous. In healthcare, patients often stick to existing treatments rather than switching to new, potentially more effective therapies, demonstrating the influence of status quo bias on decision-making. This contrasts with the endowment effect, where ownership increases perceived value, such as homeowners overvaluing their property when deciding to sell.

Real-World Examples of the Endowment Effect

The endowment effect manifests in real estate when homeowners overvalue their properties simply because they own them, leading to inflated asking prices compared to market values. In consumer behavior, people often demand significantly more money to sell a coffee mug they possess than they are willing to pay for the same mug if they did not own it. Sports memorabilia collectors demonstrate the endowment effect by placing a higher personal value on signed items they own, resulting in resistance to selling at typical market rates.

Impact on Decision-Making and Behavior

Status quo bias leads individuals to prefer maintaining current situations, significantly influencing decision-making by causing resistance to change even when better alternatives exist. The endowment effect increases the perceived value of owned items, resulting in decisions that favor retaining possessions rather than trading or selling them. Both biases collectively contribute to suboptimal economic and behavioral outcomes by reinforcing attachment to existing assets and preferences.

Strategies to Overcome These Cognitive Biases

Overcoming status quo bias involves implementing strategies such as setting default options to encourage desired changes and providing clear, evidence-based information to highlight benefits of alternatives. To counteract the endowment effect, reframing ownership by encouraging decision-makers to evaluate items from an outsider's perspective or using monetary incentives to detach emotional attachment can be effective. Behavioral nudges and decision aids that promote objective comparison support reducing the impact of both biases in financial and consumer decision-making contexts.

Conclusion: Implications for Individuals and Organizations

Understanding the distinction between status quo bias and the endowment effect has significant implications for decision-making in individuals and organizations. Status quo bias leads to excessive preference for current states, causing resistance to change and missed opportunities, while the endowment effect inflates the perceived value of owned assets, impacting negotiation and asset management strategies. Recognizing these biases enables tailored interventions to enhance adaptability, optimize resource allocation, and improve strategic outcomes in both personal and organizational contexts.

Status quo bias Infographic

libterm.com

libterm.com