Substitution elasticity measures how easily consumers or producers switch between different goods or inputs when relative prices change, reflecting preferences and technology flexibility. Understanding substitution elasticity is crucial for analyzing market behavior, pricing strategies, and economic policy impacts. Explore this article to uncover the implications of substitution elasticity for Your financial decisions and market dynamics.

Table of Comparison

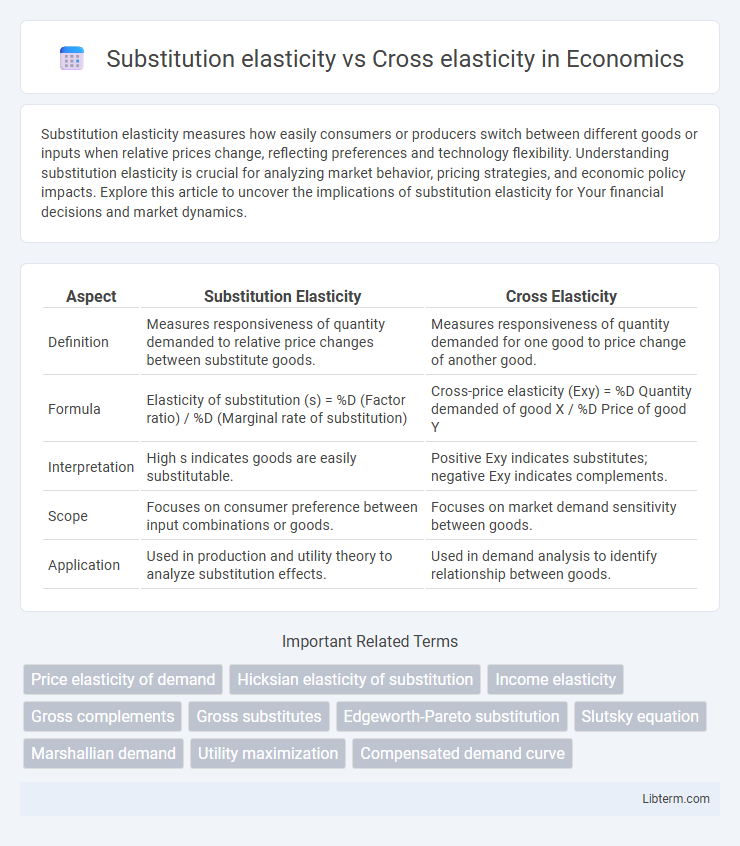

| Aspect | Substitution Elasticity | Cross Elasticity |

|---|---|---|

| Definition | Measures responsiveness of quantity demanded to relative price changes between substitute goods. | Measures responsiveness of quantity demanded for one good to price change of another good. |

| Formula | Elasticity of substitution (s) = %D (Factor ratio) / %D (Marginal rate of substitution) | Cross-price elasticity (Exy) = %D Quantity demanded of good X / %D Price of good Y |

| Interpretation | High s indicates goods are easily substitutable. | Positive Exy indicates substitutes; negative Exy indicates complements. |

| Scope | Focuses on consumer preference between input combinations or goods. | Focuses on market demand sensitivity between goods. |

| Application | Used in production and utility theory to analyze substitution effects. | Used in demand analysis to identify relationship between goods. |

Definition of Substitution Elasticity

Substitution elasticity measures the responsiveness of the ratio of consumption quantities between two goods when their relative prices change, indicating consumer preference flexibility. It quantifies how easily consumers can replace one good with another in response to price variations. Cross elasticity, in contrast, measures the percentage change in demand for one good resulting from a price change in another related good, highlighting inter-product demand relationships.

Definition of Cross Elasticity

Cross elasticity of demand measures the responsiveness of the quantity demanded of one good to changes in the price of another good, indicating whether products are substitutes or complements. It is calculated as the percentage change in the quantity demanded of good A divided by the percentage change in the price of good B. Unlike substitution elasticity, which focuses on consumer preference between goods, cross elasticity specifically quantifies the interdependence between the prices and demands of two different products.

