Excise tax is a government-imposed levy on specific goods such as tobacco, alcohol, and fuel, designed to generate revenue and discourage harmful consumption. This tax is often included in the price of the product, impacting your purchasing decisions without an immediate visible cost. Explore the rest of the article to understand how excise taxes affect different industries and your everyday expenses.

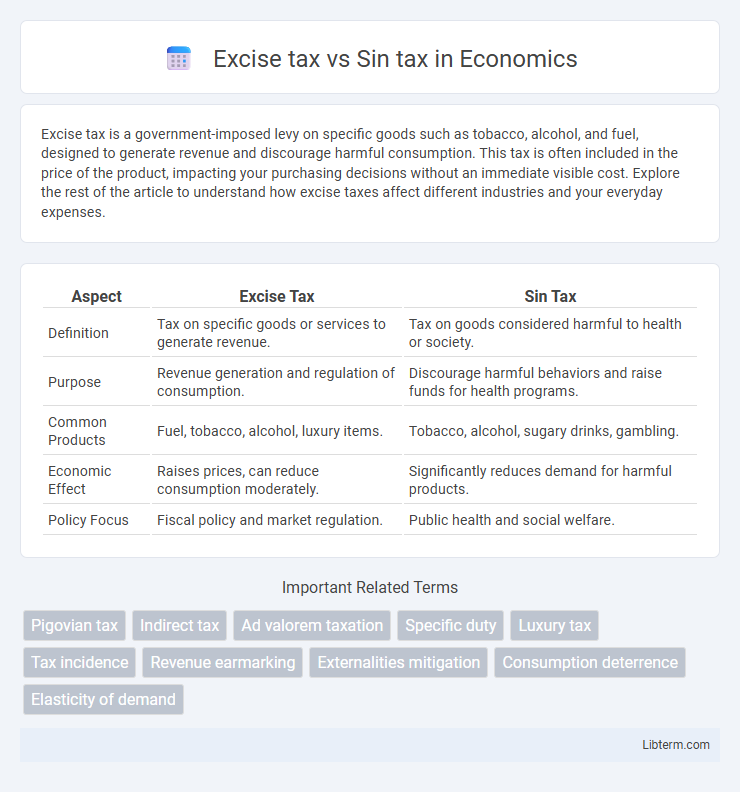

Table of Comparison

| Aspect | Excise Tax | Sin Tax |

|---|---|---|

| Definition | Tax on specific goods or services to generate revenue. | Tax on goods considered harmful to health or society. |

| Purpose | Revenue generation and regulation of consumption. | Discourage harmful behaviors and raise funds for health programs. |

| Common Products | Fuel, tobacco, alcohol, luxury items. | Tobacco, alcohol, sugary drinks, gambling. |

| Economic Effect | Raises prices, can reduce consumption moderately. | Significantly reduces demand for harmful products. |

| Policy Focus | Fiscal policy and market regulation. | Public health and social welfare. |

Introduction to Excise Tax and Sin Tax

Excise tax is a specific tax levied on the manufacture, sale, or consumption of certain goods, often aimed at regulating demand and generating revenue for government programs. Sin tax is a type of excise tax imposed specifically on products considered harmful to health or society, such as tobacco, alcohol, and gambling. Both taxes serve fiscal and public health purposes but are distinguished by their targeted application towards "sinful" or socially detrimental goods.

Definitions: What is an Excise Tax?

An excise tax is a government-imposed levy on specific goods or services, often aimed at raising revenue or regulating consumption. It typically applies to products like fuel, alcohol, tobacco, and other luxury or non-essential items. Unlike general sales taxes, excise taxes are included in the price of the product and paid by manufacturers or retailers before reaching consumers.

Understanding Sin Tax: Key Characteristics

Sin tax is a type of excise tax specifically imposed on goods and activities considered harmful to health or society, such as tobacco, alcohol, and gambling. Its key characteristics include deterring consumption through higher prices, generating government revenue for public health programs, and addressing social costs linked to these substances or behaviors. Unlike general excise taxes, sin taxes target products with negative externalities to discourage their use and promote healthier lifestyles.

Core Differences Between Excise Tax and Sin Tax

Excise tax is a broad levy imposed on specific goods such as fuel, tobacco, and alcohol to generate government revenue and regulate consumption, while sin tax specifically targets products deemed harmful to public health, primarily tobacco and alcohol, to discourage their use. Excise taxes apply to both necessary and non-essential goods, whereas sin taxes are aimed exclusively at reducing negative social and health impacts associated with certain goods. Core differences include their purpose--excise tax focuses on revenue generation and regulation, sin tax emphasizes health deterrence--and their targeted product scope.

Examples of Excise Taxes in Practice

Excise taxes apply to specific goods like gasoline, tobacco, and alcohol, aimed at raising revenue and curbing consumption, with examples including federal gasoline taxes funding highway infrastructure and tobacco taxes intended to reduce smoking rates. Sin taxes, a subset of excise taxes, specifically target products deemed harmful such as cigarettes and sugary beverages to discourage unhealthy behaviors. Countries like the United States impose excise taxes on gasoline at about 18.4 cents per gallon, while sin taxes on cigarettes can exceed $2 per pack to offset public health costs.

Common Sin Taxed Products and Activities

Common sin taxed products include tobacco, alcoholic beverages, and sugary drinks, each targeted due to their negative health impacts and social costs. Excise taxes often cover a broader range of goods and services such as gasoline, firearms, and luxury items, designed to generate revenue and regulate consumption. Sin taxes specifically aim to discourage harmful behaviors by increasing the cost of products like cigarettes, beer, and candy, thereby promoting public health initiatives.

Economic Impact of Excise and Sin Taxes

Excise taxes, levied on specific goods like fuel or tobacco, generate significant government revenue while potentially reducing consumption of harmful products, thereby influencing public health and economic behavior. Sin taxes, a subset of excise taxes targeting goods associated with negative externalities such as alcohol and cigarettes, aim to correct market failures by internalizing social costs, potentially decreasing societal healthcare expenses. Both taxes can impact consumer spending patterns and business profitability, with their economic effectiveness depending on demand elasticity and tax rate structure.

Public Health Implications of Sin Taxation

Sin tax, imposed on products like tobacco and alcohol, aims to reduce consumption by increasing prices, thereby lowering public health risks such as addiction, cancer, and liver disease. Excise tax broadly applies to goods including fuel and luxury items but may lack targeted health objectives present in sin taxes. Evidence from multiple countries reveals that sin taxation effectively decreases usage rates and associated healthcare costs, improving population health outcomes.

Government Revenue and Policy Considerations

Excise tax and sin tax are important tools for government revenue, as excise taxes apply broadly to goods like fuel and tobacco, generating significant funds for public services and infrastructure. Sin taxes specifically target products deemed harmful, such as alcohol and cigarettes, aligning revenue goals with public health policy to discourage consumption. Policy considerations include balancing revenue generation with social impact, as higher sin taxes can reduce demand but also address healthcare costs associated with risky behaviors.

Future Trends in Excise and Sin Tax Legislation

Future trends in excise and sin tax legislation indicate a shift towards broader application and increased rates to address public health and environmental concerns. Governments are exploring dynamic tax frameworks that incorporate digital economy goods and emerging products like vaping devices and cannabis. Enhanced data analytics and automated compliance systems are expected to improve tax collection efficiency and reduce evasion in these sectors.

Excise tax Infographic

libterm.com

libterm.com