Key Differences Between Substitution and Cross Elasticity

Substitution elasticity measures the responsiveness of the quantity demanded of one good when the relative price of a substitute changes, highlighting consumer preference shifts within similar products. Cross elasticity of demand quantifies the percentage change in demand for one good in response to a price change of another good, indicating whether goods are substitutes or complements. The key difference lies in substitution elasticity focusing specifically on close substitutes' relative price changes, while cross elasticity encompasses demand interdependencies between any two goods, whether substitutes or complements.

Economic Importance of Substitution Elasticity

Substitution elasticity measures consumers' responsiveness to changes in relative prices between substitute goods, playing a crucial role in pricing strategies and market competition analysis. It directly influences supply chain decisions and product differentiation by indicating how easily consumers switch between alternatives when prices fluctuate. Understanding substitution elasticity helps firms optimize revenue, anticipate market shifts, and design policies promoting consumer welfare and efficient resource allocation.

Economic Significance of Cross Elasticity

Cross elasticity of demand measures how the quantity demanded of one good responds to price changes of another, indicating the degree of substitutability or complementarity between products in the market. This metric is crucial for firms in setting competitive pricing strategies and understanding market interdependencies, as positive cross elasticity signals substitutable goods while negative values suggest complementary relationships. High cross elasticity informs businesses about potential market entry threats and helps policymakers anticipate the ripple effects of tax changes or tariffs on related industries.

Factors Influencing Substitution Elasticity

Substitution elasticity measures the responsiveness of the quantity demanded of one good when its price changes relative to a substitute good, while cross elasticity directly quantifies the change in demand for one good in response to a price change of another. Factors influencing substitution elasticity include the degree of similarity between goods, availability of close substitutes, consumer preferences, and income levels. Market structure and the time horizon also play critical roles, as consumers may gradually adjust their consumption patterns, increasing substitution elasticity over time.

Factors Affecting Cross Elasticity

Cross elasticity of demand measures the responsiveness of quantity demanded for one good when the price of another good changes, influenced by factors such as the degree of substitutability between the two goods, the proportion of consumer budget spent on the goods, and the closeness of their market relationship. The higher the substitutability, the greater the positive cross elasticity, especially in closely related products like tea and coffee. Consumer preferences, availability of alternatives, and time period for adjustment further affect cross elasticity, distinguishing it from substitution elasticity, which specifically captures consumer willingness to replace one good with another.

Real-World Examples of Substitution Elasticity

Substitution elasticity measures how easily consumers switch between similar goods when relative prices change, exemplified by the shift from butter to margarine as butter prices rise. Cross elasticity of demand, by contrast, quantifies the responsiveness of demand for one good when the price of a related good changes, such as increased demand for electric vehicles following a gasoline price hike. Real-world substitution elasticity is evident in smartphone markets where consumers switch brands due to price differences without compromising on essential features.

Practical Applications of Cross Elasticity

Cross elasticity of demand measures how the quantity demanded of one good changes in response to the price change of a related good, making it essential for businesses to analyze competitor products and substitute goods in pricing strategies. Practical applications include evaluating the impact of complementary and substitute products on market share, optimizing product bundling, and forecasting consumer response to price changes in related markets. Firms leverage cross elasticity to design competitive pricing tactics and improve product positioning in dynamically changing market environments.

Implications for Pricing and Market Strategy

Substitution elasticity measures consumer responsiveness to price changes between similar products within the same category, guiding firms on pricing flexibility to capture market share without losing customers to close substitutes. Cross elasticity quantifies how the price change of one product affects the demand for another, enabling companies to anticipate competitive reactions and optimize product bundling or differentiation strategies. Understanding both elasticities helps businesses set strategic prices that balance competitive positioning and maximize revenue across interconnected markets.

Substitution elasticity Infographic

libterm.com

libterm.com